FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

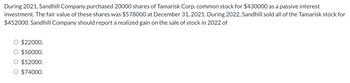

Transcribed Image Text:During 2021, Sandhill Company purchased 20000 shares of Tamarisk Corp. common stock for $430000 as a passive interest

investment. The fair value of these shares was $578000 at December 31, 2021. During 2022, Sandhill sold all of the Tamarisk stock for

$452000. Sandhill Company should report a realized gain on the sale of stock in 2022 of

O $22000.

O $50000.

O $52000.

O $74000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2020, Bar Inc. purchased 50,000 of Tell Inc.’s preference shares in exchange of a tract of Bar’ land which was carried in the books at P1,200,000. The shares were classified as financial assets at fair value through profit or loss. The land had a fair value of P1,500,000. Meanwhile, Tell's shares had a fair value of P29 per share. How much is the gain to be recognized from the exchange of the land?arrow_forwardStrawberry Corp. has various equity investment at fair value through profit or loss transactions during 2020 and 2021. The acquisition cost of all the securities in its portfolio during 2020 was P 532,000. At December 31, 2020 and December 31, 2021, the market values of these investments were P 541,000 and P 512,000, respectively. In 2022, all of these securities were sold for P 550,000. Assuming no other transactions are noted regarding these financial assets at fair value through profit or loss, what is the amount of unrealized gain/loss reported in the 2021 income statement relating to these securities? A. P 29,000 loss B. P 20,000 loss C. P 29,000 gain D. P 20,000 gainarrow_forwardOn June 30, 2021, Peter, Inc. purchased the following shares at a total cost of P10,700,000 designated as FVPL investment: Number of shares Total fair value Faye Corp. 100,000 1,400,000 Barto Corp. 200,000 3,700,000 Kesha Corp. 400,000 5,600,000 At the end of the year, the fair values of the shares are as follows: Faye Corp. P17 Barto Corp. 21 Kesha Co. 11 On June 30, 2022, Peter sold 75% of its holdings in Kesha at P13 per share. How much is the realized gain on sale on FVPL to be reported in net income during 2022?arrow_forward

- Cariston, Inc. has equity securities designated as at fair value through profit or loss that were purchased during 2020. At the end of 2020, the securities had total market value of P525,000. As of December 31, 2021, the records show cost and market value as follows: Investment Cost Market Value 1 P100,000 P90,000 2 190,000 210,000 3 250,000 235,000 The gain or loss that would reported in profit or loss as a result of the valuation of the securities at the end of 2021 isarrow_forwardPearson Corporation purchased a 20% interest in Dish Company common stock on January 1, 2019 for $300,000. This investment was accounted for using the complete equity method and the correct balance in the Investment in Dish account on December 31, 2021 was $440,000. The original excess purchase transaction included $60,000 for a patent amortized at a rate of $6,000 per year. In 2022, Dish Corporation had net income of $4,000 per month earned uniformly throughout the year and paid $20,000 of dividends in May. If Pearson sold one-half of its investment in Dish on August 1, 2022 for $500,000, how much gain was recognized on this transaction? A) $190,540B) $280,950 C) $610,000D) $438,100arrow_forwardOn January 2, 2020, Black Company purchased 17% of Rock Company's common stock for $51,000. Rock's net income for the years ended December 31, 2020, and December 31, 2021, were $15,000 and $59,000, respectively. During 2020, Rock declared and paid a dividend of $67,500. On December 31, 2020, the fair value of the Rock stock owned by Black had increased to $69,000. How much should Black show in the 2020 income statement as income from this investment? Multiple Choice $29,475. There is no correct answer. $24,000. $11,475. $18,000. ME MacBook Airarrow_forward

- Cloud 9 Inc. has equity securities designated as at fair value through profit or loss that were purchased during 2020. At the end of 2020, the securities had a total fair value of P525,000. As of December 31, 2021, the cost and fair values are as follows: Investment Cost Fair Value 1 P100,000 P 90,000 2 190,000 210,000 3 250,000 235,000 The gain or loss that would be reported in profit or loss as a result of the valuation of the securities at the end of 2021 is? A P5,000 B P25,000 c) P10,000 D P20,000arrow_forwardOn February 2, 2020, Groove Company purchased 15% of Pop Company's common stock for $54,00O. Pop's net income for the years ended December 31, 2020, and December 31, 2021, were $16,000 and $54,000, respectively. On July 30, 2020, Pop declared and paid a dividend of $66,500. On December 31, 2020, the fair value of the Pop stock owned by Groove had increased to $72,000. How much should Groove show in the 2020 income statement as income from this investment? Multiple Choice $18,000. $9,975. $24,000. $27,975.arrow_forwardOn December 31, 2020, Hazel Company held 1,000 ordinary shares of X Co. in its portfolio of long-term investments in equity securities. The shares were designated as at fair value through other comprehensive income. The shares had a cost of P150 per share and had a fair value of P130 per share at December 31, 2020. During 2021, Hazel acquired the following investments, all of which were designated as at fair value through other comprehensive income: 900 ordinary shares of Y Co. for P180 per share and 800 ordinary shares of Z Co. for P220 per share. At the end of 2021, market values per share were: X - P140; Y - P170; Z - P200. What is the net unrealized loss account balance reported in the stockholders' equity section of Hazel Company's statement of financial position at December 31, 2021? (A) PO B) P15,000 P20,000 D) P35,000arrow_forward

- On its December 31, 2024, balance sheet, Sandhill Company reported its investment in equity securities, which cost $690000, at fair value of $618000. At December 31, 2025, the fair value of the securities was $649000. What should Sandhill report on its 2025 income statement as a result of the increase in fair value of the investments in 2025? O Realized gain of $31000 O Unrealized gain of $31000 O Unrealized loss of $41000 O $0arrow_forwardDuring 2019, the first year of operation, Maly Corporation made various investments in trading securities. On December 31, 2019, the investments had the following cost and market value: Cost Market Value P 1,300,000 800,000 1,000,000 12/31/2019 P 1,250,000 900,000 700,000 XYZ MNO FGH How much should be included as unrealized loss on the income statement for the year 2019?arrow_forwardOn February 11, 2021, Brownie Corp. purchased 500 common shares of Candy Inc. for $45,000 and classified the investment as FV-OCI. At December 31, 2021, the fair value of the shares is $42,160. Assuming that Brownie has a December 31 year-end, the required year-end adjusting entry for this investment is: Question 13 options: DR FV-OCI investments $42,160 CR AOCI $42,160 DR AOCI $2,840 CR FV-OCI investments $2,840 DR AOCI $42,160 CR FV-OCI investments $42,160 DR FV-OCI investments $2,840 CR AOCI $2,840arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education