FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer fast and take care of plagiarism i give positive ?

0

100000

200000

300000

700000

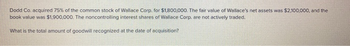

Transcribed Image Text:Dodd Co. acquired 75% of the common stock of Wallace Corp. for $1,800,000. The fair value of Wallace's net assets was $2,100,000, and the

book value was $1,900,000. The noncontrolling interest shares of Wallace Corp. are not actively traded.

What is the total amount of goodwill recognized at the date of acquisition?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Microsoft W X Risk Analy & X 1 (1) WhatsAp x ← → CO To get future Google Chrome updates, you'll need Windows 10 or later. This computer is using Windows 7. Microsoft Word - MGMT 2023_U8_Version1_new.docx e WACC-CheatSheet....pdf Assessing P X < Instant + A X ► ● Weighted x 2022.tle.courses.open.uwi.edu/pluginfile.php/108157/mod_resource/content/3/MGMT%202023%20_U8_Version1_new.pdf 6 / 11 100% + ▶ Cost of Debt, preferred stock and common equity Having read the recommended pages, please attempt the following problems and post your response to the discussion forum for review by your tutor and peers. Video Tutor X 1. Rick and Stacy Stark, a married couple, are interested in purchasing their first boat. They have decided to borrow the boat's purchase price of $100,000. The family is in the 28% federal income tax bracket. There are two choices for the Stark family: They can borrow the money from the boat dealer at an annual interest rate of 8%, or they could take out a $100,000 second…arrow_forwardIt says the answer I type in the boxes are wrong. What is the correct solution.arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- 1. Signs of job burnout include: A. Listening to workplace gossip B. Being a perfectionist a work C. Continual complaining D. Coming to work early 2. A ________ is one or more people assigned to reaching a goal. A. Team B. Department C. Group D. Company 3. An event that would affect employees in the "safety" level of Maslow's hierarchy includes: A. A cancelled vacation B. Recent layoffs C. A cancelled company picnic D. A salary freezearrow_forward7:27 f t < Session[1].docx - Word ✓ Qo 138 - 21 Paragraph O References Mailings Review View Help BLUEBEAM One day you're going to miss my boring texts ## TO Accessibility: Investigate Search Costs to date Estimated costs to complete Progress billings during the year Cash collected during the year hoher webb ng Normal ||| No Spacing Styles Acrobat 2021 $ 980,000 3,020,000 1,000,000 648,000 Go to website O Heading 1 √ Calculate the amount will be reported for accounts receivable on the statement of financial position at December 31, 2022. 3. Accounts Receivable on the Statement of Financial Position at December 31, 2022 for Newton Corp.: Accounts Receivable is calculated as the cumulative billings to date minus the cumulative cash collected: Accounts Receivable at December 31, 2022 = Cumulative Billings- Cumulative Cash Collected Accounts Receivable at December 31, 2022 = ($1,000,000+ $1,000,000) - ($648,000+ $1,280,000) = $2,000,000 - $1,928,000 = $72,000 Therefore, the amount reported…arrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward

- Please help on part a and it’s subparts and part barrow_forwardInbox (74) - flyingparul008@gma X Chegg Expert Registration: Finan X 3o Zoho Creator - Chegg Expert Hir X g.cheggindia.com/#Form:Subject test?privateLink=bF53Pq3tqOdXDb6qq0PKbXBKnU6s212F4b2fdONuXXgZX2DīmgJz56EF3A. Subject Test Note: - You are attempting question 10 out of 1: The $1.000 face value 7% coupon bond pays interest semi-annually. The bond will mature in 5-years. Find the Modified duration of the bond if it sells for $1,025.30. (A) 4.54-years (B) 4.18-years (C) 4.40-years (D) 5.00-years Answerarrow_forwardungageNOWv2 | Online teachin x takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * O H. C20-128PR01-2016. O Final Exam Review -. G Professional Certific. Cancel Your. F Startup Opportuniti. V How brands are co. A Assignment Practic. A COVID-19 Student. Extreme Sports sells logo sports merchandise. The company is contemplating whether or not to continue its custom embroidery service. All of the company's direct fixed costs can be avoided if a segment is dropped. The information is available for the segments. Custom Logo Embroidery Apparel Sales $61,000 $249,000 Variable costs 31,000 110,000 Contribution margin $30,000 $139,000 Direct fixed costs 22,000 40,000 Allocated common fixed costs 13,000 50,000 Net income $(5,000) $49,000 A. What will be the impact on net income if the embroidery segment is dropped? Net income $ B. Assume that if the embroidery segment is dropped, apparel sales will increase 10%. What is the impact on the contribution…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education