FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

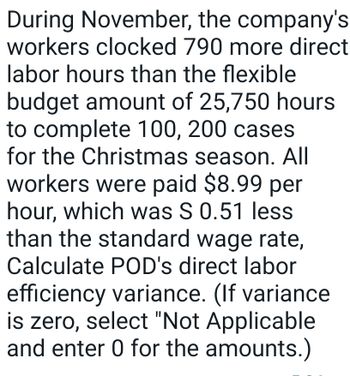

Transcribed Image Text:During November, the company's

workers clocked 790 more direct

labor hours than the flexible

budget amount of 25,750 hours

to complete 100, 200 cases

for the Christmas season. All

workers were paid $8.99 per

hour, which was S 0.51 less

than the standard wage rate,

Calculate POD's direct labor

efficiency variance. (If variance

is zero, select "Not Applicable

and enter 0 for the amounts.)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- J&J Co. provides house cleaning services. The company uses the number of jobs to measure activity. At the beginning of March, the company budgeted for 60 jobs, but the actual number of jobs turned out to be 70. Wages and salaries expense is a mixed cost. Supplies expense is a variable cost. Transportation expense is a fixed cost. Here is a report comparing the actual vs. budgeted revenues and costs for the month of March: What is the amount of Supplies Expense in the Flexible Budget?arrow_forwardYour Company’s cost formula for its wages and salaries is $2,500 per month plus $475 per unit sold. For the month of May, the company planned for activity of 120 units, but the actual level of activity was 115 units. The actual wages and salaries for the month was $56,850. What is the spending variance for wages and salaries in May? $2,650 F $ 275 F $ 275 U $2,650 Uarrow_forwardLily Company uses a standard cost accounting system. In 2025, the company produced 28,300 units. Each unit took several pounds of direct materials and 1.6 standard hours of direct labor at a standard hourly rate of $13.00. Normal capacity was 49,900 direct labor hours. During the year, 131,200 pounds of raw materials were purchased at $0.94 per pound. All materials purchased were used during the year. (a) If the materials price variance was $1,312 favorable, what was the standard materials price per pound? (Round answer to 2 decimal places, e.g. 2.75.) Your answer is correct. Standard materials price per pound $ (b) eTextbook and Media (c) Your answer is correct. Standard materials quantity per unit If the materials quantity variance was $17,100 unfavorable, what was the standard materials quantity per unit? eTextbook and Media Your answer is correct. What were the standard hours allowed for the units produced? Standard hours allowed 0.95 45,280 hours Attempts: 1 of 5 used 4 pounds…arrow_forward

- Rooney Car Wash, Incorporated expected to wash 1,000 cars during the month of August. Washing each car was expected to require 0.2 hour of labor. The company actually used 224 hours of labor to wash 970 cars. The labor usage variance was $600 unfavorable. Required a. Determine the standard labor price. b. If the actual labor rate is $13, calculate the labor price variance and indicate whether it would be favorable (F) or unfavorable (U). Note: Select "None" if there is no effect (i.e., zero variance). a. Standard labor price b. Total labor price variancearrow_forwardSwan Company has a direct labor standard of 34 hours per unit of output. Each employee has a standard wage rate of $33 per hour. During March, employees worked 15,000 hours. The direct labor rate variance was $11,070 favorable, and the direct labor efficiency variance was $17,300 unfavorable. What was the actual payroll? Multiple Choice $495,000 $477,700 $506,070 $483,930arrow_forwardUnder normal conditions, Sarah pays her employees $8.50 per hour, and it will take 2.8 hours of labor per pair of shoes. During August, Sole Purpose Shoe Company incurred actual direct labor costs of $65,148 for 7,320 hours of direct labor in the production of 2,300 pairs of shoes. Complete the following table, showing the direct labor variance relationships for August for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable variance, and a positive number for an unfavorable variance. Actual Cost Standard Cost Actual Hours X Actual Rate Actual Hours X Standard Rate Standard Hours X Standard Rate X X = = = Direct Labor Variance: Direct Labor Variance: Total Direct Labor Variance:arrow_forward

- Under normal conditions, Sarah pays her employees $8.50 per hour, and it will take 2.80 hours of labor per pair of shoes. During August, Sole Purpose Shoe Company incurred actual direct labor costs of $65,610 for 7,290 hours of direct labor in the production of 2,300 pairs of shoes. Complete the following table, showing the direct labor variance relationships for August for Sole Purpose Shoe Company. If required, round your answers to two decimal places. When entering variances, use a negative number for a favorable variance, and a positive number for an unfavorable variance. Actual Cost Standard Cost ActualHours X ActualRate ActualHours X StandardRate StandardHours X StandardRate fill in the blank b8e89601ef8d04f_1 X $fill in the blank b8e89601ef8d04f_2 fill in the blank b8e89601ef8d04f_3 X $fill in the blank b8e89601ef8d04f_4 fill in the blank b8e89601ef8d04f_5 X $fill in the blank b8e89601ef8d04f_6 = $fill in the blank b8e89601ef8d04f_7 = $fill in…arrow_forwardConcord Products embosses notebooks with school and corporate logos. Last year, the company's direct labor payroll totaled $296,990 for 49,990 direct labor hours. The standard wage rate is $6.00 per direct labor hour. Calculate Concord's direct labor rate variance. (Round answer to O decimal places, e.g. 125. If variance is zero, select "Not Applicable" and enter o for the amounts.) Direct labor rate variance $arrow_forwardAnnie's Homemade's cost formula for salaries and wages includes managers' salaries of $7,000 per month plus wages of $8.00 per employee labor-hour. In August, Annie's expected to staff 700 employee labor-hours, but actually staffed 780 labor-hours. Required: Calculate the salaries and wages activity variance for August. X Answer is not complete. Salaries and wages activity variance would be Unfavorablearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education