Concept explainers

Dropping or Retaining a Segment

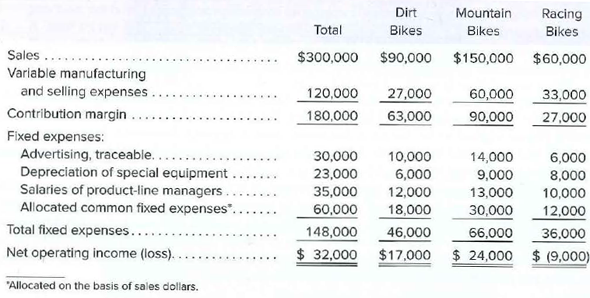

The Regal Cycle Company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow:

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Required information Skip to question [The following information applies to the questions displayed below.] Accents Associates sells only one product, with a current selling price of $150 per unit. Variable costs are 30% of this selling price, and fixed costs are $19,600 per month. Management has decided to reduce the selling price to $145 per unit in an effort to increase sales. Assume that the cost of the product and fixed operating expenses are not changed by this reduction in selling price. At the current selling price of $150 per unit, what dollar volume of sales per month is required for Accents to earn a monthly operating income of $10,400?arrow_forwardA manufacturer is considering eliminating a segment because it shows the following $6,100 loss. All $20,300 of its variable costs are avoidable, and $36,700 of its fixed costs are avoidable.arrow_forwardCase Impairment Panoramic Equiptindo Company Limited (PE) is an experienced original equipment manufacturing (OEM) in cameras. However, it focuses on film camera production while its production of compact digital camera (CDCs) accounts for only 10% of its production. PE realises that the market for traditional film camera is declining in terms of demand and profit margin because costumers are shifting to digital camera. In view of the market sentiment, PE is considering the following two options: Option 1: Upgrading as an OEM manufacturer for consumer CDCsFollowing this option, PE would need to invest at least $40 million to replace its existing production facilities to meet costumer requirements. Panoramic Equiptindo would remain principally an OEM manufacturer for costumer CDCs of major brands. Option 2: Becoming an original brand manufacturer (OBM) for budget CDCs for the PCR using the “Marvelous” brand. Following this option. Panoramic Equiptindo could retain its manufacturing…arrow_forward

- Help Save & Che Required information [The following information applies to the questions displayed below.] Armstrong Corporation manufactures bicycle parts. The company currently has a $19,700 inventory of parts that have become obsolete due to changes in design specifications. The parts could be sold for $7,200, or modified for $10,200 and sold for $20,700. 2-a. Calculate the benefit under each alternative for disposing of the obsolete parts. 2-b. How should the obsolete parts be disposed? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Calculate the benefit under each alternative for disposing of the obsolete parts. Benefit if parts are sold without modification Net benefit if parts are sold after being modified Req 2B >arrow_forwardPlease don't provide answer in image format thank youarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Please do not give solution in image format thankuarrow_forwardA manufacturer is considering eliminating a segment because it shows the following $6,300 loss. All $21,100 of its variable costs are avoidable, and $38,500 of its fixed costs are avoidable. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated? Complete this question by entering your answers in the tabs below. Required A $ 63,300 21,100 42,200 48,500 (6,300) Required B Compute the incomoarrow_forwardQ2 Tool Industries manufactures large workbenches for industrial use. Sam Hartnet, the Vice President for marketing at Tool Industries, concluded from market analysis that sales were dwindling for Tool's workbenches due to aggressive pricing by competitors. Tool's workbench sells for $2,040 whereas the competition's comparable workbench sells for $1,780. Sam determined that a price drop to $1,780 would be necessary to protect its market share and maintain an annual sales level of 14,800 workbenches. Cost data based on sales of 14,800 workbenches: Budgeted Quantity Actual Quantity Actual Cost Direct materials (pounds) 184,000 177,000 $ 3,459,000 Direct labor (hours) 76,400 76,000 829,500 Machine setups (number of setups) 1,800 1,240 259,000 Mechanical assembly (machine hours) 33,600 285,750 3,768,000 The current cost per unit is (rounded to the nearest whole dollar): Multiple Choice $448. $390. $513. $562. $370.arrow_forward

- do not give solution in imagearrow_forwardGranfield Company is considering eliminating its backpack division, which reported a loss for the recent year of $46,500 as shown below. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) If the backpack division is dropped, all $484,000 of its variable costs are avoidable, and $216,200 of its fixed costs are avoidable. The impact on Granfield's income from eliminating this business segment would be: Multiple Choice $494,000 decrease $216,200 increase $277,800 decrease $ 978,000 484,000 494,000 540,500 $ (46,500) $494,000 increasearrow_forwardMarin Company makes several products, including canoes. The company reports a loss from its canoe segment (see below). All its variable costs are avoidable, and $330,000 of its fixed costs are avoidable. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) $ 1,097, 600 784,000 313,600 376,000 $ (62,400) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be continued or eliminated?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education