Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

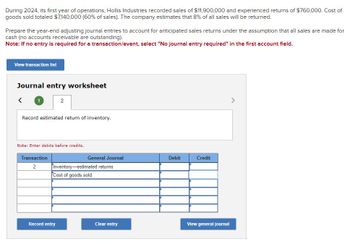

Transcribed Image Text:During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of

goods sold totaled $7,140,000 (60% of sales). The company estimates that 8% of all sales will be returned.

Prepare the year-end adjusting journal entries to account for anticipated sales returns under the assumption that all sales are made for

cash (no accounts receivable are outstanding).

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

1

2

Record estimated return of inventory.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

2

Inventory-estimated returns

Cost of goods sold

Record entry

Clear entry

View general journal

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Using the following select financial statement information from Mover Supply Depot, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Mover Supply Depot if the industry average is 4 times?arrow_forwardUsing the following select financial statement information from Mover Supply Depot, compute the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Mover Supply Depot if the competition collects in approximately 65 days?arrow_forwardDuring 2021, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all sales will be returned. Prepare the year-end adjusting journal entries to account for anticipated sales returns, assuming that all sales are made on credit and all accounts receivable are outstanding. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- During 2018, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returnsof $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all saleswill be returned. Prepare the year-end adjusting journal entries to account for anticipated sales returns, assumingthat all sales are made on credit and all accounts receivable are outstanding.arrow_forwardIndigo Corporation had record sales in 2023. It began 2023 with an Accounts Receivable balance of $613,500 and an Allowance for Expected Credit Losses of $40,400. Indigo recognized credit sales during the year of $8,020,000 and made monthly adjusting entries equal to 0.5% of each month's credit sales to recognize the loss on impairment. Also during the year, the company wrote off $42,400 of accounts that were deemed to be uncollectible, although one customer whose $4,800 account had been written off surprised management by paying the amount in full in late September. Including this surprise receipt, $7,882,200 in cash was collected on account in 2023. To assess the reasonableness of the allowance for expected credit losses, the controller prepared the following aged listing of the receivables at December 31, 2023: Days Account Outstanding Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days (b) Amount $378,500…arrow_forwardUSM records $120,000 of sales in the month of December 2020. USM estimates that $10,000 of returns of December sales will eventually be returned. As of December 31, 2020, $2,000 of returns have been processed. Assuming zero balance in the refund liability account, what is the effect of the entry necessary at December 31 to record estimated returns? Omit the cost of sales entry. Group of answer choices: a,) Decrease revenues and increase liabilities for $8,000 b.) Decrease revenues and increase liabilities for $10,000 c.) Increase expenses and Increase Liabilities for $8,000 d.) Increase expenses and Increase Liabilities for $10,000 e.) None of the abovearrow_forward

- Potaw Company reported the following data at the end of 2019: Sales revenue (80% on credit) Expenses (25% on credit) Accounts receivable, net at December 31, 2019 (a decrease of $12,500 during 2019) Total assets Stockholders' equity The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) Multiple Choice The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) O O O 17.67. 22.08. $470,000 77,000 12.81. 16,500 370,000 170,000 30.90.arrow_forwardIn the current year, Borden Corporation had sales of $2,000,000 and cost of goods sold of $1,200,000. Borden expects returns in the following year to equal 8% of sales. The unadjusted balance in Inventory Returns Estimated is a debit of $6,000, and the unadjusted balance in Sales Refund Payable is a credit of $10,000. The adjusting entry or entries to record the expected sales returns is (are): (A) Accounts Receivable 2,000,000 Sales 2,000,000 (B) Sales returns and allowances 150,000 Sales 150,000 Cost of Goods Sold 90,000 Inventory Returns Estimated 90,000 (C) Sales 2,000,000 Sales Refund Payable 160,000 Accounts receivable 1,840,000 Sales Refund Payable 150,0000 Accounts receivable 150,000 (D) Sales Returns and Allowances 150,000 Sales Refund Payable 150,000 Inventory Returns Estimated 90,000 Cost of goods sold 90,000arrow_forwardWinterwear Clothiers reported the following selected items at April 30, 2025 (last year's-2024-amounts also given as needed): View the financial data. Compute Winterwear Clothiers' (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days' sales in receivables for the year ending April 30, 2025. Evaluate each ratio value as strong or weak. Winterwear Clothiers sells on terms of net 30. (Round days' sales in receivables to a whole number.) (Ignore leap-years, using a 365-day where needed.) (a) Compute Winterwear Clothiers' acid-test ratio. (Round your final answer to two decimal places. Abbreviation used: Avg. = Average; Invest. = Investment; Liab. = Liabilities; Merch. = Merchandise; Receiv. = Receivable; Rev. = Revenue.) + + + + Financial Data = Acid-test ratio = Accounts Payable 320,000 Accounts Receivable, net: Cash 260,000 April 30, 2025 $ 270,000 Merchandise Inventory: April 30, 2024 170,000 April 30, 2025 290,000 Cost of Goods Sold 1,150,000 April 30, 2024 200,000…arrow_forward

- Cheyenne Limited had net sales in 2023 of $2.0 million. At December 31, 2023, before adjusting entries, the balances in selected accounts were as follows: Accounts Receivable $237,600 debit; Allowance for Expected Credit Losses $3,500 debit. Assuming Cheyenne has examined the aging of the accounts receivable and has determined the Allowance for Expected Credit Losses should have a balance of $25,800, prepare the December 31, 2023 journal entry to record the adjustment to Allowance for Expected Credit Losses. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardBluebird, Inc. had net sales (all on account) in 2020 of$600,000. At December 31,2020 , before adjusting entries, the balances in selected accounts were: accounts receivable$75,000debit and allowance for doubtful accounts$1,500debit. Bluebird estimates that3%of its net sales will prove to be uncollectible. What is the net realizable value of the receivables reported on the financial statements at December 31,2020 ?arrow_forwardBecky had net sales (all on Accounts) in 2020 of $8,000,000. At december 31, 2020, before adjusting entries, the balances in selected accounts were:accounts receivable $1,000,000 debit, and allowance for doubtful accounts $2,000 debit. Becky estimates that 3%of its accounts receivable will prove to be uncollectible. What is the net amount expected to be collected of the receivables reported on the financial statement at December 31, 2020arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College