FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please do not give solution in image format thanku

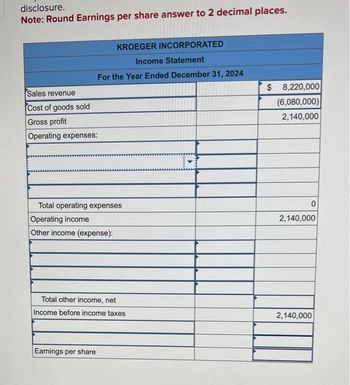

Transcribed Image Text:disclosure.

Note: Round Earnings per share answer to 2 decimal places.

KROEGER INCORPORATED

Income Statement

For the Year Ended December 31, 2024

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Total operating expenses

Operating income

Other income (expense):

Total other income, net

Income before income taxes

Earnings per share

$ 8,220,000

(6,080,000)

2,140,000

0

2,140,000

2,140,000

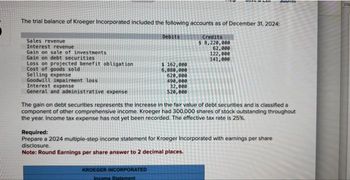

Transcribed Image Text:Sales revenue

Interest revenue

Gain on sale of investments

Gain on debt securities

Loss on projected benefit obligation

Cost of goods sold

The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024:

Selling expense

Goodwill impairment loss

Interest expense

General and administrative expense

Debits

$ 162,000

6,080,000

620,000

490,000

32,000

520,000

KROEGER INCORPORATED

Income Statement.

Credits

$ 8,220,000

OUT OF CARL

62,000

122,000

141,000

JUDITH

The gain on debt securities represents the increase in the fair value of debt securities and is classified a

component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout

the year. Income tax expense has not yet been recorded. The effective tax rate is 25%.

Required:

Prepare a 2024 multiple-step income statement for Kroeger Incorporated with earnings per share

disclosure.

Note: Round Earnings per share answer to 2 decimal places.

Clic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education