Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

please help me how to answer all of them. Slso, it is not writing an essay. it is math

Transcribed Image Text:1) INCOME CALCUATION

Gross Income (pay/earnings)

The amount of income/earnings, for any pay period, before deductions

Net income (pay/earnings) (Take home pay)

The amount of income/earnings, for any pay period, after deductions

CPP - Canada Pension Plan

5.1 % of gross income deducted for contribution to your future pension

El - Employment Insurance

1.6 % of gross income deducted for payment in case of future unemployment

Income Tax

A deduction paid to the Federal and Provincial government for taxes. While there are many different income tax

rates, we'll use an average tax rate of 15%.

Union Dues

Fees paid for membership in a union

Now calculate your net monthly income:

$

$16 per hour X 8 hours per day X 21 days per month =

X 15% = $

Gross Income:

%3D

Income Tax: Gross Income $

CPP: Gross Income $

_X 4.95% = | $

X 1.88% =| $

El: Gross Income $

Union Dues: Income $

_X 1% = $

Income Tax + CPP + El + Union Dues = Paycheque Deductions $

%3D

Gross Income $

-- Paycheque Deductions $

Net Income $

%3D

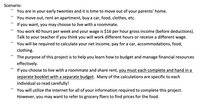

Transcribed Image Text:Scenario:

You are in your early twenties and it is time to move out of your parents' home.

You move out, rent an apartment, buy a car, food, clothes, etc.

If you want, you may choose to live with a roommate.

You work 40 hours per week and your wage is $16 per hour gross income (before deductions).

Talk to your teacher if you think you will work different hours or receive a different wage.

You will be required to calculate your net income, pay for a car, accommodations, food,

clothing.

The purpose of this project is to help you learn how to budget and manage financial resources

effectively.

If you choose to live with a roommate and share rent, you must each complete and hand in a

separate booklet with a separate budget. Many of the calculations are specific to each

individual so read carefully!

You will utilize the internet for all of your information required to complete this project.

However, you may want to refer to grocery fliers to find prices for the food.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,