Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:$ !

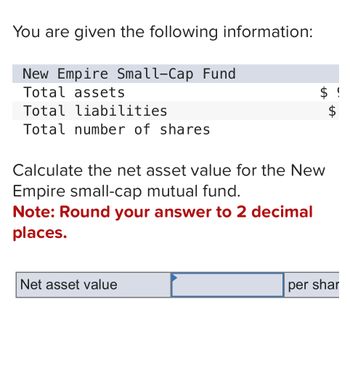

You are given the following information:

New Empire Small-Cap Fund

Total assets

Total liabilities

Total number of shares

Calculate the net asset value for the New

Empire small-cap mutual fund.

Note: Round your answer to 2 decimal

places.

Net asset value

per shar

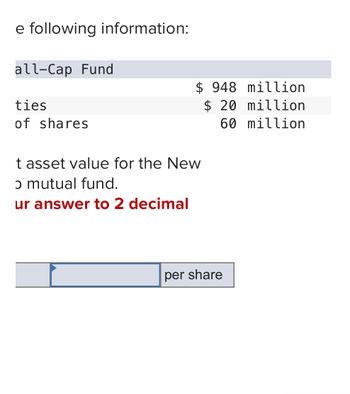

Transcribed Image Text:e following information:

all-Cap Fund

ties

of shares

t asset value for the New

ɔ mutual fund.

ur answer to 2 decimal

$ 948 million

$ 20 million

60 million

per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the primary goal of management? What are the primary tasks of a Chief Financial Officer (CFO) and others in finance function of an organization? Name and explain three tricks that management can play to manage earnings. Explain how using financial ratios can help spot these tricks. . Why is it important to analyze profitability, specifically focusing on return on investment? Invoke the breakdown of ROI in thinking about your responsarrow_forward1. The finance discipline aims to help the business decision makers in answering key questions. How would you answer the following questions? Fully explain. a. Who is your primary customer? b. How company values select shareholder, customer, and employees? c. What critical performance variables would you be tracking? Why? d. How would you solve conflicts between management and shareholders?arrow_forwardwhich of the following is a type of start up costs that should be estimated before starting a business? start up expenses. start up financing. start up assets. all of the above.arrow_forward

- One year ago, you wrote a put option with strike price $30 and one year to expiration. Option premium was $12. Ignore the interest rate. Today is the expiration day, and you still have an open short position in the put. The underlying stock is trading at $42. Your profit is a. Zero. You just broke even. b. $18 c. $42 d. $12arrow_forwardView Policies Show Attempt History Current Attempt in Progress Sheridan Company sold $2,400,000, 7%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022 and pay interes annually on January 1. Sheridan Company uses the straight-line method to amortize bond premium or discount. (a) (b) ง Your answer is partially correct. Prepare all the necessary journal entries to record the issuance of the bonds and bond interest expense for 2022, assuming that the bonds are sold at 99. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Jan. 1, 2022 Cash Discount on Bonds Payable Bonds Payable Dec. 31, 2022 Interest Expense eTextbook and Media Discount on Bonds Payable Interest Payable Debit 2,367,000 165,600 2,400 Crearrow_forwardDescribe how you can identify opportunities for improving cash flow for an organization financial data and how to capture the data required for the analysisarrow_forward

- Nonearrow_forwardMicroTech Corporation is subject to a 35% income tax rate. Given the following information aboutthe firm’s capital structure, calculate the corporation’s weighted-average cost of capital (WACC),rounded to 1 decimal place:Source of Funds Market Value After-Tax Rate or Expected ReturnLong-term debt $40 million 7.0%Preferred stock 20 million 9.0 Common stock 60 million 12.0arrow_forwardDon't use chatgpt, I will 5 upvotes Manning Company issued 10,000 shares of its no-par common stock having a fair value of $30 per share and 15,000 shares of its $15 par value preferred stock having a fair value of $20 per share for a lump sum of $700,000. How much of the proceeds would be allocated to the common stock? a) $300,000 b) $350,000 c) $225,000 d) $200,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON