ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

May i know the correct answers from 1-3

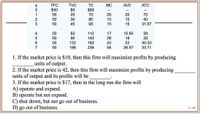

Transcribed Image Text:TFC

TVC

$0

TC

MC

AVC

ATC

$50

$50

--

--

1

50

20

70

20

20

70

50

30

80

10

15

40

3

50

45

95

15

15

31.67

4

50

62

112

17

15.50

28

50

90

140

28

18

28

50

132

182

42

22

30.33

7

50

186

236

54

26.57

33.71

1. If the market price is $10, then this firm will maximize profits by producing

units of output.

2. If the market price is 42, then this firm will maximize profits by producing

units of output and its profits will be

3. If the market price is $17, then in the long run the firm will

A) operate and expand.

B) operate but not expand.

C) shut down, but not go out of business.

D) go out of business.

11-48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- '0.1×1502+0.2×1002+0.3×502' mean is '0.1×1502+0.2×1002+0.3×502 = 2250 + 2000 + 750' or '0.1×150×2+0.2×100×2+0.3×50×2 = 30 + 40 + 30' ?arrow_forwardSuppose that the repeated application of a pesticide used on orange trees causes harmful contamination of groundwater. The pesticide is applied annually in almost all of the orange groves throughout the world. Most orange growers regard the pesticide as a key input in their production of oranges. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWrite down the name of the sections of the report. (a) What questions are answered in each section? Write one specific question and one general question for each section.arrow_forward

- please answer the questions on the image attached with work shown, thanks!arrow_forwardf (x, y) = 3x² + y³ + 4xy² +8 Of(x,y) dr Of(x,y) dy What is the value of when x = 4 and y = 5? (Note: the answer may not be a whole number, so please round to the nearest hundredth) (Note: the numbers may change between questions, so read carefully)arrow_forwardA country’s gini co-efficient was 0.46 last year and is now 0.48. What can we infer from the change? What would it mean if a country had a co-efficient of 0 or 1?arrow_forward

- No chatgpt used i will give 5 upvotes typing pleasearrow_forward(dollars/16) 8= Ps 5 = P₁ 4= P₂ 0.1 = P4 016 а b g U.S. beef market Q3 Q₁ 113 120 125 (dollars/16) (thousand tons) Rises, L+m+n Falls, L Falls, o None of the above is correct 10=P₂ 7=P3 5-Pi 2= P6 k l Im Q4 Q5 74 76 Japan beef market 'S Q6 86 (thousand tons Refer to the above partial equilibrium model of trade (large country case). Assume the world price is $5 when reaching free-trade equilibrium. Moving from a closed situation to free trade, producer surplus in Japan______ byarrow_forwardGive an example of a kind of sampling error you might see in a poll besides random sampling errorarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education