FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

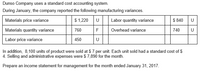

Transcribed Image Text:Dunso Company uses a standard cost accounting system.

During January, the company reported the following manufacturing variances.

Materials price variance

$ 1,220

U

Labor quantity variance

$ 840

U

Materials quantity variance

760

F

Overhead variance

740

U

Labor price variance

450

U

In addition, 8,100 units of product were sold at $7 per unit. Each unit sold had a standard cost of $

4. Selling and administrative expenses were $ 7,890 for the month.

Prepare an income statement for management for the month ended January 31, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following labor standards have been established for a particular product Standard labor hours per unit of output Standard labor rate 4.3 hours $ 20.10 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked Actual total labor cost Actual output 6,900 hours $ 139,380 1,500 units Required: a. What is the labor rate variance for the month? b. What is the labor efficiency variance for the month? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (Le zero variance). Input all amounts as positive values. a. Labor rate variance. b. Labor efficiency variancearrow_forwardThe standard cost of product 2525 includes 4.10 hours of direct labour at $14.40 per hour. The predetermined overhead rate is $21.60 per direct labour hour. During July, the company incurred 11,170 hours of direct labour at an average rate of $14.80 per hour and $237,012 of manufacturing overhead costs. It produced 2,700 units. (a) Calculate the total, price, and quantity variances for labour. (Round per unit calculations to 2 decimal places, e.g. 1.25 and final answers to O decimal places, e.g. 125.) Total labour variance Labour price variance Labour quantity variance eTextbook and Media Save for Later tA $ $ +A ta $ Favourable Unfavourable Neither favourable nor unfavourable Attempts: 0 of 3 used Submit Answerarrow_forwardThe following information was gathered for Larsen Corp. for the year ending 20xx. Budgeted direct labor hours 15,500 Actual direct labor hours 16,200 Budgeted factory overhead cost $73,625 Actual factory overhead cost $74,990 -Assume direct labor hours is the cost driver Required: What is the amount of over/underapplied overhead ? Is the variance over or under estimated ?arrow_forward

- The records of Heritage Home Supplies show the following for July: Standard direct labor-hours allowed per unit of output 4 Standard variable overhead rate per standard direct labor-hour $ 44 Good units produced 3,800 Actual direct labor-hours worked 14,675 Actual total direct labor cost $ 537,200 Direct labor efficiency variance $ 19,530 F Actual variable overhead $ 645,700 Required: Compute the direct labor and variable overhead price and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Direct labor: Price variance Efficiency variance Variable overhead: Price variance Efficiency variance need helparrow_forwardChulak Company uses a standard costing system. The following data are available for the month: Actual quantity of direct materials purchased 25,000 pounds Standard price of direct materials $2 per pound Material price variance $2,500 unfavorable The actual price per pound of direct materials purchased during the month isarrow_forwardIn October, Pine Company reports 21,000 actual direct labor hours, and it incurs $118,000 of manufacturing overhead costs. Standard hours allowed for the work done is 20,600 hours. The predetermined overhead rate is $6.00 per direct labor hour. In addition, the flexible manufacturing overhead budget shows that budgeted costs are $4 variable per direct labor hour and $50,000 fixed. Compute the overhead controllable variance. Overhead Controllable Variance $ 5600 Favorable 23arrow_forward

- The following materials standards have been established for a particular product: Standard quantity per unit of output Standard price 4.9 pounds $13.70 per pound The following data pertain to operations concerning the product for the last month: Actual materials purchased Actual cost of materials purchased Actual materials used in production Actual output 5,550 pounds $63,380 5,050 pounds 750 units The direct materials purchases variance is computed when the materials are purchased. What is the materials quantity variance for the month? Multiple Choice $5,710 U $15,702 U $18,838 U $6,850 Uarrow_forwardThe following information is gathered from the labor records of Binamul & Co. Payroll allocation for direct labor is Rs. 1, 31, 600 Time card analysis shows that 9,400 hours were worked on productions lines. Production reports for the period showed that 4,500 units have been completed, each having standard labor time of 2 hours and a standard labor rate of Rs. 15 per hour. Calculate the labor variances.arrow_forwardBudget Performance Report Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: Standard Cost per 100 Two-Liter Cost Category Direct labor Direct materials Factory overhead Total At the beginning of March, Salisbury's management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: Actual Cost for the Month Ended March 31 Cost Category Direct labor Direct materials Factory overhead Total Bottles $1.20 6.50 1.80 $9.50 Manufacturing costs: Direct labor Direct materials Factory overhead Total a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. Salisbury Bottle Company Manufacturing Cost Budget For the Month Ended March 31 $6,550 33,800 9,100 $49,450 $ Standard Cost at Planned…arrow_forward

- In October, Pine Company reports 19,400 actual direct labor hours, and it incurs $122,380 of manufacturing overhead costs Standard hours allowed for the work done is 21,100 hours. The predetermined overhead rate is $5.75 per direct labor hour. Compute the total overhead variance Total Overhead Variancearrow_forwardNonearrow_forwardSubject:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education