FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

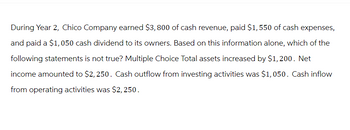

Transcribed Image Text:During Year 2, Chico Company earned $3,800 of cash revenue, paid $1,550 of cash expenses,

and paid a $1,050 cash dividend to its owners. Based on this information alone, which of the

following statements is not true? Multiple Choice Total assets increased by $1,200. Net

income amounted to $2,250. Cash outflow from investing activities was $1,050. Cash inflow

from operating activities was $2,250.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet of Cranium Gaming reports total assets of $480,000 and $780,000 at the beginning and end of the year, respectively. Sales revenues are $1.90 million, net income is $73,000, and operating cash flows are $59,000.arrow_forward#11arrow_forwardThe following information ($ in millions) comes from a recent annual report of Orinoco.com, Incorporated: Net sales $ 10,858 Total assets 4,405 End of year balance in cash 1,117 Total stockholders' equity 498 Gross profit (Sales − Cost of Sales) 2,601 Net increase in cash for the year 23 Operating expenses 2,049 Net operating cash flow 735 Other income (expense), net (24) Compute Orinoco's total liabilities at the end of the year. Multiple Choice $3,907 $3,166 $2,350 $4,405arrow_forward

- OllyPop Beverage Company reported the following items in the most recent year. Net income $41,700 Dividends paid 5,060 Increase in accounts receivable 10,640 Increase in accounts payable 7,220 Purchase of equipment (capital expenditure) 8,300 Depreciation expense 4,220 Issue of notes payable 21,440 Compute net cash provided by operating activities, the net change in cash during the year.arrow_forwardFollowing are the income statement and balance sheet items for Faison Corporation from the company’s books and records at the end of fiscal year-end 20x1: ($ millions) Contributed capital $1,702 Cost of sales 13,567 Cash 1,393 Long-term liabilities 3,719 Accounts receivable 2,662 Other current assets 604 Other long-term assets 2,079 Other current liabilities 1,299 Other operating expenses 1,212 Other non-operating expenses 161 Inventory 1,093 Accounts payable 2,595 Property, net 3,216 Retained earnings 1,209 Sales 16,463 Tax expense 256 Equity income, net of tax 34 Other equity 523 Required: Using the information above, prepare the company’s year-end income statement and a balance sheet.arrow_forwardthe net income reported on the income statement for the current year was $250,000. depreciation was $54,000. Accounts receivable and inventories decreased by $5000 and $16000, respectively. Prepaid expenses and accounts payable increased, respectively, by $500 and $15000. Investments were sold at a loss of $21500. How much cash was provided by operating activities. Can some one break this down and exaplin why the answer is $361,000?arrow_forward

- Net income of Mansfield Company was $45,000. The accounting records reveal depreciation expense of $80,000 as well as increases in prepaid rent, salaries payable, and income taxes payable of $60,000, $15,000, and $12,000, respectively. Prepare the cash flows from operating activities section of Mansfield’s statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardPinnacle Plus declared and paid a cash dividend of $7,000 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information: Required: 1. Complete the two final columns shown beside each item in Pinnacle Plus's comparative financial statements. 2-a. Which account increased by the largest dollar amount? 2-b. Which account increased by the largest percentage? Complete this question by entering your answers in the tabs below. Reg 1 Income Statement Sales Revenue Cost of Goods Sold Gross Profit Req 2A Complete the two final columns shown beside each item in Pinnacle Plus's comparative financial statements. (Decreases should be indicated by a minus sign. Round percentage values to 1 decimal place.) Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (30%) Net Income Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net Total Assets Req 2B Accounts Payable Income…arrow_forwardGarrett Company had the following activities for a recent year ended December 31: Sold land that cost $32,000 for $32,000 cash; purchased $190,000 of equipment, paying $160,000 in cash and signing a note payable for the rest; and recorded $6,700 in depreciation expense for the year. Net income for the year was $13,000. Compute (1) cash provided by operating activities and (2) cash used in investing activities for the year based on the data provided. (List cash outflows as negative amounts.) GARRETT COMPANY Excerpts from Statement of Cash Flows For the Year Ended December 31 Cash flows from operating activities: Net income Add back: Depreciation expense Cash flows from investing activities: Purchase of equipment Sale of land $ 13,000 6,700 19,700 (160,000) 32,000 $ (128,000)arrow_forward

- JJ's has net sales of $48,920, depreciation of $711, cost of goods sold of $31,890, administrative costs of $11,210, interest expense of $680, dividends paid of $450, and a tax rate of 20%. What is the net cash from operating activities as it will appear on the accounting statement of cash flows if the firm spent $274 on net working capital? $3,980 $3,056 $3,667 $4,066arrow_forwardGet Answer pleasearrow_forwardThe following information ($ in millions) comes from a recent annual report of Orinoco.com, Incorporated: Net sales $ 10,743 Total assets 4,540 End of year balance in cash 1,168 Total stockholders' equity 512 Gross profit (Sales − Cost of Sales) 2,500 Net increase in cash for the year 26 Operating expenses 2,065 Net operating cash flow 660 Other income (expense), net $ (24) Compute Orinoco's balance in cash at the beginning of the year. Multiple Choice $1,020 $1,168 $733 $1,142arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education