FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Create a schedule of cash collection using both pi

Transcribed Image Text:viii

Rent was charged at $ 20 000.00 quarterly.

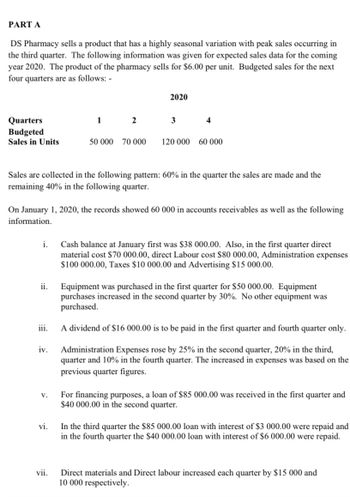

Transcribed Image Text:PART A

DS Pharmacy sells a product that has a highly seasonal variation with peak sales occurring in

the third quarter. The following information was given for expected sales data for the coming

year 2020. The product of the pharmacy sells for $6.00 per unit. Budgeted sales for the next

four quarters are as follows: -

Quarters

Budgeted

Sales in Units

i.

ii.

iii.

iv.

V.

1

Sales are collected in the following pattern: 60% in the quarter the sales are made and the

remaining 40% in the following quarter.

vi.

2

On January 1, 2020, the records showed 60 000 in accounts receivables as well as the following

information.

vii.

2020

3

50 000 70 000 120 000

4

60 000

Cash balance at January first was $38 000.00. Also, in the first quarter direct

material cost $70 000.00, direct Labour cost $80 000.00, Administration expenses

$100 000.00, Taxes $10 000.00 and Advertising $15 000.00.

Equipment was purchased in the first quarter for $50 000.00. Equipment

purchases increased in the second quarter by 30%. No other equipment was

purchased.

A dividend of $16 000.00 is to be paid in the first quarter and fourth quarter only.

Administration Expenses rose by 25% in the second quarter, 20% in the third,

quarter and 10% in the fourth quarter. The increased in expenses was based on the

previous quarter figures.

For financing purposes, a loan of $85 000.00 was received in the first quarter and

$40 000.00 in the second quarter.

In the third quarter the $85 000.00 loan with interest of $3 000.00 were repaid and

in the fourth quarter the $40 000.00 loan with interest of $6 000.00 were repaid.

Direct materials and Direct labour increased each quarter by $15 000 and

10 000 respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements are true regarding the control of cash receipts and cash payments? Over-the-counter cash sales should be recorded on a cash register after each sale.arrow_forwardDefine Restricted Cash and Compensating Balances.arrow_forwardTrue or False: Managing the cash inflows and payment outflows is one of the critical functions of the financial manager.arrow_forward

- Please solve all questions The transaction processing device (TPS) is an activity which includes systems daily the expenditure cycle, the conversion cycle and the revenue cycle. whilst every cycle performs unique particular tasks and helps distinctive objectives, they percentage commonplace traits. as an example, all 3 TPS cycles capture the monetary transaction, file the outcomes of transactions accounting document and offer facts about transactions day-to-day users in assist of their day to day activities. a. elaborate the cash flow through the transaction cycle by discussing the applicable subsystems and any opportunities of time lags that may occur b. explain the relationship between the balance within the account payable general ledger control account and accounts payable subsidiary ledgerarrow_forwardPrepare a flowchart of the cash receipts procedure described previouslyarrow_forwardDiscuss three (3) internal control principles for cash payments. Provide corresponding examples of procedures that are applicable to each principle.arrow_forward

- H7. What specific information would you need to begin a cash receipts forecast? Identify three items that would be helpful. Please explain with detailsarrow_forwardhow do we record in the cash payment journal for the payment in cash and with the GST included and received discountarrow_forwardWhich of the following is most likely to appear in the operating section of a cash fl ow statement under the indirect method? C . Cash received from customers.arrow_forward

- Which of the following is an effective internal control for cash payments? A.Payments should be authorised before they are made B.Payments to suppliers should be made as quickly as possible C.An experienced accountant should have total responsibility for all cash payment functions D.Supporting documentation should be destroyed immediately afterpayment to avoid incorrectly paying twicearrow_forwardDistinguish among the following: (1) a general checkingaccount, (2) an imprest bank account, and (3) a lockboxaccount.arrow_forwardAn invoice is generated in the cash receipts process.sales order creation process.shipping process.picking process.billing process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education