FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

During the year ended December 31, 2020, Gluco Inc. split its stock on a 5-for-1 basis. In its annual report for 2019, the firm reported net income of $941,200 for 2019, with an average 211,000 shares of common stock outstanding for that year. There was no preferred stock.

Required:

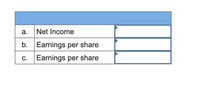

- What amount of net income for 2019 will be reported in Gluco's 2020 annual report?

- Calculate Gluco's earnings per share for 2019 that would have been reported in the 2019 annual report. (Round your answer to 2 decimal places.)

- Calculate Gluco's earnings per share for 2019 that will be reported in the 2020 annual report for comparative purposes. (Round your answer to 2 decimal places.)

Transcribed Image Text:The image contains a table with three rows, each labeled with a letter on the left side:

1. **Row a**

- **Label**: Net Income

- **Value**: Not provided (empty field)

2. **Row b**

- **Label**: Earnings per share

- **Value**: Not provided (empty field)

3. **Row c**

- **Label**: Earnings per share

- **Value**: Not provided (empty field)

The table appears to be part of a financial analysis or report, possibly comparing or emphasizing the importance of net income and earnings per share. The columns are separated by a greater-than sign, indicating a placeholder for data input or comparison.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Frenchroast Company earned net income of $93,000 during the year ended December 31, 2020. On December 15, Frenchroast declared the annual cash dividend on its 4% preferred stock (par value, $128,000) and a $0.55 per share cash dividend on its common stock (67,000) shares. Note: When entering percent values, write the value as a percent without the percent (96) symbol. Frenchroast then paid the dividends on January 4, 2021. Calculate Dividends: Preferred Dividends - Dividend percent X par value Common Dividends - Share price X # of shares Total Dividend Preferred Dividends- Common Dividends Total Dividend Date December 15 January 4 Description X Debit Creditarrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,460,000, $152,000 in the common stock account, and $2,770,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,700,000, $162,000 in the common stock account and $3,070,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $100,000 and the company paid out $157,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,080,000, and the firm reduced its net working capital investment by $137,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow Prev 9 of 10 ▬▬▬ ‒‒‒ Next >arrow_forwardAyayai Company’s net income for 2020 is $52,900. The only potentially dilutive securities outstanding were 1,040 options issued during 2019, each exercisable for one share at $6. None has been exercised, and 10,900 shares of common were outstanding during 2020. The average market price of Ayayai’s stock during 2020 was $20.(a) Compute diluted earnings per share. Diluted earnings per share $arrow_forward

- assistarrow_forwardOriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 970 shares @ $14 each $13,580 Rogers Company 910 shares @ $18 each 16,380 Chance Company 500 shares @ $9 each 4,500 Equity investments @ cost 34,460 Fair value adjustment (7,840 ) Equity investments @ fair value $26,620 During 2020, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Oriole, Inc. sold 290 shares of Chance Company for $11 per share. 3. On May 15, Oriole, Inc. purchased 90 more shares of Evers Company stock at $17 per share. 4. At December 31, 2020, the stocks had the following price per share values: Evers $18, Rogers $17, and Chance $8. During 2021, the following transactions took place. 5. On February 1, Oriole, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend.…arrow_forwardRicci Corporation is preparing their financial statements for the year ending September 30, 2021. Ricci Corporation has two categories of stock; Preferred and Common. On September 25, 2021 Ricci Corporation declared dividends on the preferred stock which will be paid on October 18, 2021. In order to calculate EPS the staff accountant had the following information: 2021 Net Income: $4,000,000 Preferred Dividends Declared in September 25, 2021 $ 500,000 but not paid until October 18, 2021 Weighted Average Number of Common Shares Outstanding 125,000 shares The staff accountant has determined that since the preferred dividends were not paid prior to September 30, 2021 the preferred dividend should not be included in the 2021 EPS. Accounting Issue: In the calculation for EPS should Ricci Corporation include the preferred dividends not paid prior to September 30, 2021? Your Interpretation of the Guidance: Should Ricci Corporation include the preferred dividends in the calculation of EPS…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education