Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Imagine you just finished 30 years-old, earning $120,000 pre-tax per year paid at the

end of each year. Assume you have no financial asset or explicit liabilities. Your salary

grows 1% per year until you retire at the end of age 65 (35 full years of working). After

retirement, you are entitled to receive a pension paying 50% of your last salary for the

rest of your life (your pension would remain constant). Assume a valuation rate of 5% and

a planning horizon to age 95 (30 full years of retirement). Your current subsistent

consumption is $20,000 (paid at the end of the year). You expect your subsistent

consumption to grow at rate of 2% until the end of age 95. Your goal is to maintain a

constant discretionary consumption (standard of living) for the rest of your life. You

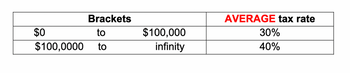

should pay taxes according to the table below.

Please answer:

Part A: If you put your savings in a TFSA account, what is the highest real & constant

standard of living that you can achieve?

Part B: What fraction of your fifth salary (salary at the end of age 35) should you save to

achieve your financial goal? Do not forget subsistent consumption.

Part C: How much financial capital should you have at age 65, so that you can achieve

your financial goal. This is also known as your target “retirement nest egg”.

end of each year. Assume you have no financial asset or explicit liabilities. Your salary

grows 1% per year until you retire at the end of age 65 (35 full years of working). After

retirement, you are entitled to receive a pension paying 50% of your last salary for the

rest of your life (your pension would remain constant). Assume a valuation rate of 5% and

a planning horizon to age 95 (30 full years of retirement). Your current subsistent

consumption is $20,000 (paid at the end of the year). You expect your subsistent

consumption to grow at rate of 2% until the end of age 95. Your goal is to maintain a

constant discretionary consumption (standard of living) for the rest of your life. You

should pay taxes according to the table below.

Please answer:

Part A: If you put your savings in a TFSA account, what is the highest real & constant

standard of living that you can achieve?

Part B: What fraction of your fifth salary (salary at the end of age 35) should you save to

achieve your financial goal? Do not forget subsistent consumption.

Part C: How much financial capital should you have at age 65, so that you can achieve

your financial goal. This is also known as your target “retirement nest egg”.

Transcribed Image Text:$0

Brackets

to

$100,0000 to

$100,000

infinity

AVERAGE tax rate

30%

40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Income Bracket Marginal Tax Rate $0-$6,000 $6,000 $40,000 > $40,000 0% 30% 40% a. Mr. Smith has an income of $50,000 per annum. Calculate his tax bill for the year: $ 14200 b. What is his average tax rate? 28.40°% (Round to two decimal places.) c. What is his highest marginal tax rate? 40°%arrow_forwardIf EBIT is 15,00,000, interest is 250000,corporare tax is 40 percent degree of financial leverage is a. 1:11 b. 1.20 c. 1.31 d. 1.41arrow_forwardHow do you calculate 2/10 net 30 on $112,000arrow_forward

- Financial accounting questionarrow_forwardGeneral accountingarrow_forwardements What is the total Wealth Accumulation of the following investment assuming the available after tax reinvestment rate is 5%? IRR 10.70% O $4,690,000 O $4,821,078 O $4,848,844 $4,905.989 n 0 $ 1 S 2 $ 3 $ AS 5 $ Investment $ (3,000,000) 240,000 250,000 260,000 266,000 3,674,000arrow_forward

- How much debt Is outstanding if the present value of a perpetual tax shield is $350,000, the tax rate is 21% and the interest rate on the debt is 10%? O $300,000 O$1428,571 O$3.000,000 O$1.666.667arrow_forwardAjax Corporation has hired Brad O'Brien as its new president. Terms included the company's agreeing to pay retirement benefits of $18,600 at the end of each semiannual period for 10 years. This will begin in 3,285 days. If the money can be invested at 8% compounded semiannually, what must the company deposit today to fulfill its obligation to Brad? (Please use the following provided Table and Table 12.3.) (Use 365 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Deposit amount 124,779.35arrow_forwardFast pls i will give u like for sure solve this question correctly in 5 min plsarrow_forward

- I & Question 24 If John is expecting sales of $80,000, cost of goods sold of $40,000, operating expenses of $37,000, interest expense of $3,000, and a tax rate of 25%, what is his estimated gross profits? A B $40,000 $0 $20,000 D) $10,000 .arrow_forward16. What would income property be valued at if it had $50,000 annual gross income with 40% expense ratio and the agent uses 10% capitalization rate? A. $300,000 B. $200,000 C. $250,000 D. $500,000arrow_forwardEf 253.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you