Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Is the estimate of $35 to $40 for Owen’s shares a fair evaluation? Explain. Type a three- to four-sentence response below.

|

Ratio Type |

2012 |

2013 |

|

Current (times) |

3.40 |

3.43 |

|

Quick (times) |

2.18 |

1.83 |

|

Debt (%) |

37.65% |

35.31% |

|

Times interest earned (times) |

8.50 |

11.61 |

|

Inventory turnover (times) |

6.99 |

4.79 |

|

Total asset turnover (times) |

2.78 |

2.71 |

|

Average collections period (days) |

50.14 |

50.99 |

|

|

11.60 |

10.81 |

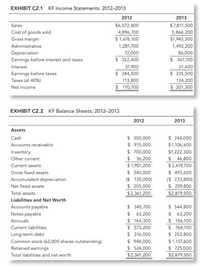

Transcribed Image Text:### Exhibit C2.1: KF Income Statements 2012–2013

#### 2012

- **Sales**: $6,572,800

- **Cost of Goods Sold**: $4,896,700

- **Gross Margin**: $1,676,100

- **Administrative Expenses**: $1,281,700

- **Depreciation**: $72,000

- **Earnings Before Interest and Taxes (EBIT)**: $322,400

- **Interest**: $37,900

- **Earnings Before Taxes**: $284,500

- **Taxes (at 40%)**: $113,800

- **Net Income**: $170,700

#### 2013

- **Sales**: $7,811,500

- **Cost of Goods Sold**: $5,866,200

- **Gross Margin**: $1,945,300

- **Administrative Expenses**: $1,491,200

- **Depreciation**: $86,000

- **Earnings Before Interest and Taxes (EBIT)**: $367,100

- **Interest**: $31,600

- **Earnings Before Taxes**: $335,500

- **Taxes (at 40%)**: $134,200

- **Net Income**: $201,300

### Exhibit C2.2: KF Balance Sheets 2012–2013

#### Assets

##### 2012

- **Cash**: $300,000

- **Accounts Receivable**: $915,000

- **Inventory**: $700,000

- **Other Current Assets**: $36,200

- **Current Assets**: $1,951,200

- **Gross Fixed Assets**: $350,000

- **Accumulated Depreciation**: ($135,000)

- **Net Fixed Assets**: $215,000

- **Total Assets**: $2,361,200

##### 2013

- **Cash**: $244,000

- **Accounts Receivable**: $1,106,600

- **Inventory**: $1,222,300

- **Other Current Assets**: $46,100

- **Current Assets**: $2,619,000

- **Gross Fixed Assets**: $493,

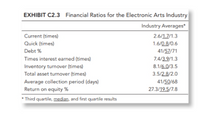

Transcribed Image Text:**EXHIBIT C2.3: Financial Ratios for the Electronic Arts Industry**

This exhibit provides an overview of key financial ratios for the Electronic Arts industry, presented as industry averages across the third quartile, median, and first quartile results.

- **Current (times):**

- Third Quartile: 2.6

- Median: 1.7

- First Quartile: 1.3

- **Quick (times):**

- Third Quartile: 1.6

- Median: 0.8

- First Quartile: 0.6

- **Debt %:**

- Third Quartile: 41

- Median: 57

- First Quartile: 71

- **Times interest earned (times):**

- Third Quartile: 7.4

- Median: 3.9

- First Quartile: 1.3

- **Inventory turnover (times):**

- Third Quartile: 8.1

- Median: 6.9

- First Quartile: 3.5

- **Total asset turnover (times):**

- Third Quartile: 3.5

- Median: 2.8

- First Quartile: 2.0

- **Average collection period (days):**

- Third Quartile: 41

- Median: 50

- First Quartile: 68

- **Return on equity %:**

- Third Quartile: 27.3

- Median: 19.5

- First Quartile: 7.8

This data provides a comprehensive look at the financial health and efficiency of companies within the Electronic Arts industry, indicating their liquidity, leverage, operational efficiency, and profitability. The ratios are vital for evaluating financial performance and making informed business decisions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- can you explain how to solve this?arrow_forwardSee Table 2.5 LOADING... showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2016-2019 as they were in 2015. What would Mydeco's EPS have been each year in this case? Calculate the new EPS for 2016-2019 below: (Round dollar amounts and number of shares to one decimal place. Round percentage amount and the EPS to two decimal places.)arrow_forwarddentifying Comparables and Valuation using PB and PE Tailored Brands Inc.’s book value of equity is $4.563 million and its forward earnings estimate per share is $1.10, or $55.7 million in total earnings. The following information is also available for TLRD and a peer group of companies (identified by ticker symbol) from the specialty retail sector. Ticker Market Cap($ mil.) PB Current Forward PE (FY1) EPS 5-Year Historical Growth Rate ROE (T 4Q) Debt-to- Equity (Prior Year) TLRD -- -- -- -0.47% 22.50% 2.53 GCO 585.7 1 9.699 -323.73% -5.86% 0.13 ZUMZ 789.7 1.95 14.17 3.28% 13.85% 0 GES 1,147.00 2.07 13.19 -37.69% 1.90% 0.56 ANF 988.2 1 19.69 9.37% 6.35% 0.25 TLYS 293.7 1.68 11.6 5.51% 13.93% 0 M 4,760.00 0.75 5.458 -1.74% 16.70% 0.74 (a) Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of…arrow_forward

- Need to calculate for "THE YEAR" *2013* this ratio: •current ratio •quick ratio •cash ratio •total debt ratio •times interested ratio •fixed assets turnover ratio •inventory turnover •net profit margin •return on total assets •return on stockholders equity balance sheet 2013 assets cash 44,494,000 short term investment 4,531,000 net receivable 12,948,000 inventory ------- other current assets 1,310,000 ______________________________________ total current assets 23,283,00 long term investment 4,971,000 PPE 2,760,000 Goodwill 9,267,000 intangible assets 941,000 Accumulated amortization ------------ other assets 266,000 deferred long term assets charge ------- __________________________ total assets 41,488,000 liabilities current liabilities accounts payable 3,215,000 short/current long term debt 9,266,000 other current liabilities 158,000 ________________- total current liabilities 12,639,000 Long term debt 4,117,000 other liabilities 244,000 deferred long term liability charge 841,000…arrow_forwardCompany has return on assets 12.4% and debt-equity ratio is 0.25. What is ROE? Select one: a.35.43% b.9.18% c.9.3% d.15.5%arrow_forwardE2.8 (LO 2) (Calculate ratios and evaluate profitability.) The following informat Saputo Inc. for the year ended March 31 (in millions, except share price): Income available for common shareholders Weighted average number of common shares Share price 2021 $625.6 409.8 $37.79 2020 $582.8 400.3 $33.84 Instructions a. Calculate the basic earnings per share and price-earnings ratio for each year. b. Based on your calculations above, how did the company's profitability change from 2020 to 2021? c. When income rose, did the share price increase? How does this affect the price-earnings ratio? d. Do you think investors are more or less optimistic about the company's profitability in the future? OC €arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education