FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:$66

14.10

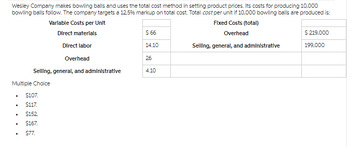

Wesley Company makes bowling balls and uses the total cost method in setting product prices. Its costs for producing 10,000

bowling balls follow. The company targets a 12.5% markup on total cost. Total cost per unit if 10,000 bowling balls are produced is:

Variable Costs per Unit

Direct materials

Direct labor

Fixed Costs (total)

Overhead

$ 219,000

Selling, general, and administrative

199,000

Overhead

26

Selling, general, and administrative

4.10

Multiple Choice

•

$107.

$117.

.

$152

•

$167.

$77.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Requlred Informatlon [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product Its average cost per unit for each product at this level of activity are given below. Alpha $42 42 $24 Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses 24 26. 34 27 29. $173 Total cost per unit The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 4. Assume that Cane expects to produce and sell 109,000 Betas during the current year. One of Cane's sales representatives has found a new customer who is willing to…arrow_forwardProblem 6-18 (Algo) Relevant Cost Analysis In a Variety of Situations [LO6-2, LO6-3, LO6-4] Andretti Company has a single product called a Dak. The company normally produces and sells 87,000 Daks each year at a selling price of $60 per unit. The company's unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 7.50 8.00 2.90 5.00 ($435,000 total) 2.70 2.50 ($217,500 total) $28.60 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 113,100 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 30% above the present 87,000 units each year if it were willing to increase the fixed selling expenses by $110,000. What is the financial…arrow_forwardDirect materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit cost Cost per Unit $ 32.50 13.00 19.50 26.00 $91.00 An outside supplier has offered to provide Cotton with the 10,000 subcomponents at an $84.50 per-unit price. No portion of fixed overhead is avoidable. If Cotton accepts the outside offer, what will be the effect on short-term profits?arrow_forward

- Vegas Company has the following unit costs: Variable manufacturing overhead $ 30 Direct materials 25 Direct labor 24 Fixed manufacturing overhead 17 Variable marketing and administrative 8 Vegas produced and sold 13,500 units. If the product sells for $115, what is the contribution margin? Multiple Choice $148,500 $486,000 $256,500 $378,000arrow_forwardHelp answer plsarrow_forward5arrow_forward

- LL Requlred Information The following information applies to the questions displayed below] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product Its average cost per unit for each product at this level of activity are given below. Alpha $42 Beta $ 24 32 24 Direct materials Direct labor Variable manufacturing overhead Traceable Fixed manufacturing overhead Variable selling expenses Common fixed expenses 42. 26. 34 31. 34. 27. Total cost per unit $173 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 2 What is the company's total amount of common fixed expenses? Total common fixed expenses. ( Prev of 15 2 3 4 Next e to search TPL F4 F5arrow_forwardNonearrow_forwardt 0 ences Mc Graw Hill Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense Break even point $ 25 $ 20 The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing…arrow_forward

- 55arrow_forwardNonearrow_forward6 Dake Corporation's relevant range of activity is 2.000 units to 6.000 units. When it produces and sells 4,000 unts, its average costs per un are as follows Average Cost per Unit $ 6.55 $ 3.50 $ 1.40 $ 2.60 5.0.70 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense $ 0.40 Fixed administrative expense Sales commissions $ 1.50 Variable administrative expense $ 0.45 For financial reporting purposes, the total amount of product costs incurred to make 4.000 units is closest to Multiple Choice $56.200arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education