FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

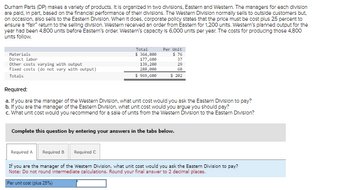

Transcribed Image Text:Durham Parts (DP) makes a variety of products. It is organized in two divisions, Eastern and Western. The managers for each division

are paid, in part, based on the financial performance of their divisions. The Western Division normally sells to outside customers but,

on occasion, also sells to the Eastern Division. When It does, corporate policy states that the price must be cost plus 25 percent to

ensure a "fair" return to the selling division. Western received an order from Eastern for 1.200 units. Western's planned output for the

year had been 4,800 units before Eastern's order. Western's capacity is 6.000 units per year. The costs for producing those 4,800

units follow.

Materials

Direct labor

Other costs varying with output

Fixed costs (do not vary with output)

Totals

Total

$364,800

177,600

139,200

288,000

$ 969,600

Required:

a. If you are the manager of the Western Division, what unit cost would you ask the Eastern Division to pay?

b. If you are the manager of the Eastern Division, what unit cost would you argue you should pay?

c. What unit cost would you recommend for a sale of units from the Western Division to the Eastern Division?

Required A

Per Unit

$ 76

37

29

60

$ 202

Complete this question by entering your answers in the tabs below.

Required B Required C

If you are the manager of the Western Division, what unit cost would you ask the Eastern Division to pay?

Note: Do not round intermediate calculations. Round your final answer to 2 decimal places.

Per unit cost (plus 25%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perfumes Ltd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division's variable manufacturing cost per unit is $3.00 and shipping costs are $0.20 per unit. The Bottle Division's external sales price is $4.00 per unit. No shipping costs are incurred on sales to the Perfume Division. The Perfume Division can purchase similar bottles in the external market for $3.50. The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division. Required: Using the general rule, determine the minimum transfer price. Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change? Assume the Bottle Division has no excess capacity and can sell everything produced…arrow_forwardsarrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales price Variable costsb Fixed costs a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. a. Optimal transfer price b. Transfer price c Transfer price Required: a. Current output in Production is 25,300 units. Packaging requests an additional 5,960 units to produce a special order. What transfer price would you recommend? to search b. Suppose Production is operating at full capacity. What transfer price would you…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education