ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

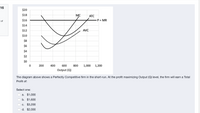

Transcribed Image Text:16

$20

$18

MC

АТС

i of

$16

P = MR

$14

$12

AVC

$10

$8

$6

$4

$2

$0

200

400

600

800

1,000

1,200

Output (Q)

The diagram above shows a Perfectly Competitive firm in the short-run. At the profit maximizing Output (Q) level, the firm will earn a Total

Profit of:

Select one:

а. $1,000

b. $1,600

с. $3,200

d. $2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Farmer Jones grows oranges in Florida. Suppose the market for oranges is perfectly competitive LOADING... and that the market price for a crate of oranges is $11 per crate. Fill in total revenue, average revenue, and marginal revenue in the table below. (Enter your responses as integers.)arrow_forwardNonearrow_forwardQuestion What should the perfectly competitive firm do in the short run, and why? What will this firm do in the long run? Current production = 10,000 Current price = $15 Total cost $300,000 Fixed cost = $200,000 Marginal cost = $15 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a C d Shutdown in the short run, because their shutdown loses will be $100,000 smaller compared to their loses if they stay open. In the long run they should exit the market. Shutdown in the short run, because their shutdown loses will be $50,000 smaller compared to their loses if they stay open. In the long run they should exit the market. Continue to produce in the short run, because their loses will be $50,000 smaller compared to their loses if they shut down. In the long run they should exit the market. Continue to produce in the short run, because their loses will be $50,000 smaller compared to their loses if they shut down. In the long run they should…arrow_forward

- Consider the following graph to answer questions 1) Find the total cost when the firm maximizes profit. 2) Find the CS when the firm maximizes profit. (Don't forget to multiply 0.5 to get the area of a triangle.)arrow_forwardSuppose solar panel manufacturing is an industry subject to significant economies of scale, and there are currently three solar panel manufacturers all with identical costs. If the demand for solar panels is 5 times the quantity produced at the bottom of the long-run average cost curve, which of the following is most likely to happen to the solar panel manufacturing industry in the long run? O The number of solar panel manufacturers will increase O The price of solar panels will increase O The fixed costs of manufacturing solar panels will increase The quantity supplied of solar panels will decreasearrow_forwardThe figure below depicts the short-run market equilibrlum In a perfectly competitive market and the cost curves for a representative firm In that market. Assume that all firms In this market have identical cost curves. Entire Market Single Representative Firm MC ATC ----...... 5 2 300 500 700 10 25 30 Quantity (Number of Units) Quantity (Number of Units) A starting assumption about this Industry was that all of the firms In the market had Identical cost curves. This assumption Is Multiple Choice unrealistic because each firm is unique. realistic because any cost-saving innovation adopted by one firm will be quickly adopted by others. unrealistic because firms closely guard the details of their production processes. realistic because firms rarely seek out cost-saving innovations.arrow_forward

- The table below shows the total cost (TC) and marginal cost (MC) for Choco Lovers, a purely competitive firm producing different quantities of chocolate gift boxes. The market price for a box of chocolates is $5 per box. Instructions: Enter your answers as a whole number. a. Fill in the marginal revenue (MR) and average revenue (AR) columns. Choco Lovers Cost and Revenue Quantity TC MC MR AR of Gift Boxes ($) ($) ($) ($) 10 65 4 15 82 3.50 20 102 4 25 127 5 30 162 7 35 207 9. Instructions: For profit/loss, round your answers to two decimal places. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. A loss should be entered as a negative number. b. Given a price of $5 per gift box, how many boxes of chocolate should Choco Lovers produce? gift boxes What will the profit or loss be per gift box? 2$ per gift box c. Suppose that Choco Lovers raises the price to $7 per gift box. Now how many boxes should Choco Lovers produce? gift boxes…arrow_forwardSuppose she runs a small business that manufactures teddy bears. Assume that the market for teddy bears is a competitive market, and the market price is $20 per teddy bear.arrow_forwardTomas is the general manager for a local automated car wash. The market he operates is perfectly competitive. Every car wash in the area is charging $7 for a car wash, which is also the marginal cost per wash. What will happen to Tomas’ profits if he changes his price to $8. Why? What about the price of $5? What is his profit-maximizing price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education