FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help on #4 and onward

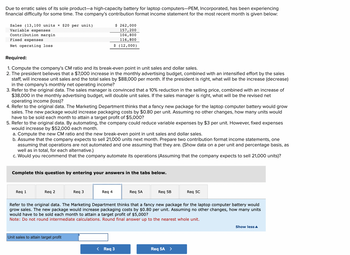

Transcribed Image Text:Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorporated, has been experiencing

financial difficulty for some time. The company's contribution format income statement for the most recent month is given below:

Sales (13,100 units x $20 per unit)

Variable expenses

Contribution margin.

Fixed expenses

Net operating loss

Required:

1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales.

2. The president believes that a $7,000 increase in the monthly advertising budget, combined with an intensified effort by the sales

staff, will increase unit sales and the total sales by $88,000 per month. If the president is right, what will be the increase (decrease)

in the company's monthly net operating income?

3. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of

$38,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net

operating income (loss)?

4. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grow

sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how many units would

have to be sold each month to attain a target profit of $5,000?

5. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses

would increase by $52,000 each month.

a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales.

b. Assume that the company expects to sell 21,000 units next month. Prepare two contribution format income statements, one

assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as

well as in total, for each alternative.)

c. Would you recommend that the company automate its operations (Assuming that the company expects to sell 21,000 units)?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Req 3

$

$ 262,000

157,200

104,800

116,800

$ (12,000)

Total

Req 4

0

Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses

would increase by $52,000 each month. Assume that the company expects to sell 21,000 units next month. Prepare two

contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show

data on a per unit and percentage basis, as well as in total, for each alternative.)

Note: Do not round your intermediate calculations. Round your percentage answers to the nearest whole number.

PEM, Incorporated

Contribution Income Statement

Not Automated

Per Unit

0

$

Req 5A

< Req 5A

0

%

Req 5B

0

Total

Automated

Per Unit

0

0

Req 5C

Req 5C >

$

0

%

0

Show less A

Transcribed Image Text:Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorporated, has been experiencing

financial difficulty for some time. The company's contribution format income statement for the most recent month is given below:

Sales (13,100 units x $20 per unit)

Variable expenses

Contribution margin

Fixed expenses

Net operating loss

Required:

1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales.

2. The president believes that a $7,000 increase in the monthly advertising budget, combined with an intensified effort by the sales

staff, will increase unit sales and the total sales by $88,000 per month. If the president is right, what will be the increase (decrease)

in the company's monthly net operating income?

3. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of

$38,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net

operating income (loss)?

4. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grow

sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how many units would

have to be sold each month to attain a target profit of $5,000?

5. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses

would increase by $52,000 each month.

a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales.

b. Assume that the company expects to sell 21,000 units next month. Prepare two contribution format income statements, one

assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as

well as in total, for each alternative.)

c. Would you recommend that the company automate its operations (Assuming that the company expects to sell 21,000 units)?

Complete this question by entering your answers in the tabs below.

Req 1

$ 262,000

157,200

104,800

116,800

$ (12,000)

Req 2

Req 3

Unit sales to attain target profit

Req 4

Req 5A

< Req 3

Req 5B

Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would

grow sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how many units

would have to be sold each month to attain a target profit of $5,000?

Note: Do not round intermediate calculations. Round final answer up to the nearest whole unit.

Req 5C

Req 5A >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- NWP Assessment Player UI Ap X + -> A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=c59069c8-77ac-43ad-888c-80c06e514aa6#/question/0 Update : Apps M Gmail YouTube P MyLab & Masterin... E Brytewave eReader E Home | North Car... VitalSource Books... GRLContent WP WileyPLUS E Reading List E Chapter 6.A Homework Question 1 of 6 > -/3 View Policies Current Attempt in Progress Wildhorse Co. just took its physical inventory on December 31. The count of inventory items on hand at the company's business locations resulted in a total inventory cost of $ 289,300. In reviewing the details of the count and related inventory transactions, you have discovered the following items that had not been considered. 1. Wildhorse has sent inventory costing $ 30,510 on consignment to Richfield Company. All of this inventory was at Richfield's showrooms on December 31. The company did not include in the count inventory (cost, $ 18,270) that was sold on December 28, terms FOB shipping point.…arrow_forwardAssistarrow_forwardNot a previously submitted question. Thank youarrow_forward

- MindTap - Cengage Learning CengageNOWv2 | Online teachin x 9 Cengage Learning b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Ch 13-2 Practice Exercises E Calculator eBook Show Me How Print Item Reporting Stockholders' Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 50,000 shares of common stock authorized, and 2,000 shares have been reacquired. Common Stock, $80 par $3,200,000 Paid-In Capital from Sale of Treasury Stock 64,000 Paid-In Capital in Excess of Par-Common Stock 440,000 Retained Earnings 1,728,000 Treasury Stock 42,000 Stockholders' Equity Paid-In Capital: Common Stock, $80 Par 3,200,000 Excess over par 440,000 Treasury Stock From Sale of Treasury Stock 64,000 Total Paid-in Capital $ 3,704,000 Retained Earnings Total Treasury Stock Total Stockholders' Equity Check My Work 2 more…arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease help on parts 4 and 5. Please also show work on how to do.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education