FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

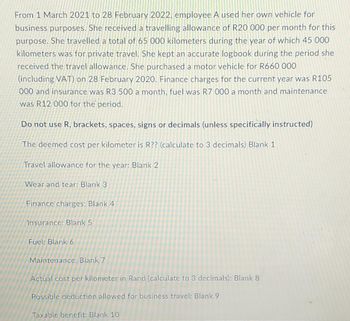

Transcribed Image Text:From 1 March 2021 to 28 February 2022, employee A used her own vehicle for

business purposes. She received a travelling allowance of R20 000 per month for this

purpose. She travelled a total of 65 000 kilometers during the year of which 45 000

kilometers was for private travel. She kept an accurate logbook during the period she

received the travel allowance. She purchased a motor vehicle for R660 000

(including VAT) on 28 February 2020. Finance charges for the current year was R105

000 and insurance was R3 500 a month, fuel was R7 000 a month and maintenance

was R12 000 for the period.

Do not use R, brackets, spaces, signs or decimals (unless specifically instructed)

The deemed cost per kilometer is R?? (calculate to 3 decimals) Blank 1

Travel allowance for the year: Blank 2

Wear and tear: Blank 3

Finance charges: Blank 4

Insurance: Blank 5

Fuel: Blank 6

Maintenance: Blank 7

Actual cost per kilometer in Rand (calculate to 3 decimals): Blank 8

Possible deduction allowed for business travel: Blank 9

Taxable benefit: Blank 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Hi I am having trouble completing my accouitn homework, could you help me please?arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $410 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $7,470. Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $410 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $976,000 for the year. Amount added $fill in the blank 3 Ending balance $fill in the blank 4arrow_forwardJit Don't upload any image pleasearrow_forward

- Hi there, this question uses the T-char and asks to calculate: - cost of supplies during this period - cost paid to purcahse new insurance this period - amount of interest payable that was paid during this period How do I calculate this?arrow_forwardNeed both the requirementsarrow_forwardPlease do not give solution in image format thankuarrow_forward

- vnt,.1arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $300 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $8,500. Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $500 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $1,000,000 for the year. Amount added $fill in the blank 3 Ending balancearrow_forwardPlease do not give solution in image format ?arrow_forward

- 2arrow_forwardPlease don't provide answer in image format thank youarrow_forwardstion 5 USING THE FOLLOWING DATA, CALCULATE THE CURRENT RATIO (X): TAKE ANSWER OUT TO ONE PLACE AFTER THE DECIMAL accounts payable 15 merchandise inventory 30 +-- 22 --- 51 accounts receivable medical supplies 9 long term notes payable nursing revenue : 50 -- - 6. + - - 4 4 accumulated depreciation -blg 4 prepaid rent expense amortization expense property taxes payable building 60 pension obligation : 27 8' transportation expense 9 bonds payable 115 unearned nursing income 24 cash 1. Zorro, capital 39 depreciation expense : 18 7. Zorro, withdrawals marketable securities A Moving to the next question prevents changes to this answer. MacBook Air 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education