FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

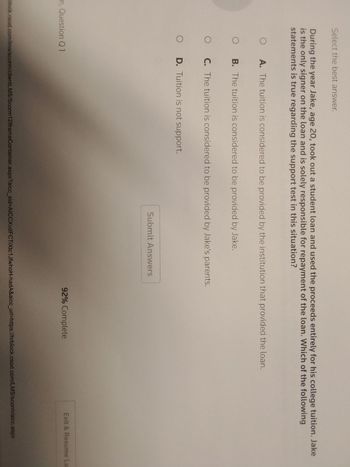

Transcribed Image Text:Select the best answer.

During the year Jake, age 20, took out a student loan and used the proceeds entirely for his college tuition. Jake

is the only signer on the loan and is solely responsible for repayment of the loan. Which of the following

statements is true regarding the support test in this situation?

O

A. The tuition is considered to be provided by the institution that provided the loan.

OB. The tuition is considered to be provided by Jake.

O C. The tuition is considered to be provided by Jake's parents.

O D. Tuition is not support.

m, Question Q1

Submit Answers

92% Complete

Exit & Resume La

block.csod.com/lms/scorm/clientLMS/Scorm 12lframeContainer.aspx?aicc_sid-AICCXvd FC TiXtc1JfwhoH-hadA&aicc_url=https://hrblock.csod.com/LMS/scorm/aicc.aspx

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Choose the response that accurately completes the following sentence. Člaiming the Child and Dependent Care Credit is NOT allowed for taxpayers who: Are actively searching for employment. Lived with their spouse for the entire year, but will file a separate return. Are self-employed. Use the services of an independent caregiver, such as a nanny or babysitter.arrow_forwardAssume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. During 2021, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a cash- basis consulting practice that had the following income and expenses: Revenue Laptop computer purchased 4/23/21 ($ 179 elected) Travel: 2,500 miles for business, 13,000 personal Supplies Cell phone charge $ 53,000 3,300 500 960 Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowland, CA 92273. Her W-2 shows the following: Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholding Other income: $ 49,000 5,200 49,000 3,038 711 2,265 1099-INT Old Bank 2,200 1099-DIV Bake Company, Incorporated-Ordinary dividends…arrow_forwardReview the following scenario. Use the information provided to answer questions about the taxpayers’ 2020 return.Jake (27) and Nicole (26) Graham are married and filing a joint return. Jake was employed full-time during the year. Nicole worked part-time, and she was also a full-time student at State University. During the year, she paid $3,800 in tuition and fees, substantiated with Form 1098-T. She did not receive any scholarships during the year. Nicole meets all the requirements to qualify for the American Opportunity Tax Credit.The couple’s adjusted gross income is $47,000. Their tax on line 16 and on line 18 of their Form 1040 is $2,272. They had no additional taxes.To assist you in answering questions about the couple’s tax benefits for education, you may refer to the partially completed Credit Limit Worksheet, which is shown below.2020 Form 8863 Credit Limit Worksheet – Line 191. Enter the amount from Form 8863, line 18. _________2. Enter the amount from Form 8863, line 9.…arrow_forward

- A taxpayer operates a business through a single-member LLC (disregarded for federal tax purposes). The taxpayer contributes $30,000 cash and equipment worth $50,000 (having an adjusted basis of $20,000) to the LLC to fund its operations. The LLC obtains a loan from a bank of $100,000. Because the LLC has no established credit, the taxpayer has to personally guarantee the loan. What is the taxpayer's amount at risk? O The taxpayer is at risk in the amount of $30,000. The taxpayer is at risk in the amount of $50,000. O The taxpayer is at risk in the amount of $80,000. O The taxpayer is at risk in the amount of $150,000.arrow_forwardAfter agreeing to rent a car from Drive-Around Inc., Eden is given the keys to one of the agency’s cars by Fess, a Drive-Around employee. With respect to the bailed property, this is a. not a delivery. b. an involuntary delivery. c. a constructive delivery. d. a physical delivery.arrow_forwardYou are Melina’s CPA, she to whom Walter “Buck” Swords left $50,000 and a used car in his will. What do you advise Melina as to her tax return – i.e., that she should report (include in her gross income) – both the $50,000 and the value of the car? the cash but not the car? the car but not the cash? neither the cash nor the car? What and why?arrow_forward

- Which of the following items are inclusions in gross income? a. During the year, stock that the taxpayer purchased as an investment doubled in value. b. Amount an off-duty motorcycle police officer received for escorting a funeral procession. c. While his mother was in the hospital, the taxpayer sold some of her jewelry to help pay for the hospital bills. d. Child support payments received. e. A damage deposit the taxpayer recovered when he vacated the apartment he had rented. f. Interest received by the taxpayer on an investment in general purpose bonds issued by IBM. g. Amounts received by the taxpayer, a baseball "Hall of Famer," for autographing sports equipment (e.g., balls and gloves). h. Tips received by a bartender from patrons. (Taxpayer is paid a regular salary by the cocktail lounge that employs him.) I. Taxpayer sells his Super Bowl tickets for three times what he paid for them j. Taxpayer receives a new BMW from his grandmother when he passes the CPA exam.arrow_forwardFor each of the following situations, indicate the nature and amount of the penalty that could be imposed. Description of the Penalty AND Penalty Amount $ a. Larry is a tax protester and files his tax return in the name of “Mickey Mouse.” b. Anne writes a check for $900 in payment of her taxes that she knows will not clear the bank due to insufficient funds in her account. c. Gerald understated his tax liability by $10,000. The total amount of tax that should have been shown on his return was $70,000.arrow_forwardGeorge owed Keith $800 on a personal loan. Neither the amount of the debt nor George’s liability to pay the $800 was disputed. Keith had also rendered services as a carpenter to George without any agreement as to the price to be paid. When the work was completed, an honest and reasonable difference of opinion developed between George and Keith with respect to the value of Keith’s services. Upon receiving from Keith a bill of $600 for the carpentry services, George mailed in a properly stamped and addressed envelope his check for $800 to Keith. In an accompanying letter, George stated that the enclosed check was in full settlement of both claims. Keith indorsed and cashed the check. Thereafter, Keith unsuccessfully sought to collect from George an alleged unpaid balance of $600. May Keith recover the $600 from George?arrow_forward

- Rosina can withdraw from her Registered Retirement Savings Plan (RRSP) with no tax impact but if she withdraws from her Tax-Free Savings Account (TFSA) she must include the amount on her tax return and pay taxes on it unless she uses the funds under the following two plans: Home Buyers Plan and Lifelong Learning Plan. A True Falsearrow_forwardQuestion 31 of 50. Review the following scenario, then choose the appropriate response describing steps a paid tax preparer must take to demonstrate due diligence. Charlie (21) comes in to your office to have his tax return prepared. He states that he is a full-tim college student with income from a part-time job, and his parents will not claim him as a dependent. He wants to claim the American Opportunity Tax Credit (AOTC). Which of the following describes an appropriate question to ask or action to take ooo Ask him if he has ever been convicted of a misdemeanor offense or had his driver's license revoked. Inform him that he may be assessed a penalty of $545 if he fails to provide all the information required. Inform him he must provide copies of all transcripts before you can prepare his retum. Request a copy of his Form 1098-T, Tuition Statement, and inquire into when and how his education and other were paid. Mark for follow up Question 32 of 50. Tee of these pro ambing systems.…arrow_forwardEdward is attending school and had a financial emergency. He contacted his school's financial aid office and asked about a subsidized student loan, Edward's school facilitates these loans and determined that Edward qualifies for a $270 loan. Edward is able to repay the loan over the next 12 months while he is still in school. How much interest will Edward pay on this loan? O $0 because interest on subsidized loans does not accrue until Edward stops attending school. O $13.50 because the interest rate is 5%. O $6.75 because Edward has been making payments on the loan. None of the answer choices are correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education