FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

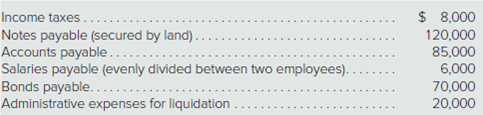

The Walston Company is to be liquidated and has the following liabilities:

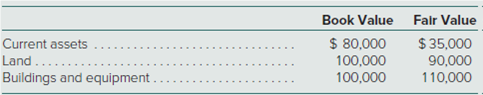

The company has the following assets:

How much money will the holders of the notes payable collect following liquidation?

Transcribed Image Text:$ 8,000

120,000

Income taxes..

Notes payable (secured by land).

Accounts payable....

Salaries payable (evenly divided between two employees).

Bonds payable.....

Administrative expenses for liquidation

85,000

70,000

Transcribed Image Text:Book Value

Falr Value

Current assets

$ 35,000

Land.....-

Buildings and equipment .

100,000

100,000

110,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are the general rules for measuring gain or loss byboth creditor and debtor in a troubled-debt restructuringinvolving a settlement?arrow_forward4. PROBLEM 3-6 In-Transit Items LO 8 On July 31, 2019, Ping Company purchased 90% of Santos Company's common stock for $2,010,000 cash. Immediately after the acquisition, the two companies' balance sheets were as follows: Ping $ 320,000 S 150,000 Santos Cash Accounts receivable 600,000 300,000 Note receivable 100,000 -0- Inventory 1,840,000 400,000 Advance to Santos Company Investment in Santos Company 2,010,000 60,000 -0- -0- Plant and equipment (net) 3,000,000 1,500,000 Land 90.000 90,000 Total $8,020,000 $2,440,000 $ 800,000 S 140,000 100,000 Accounts payable Notes payable Common stock 900,000 2,400,000 900,000 680,000 620,000 $8,020,000 $2,440,000 Other contributed capital 2,200,000 Retained earnings 1,720,000 Total Santos Company has not yet recorded the $60,000 cash advance from Ping Company. Ping Company's accounts receivable include $20,000 due from Santos Company Santos Company's $100,000 note payable is payable to Ping Company Neither company has recorded $7,000 of interest…arrow_forwardWhat are the major types of divestitures? Whatmotivates firms to divest assets?arrow_forward

- At the time companies write off accounts receivable, there is no effect on net income. true or falsearrow_forward3. a. List and describe three types of deferred credits? b. Do they meet the definition of a liability? Of short or long term? c. Why do some accountants not consider them to be a liability? d. Do deferred credits affect liquidity? 4. List and discuss four reasons a company would prefer to issue debt rather than equity securities. 5. When and why should liabilities for each of the following items be recorded on the books of an ordinary business corporation? a. Purchase of goods on account. b. Officers' salaries c. Dividends d. Interest e. Loss contingenciesarrow_forwardI need help with a case problem. I don't know how to record these entries. 1. Monthly depreciation on the assets: $60 for the Music Instruments, $40 for the Furniture, and $35 for the Computers 2. Music supplies expense 3.The office supplies expensearrow_forward

- a parent company has extended financial help as a low interest loan to one of its subsidiaries. the repayment date is negotiable but there is no set time frame. discuss the nature of this loan, its measurement and if it should be disclosed as equity or as debt.arrow_forwardWarranty liability is an estimate based on past warranty claims. How might a company determine how much to accrue for warranty? Why might it change the accrual?arrow_forwardMarshall Companies, Inc., holds a note receivable from a former subsidiary. Due to financial difficulties, the former subsidiary has been unable to pay the previous year’s interest on the note. Marshall agreed to restructure the debt by both delaying and reducing remaining cash payments. The concessions result in a credit loss on the creditor’s investment in the receivable. How is the credit loss on the troubled debt restructuring calculated?arrow_forward

- What is the purpose of a statement of financial affairs? Why might this statement be prepared before a bankruptcy petition is filed?arrow_forwardeceivables arise due to a deferred sale, and companies are often unable to collect all their debts, which means that part of those debts may become non-existent or there is doubt about the possibility of collection. 1- What is the difference between bad debts and doubtful debts? 2- Draft an example (supported by numbers) to explain the method of doubtful debts in dealing with bad debts, provided that the explanation includes accounting restrictions and the impact on the financial statements? 3- Explain why the use of the direct method (bad debt method) conflicts with generally accepted accounting principles? 4- One of the methods for estimating doubtful debts is the deferred sales method, the receivables balance method, and the receivables aging method. Required: Formulate an example (enhanced by numbers) to explain the method of aging receivables in estimating doubtful debts, taking into account the following: (1) the number of clients should be 10 clients, (2) the percentages…arrow_forwardHow to do this? 4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education