Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide Correct answer without Fail

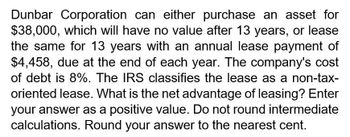

Transcribed Image Text:Dunbar Corporation can either purchase an asset for

$38,000, which will have no value after 13 years, or lease

the same for 13 years with an annual lease payment of

$4,458, due at the end of each year. The company's cost

of debt is 8%. The IRS classifies the lease as a non-tax-

oriented lease. What is the net advantage of leasing? Enter

your answer as a positive value. Do not round intermediate

calculations. Round your answer to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardDunbar Corporation can purchase an asset for $21,000; the asset will be worthless after 13 years. Alternatively, it could lease the asset for 13 years with an annual lease payment of $2,113 paid at the end of each year. The firm’s cost of debt is 7%. The IRS classifies the lease as a non-tax-oriented lease. What is the net advantage to leasing? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardProvide solution for this questionarrow_forward

- If you give me wrong answer, I will give you UN helpful rate.arrow_forwardDunbar Corporation can purchase an asset for $29,000; the asset will be worthless after 15 years. Alternatively, it could lease the asset for 15 years with an annual lease payment of $2,494 paid at the end of each year. The firm’s cost of debt is 5%. The IRS classifies the lease as a non-tax-oriented lease. What is the net advantage to leasing?arrow_forwardNonearrow_forward

- Need Full solutionarrow_forwardAt the beginning of 2021, Killion Co. leased furniture to GameStop under a seven-year operating lease agreement. The lease requires quarterly payments of $30,000 each. The furniture was acquired by Killion at a cost of $2.5 million and was expected to have a useful life of 25 years with no residual value. How will GameStop's net income be impacted by this lease? (ignore taxes)? (Enter your answer in whole dollars.).arrow_forwardSuddeth Corporation has entered into a 6 year lease for a building it will use as a warehouse. The annual payment under the lease will be $2,468. The first payment will be at the end of the current year and all subsequent payments will be made at year-ends. If the discount rate is 5%, the present value of the lease payments is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice O O $14,808 $11,050 $14,103 $12,528arrow_forward

- The Harris Company is the lessee on a four-year lease with the following payments at the end of each year: Year 1: $ 18,500 Year 2: $ 23,500 Year 3: $ 28,500 Year 4: $ 33,500 An appropriate discount rate is 7 percentage, yielding a present value of $86,637. b-1. If the lease is a finance lease, what will be the initial value of the right-of-use asset? b-2. If the lease is a finance lease, what will be the initial value of the lease liability? b-3. If the lease is a finance lease, what will be the lease expense shown on the income statement at the end of year 1? (Leave no cells blank – be certain to enter “0” wherever required.) b-4. If the lease is a finance lease, what will be the interest expense shown on the income statement at the end of year 1? (Round your answer to the nearest dollar amount.) b-5. If the lease is a finance lease, what will be the amortization expense shown on the income statement at the end of year 1? (Round your answer to…arrow_forwardBurns, Inc. (lessor) agreed to lease a delivery van to Wilmore Corp. (lessee). The lease was classified as a finance/sales-type lease, but the van will be turned back over to Burns at the end of six years. Which of the following is true regarding the proper treatment of the delivery van's estimated residual value? Multiple Choice In a lease that includes selling profit, the lessor will add the present value of the estimated residual value to sales revenue in the initial entry. U In establishing the initial lease payable, Wilmore will include the present value of the full estimated residual value, but only if it is guaranteed. Estimated residual values are ignored by both parties when initially recording a lease. In calculating the required lease payments, Burns will consider the estimated residual value regardless of whether it is guaranteed or unguaranteed by Wilmore.arrow_forwardBelardo Manufacturing is considering a lease to acquire new equipment. The useful life of the asset is 10 years. Belardo can lease the equipment from Weber City Bank for $5,000 per year over an 9-year period. The lease does not contain a purchase option. There is no transfer of ownership clause in the contract. Should Belardo account for this lease as an operating or a finance lease? Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Begin by identifying any of the Group I criteria that Belardo meets. (Select all that apply. If there is insufficient information to determine if a specific criteria is met, do not check the box for that criteria.) 1. The lease transfers ownership to the lessee at the end of the lease term. 2. The lessee is given an option to purchase the asset that the lessee is reasonably certain to exercise. 3.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning