FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

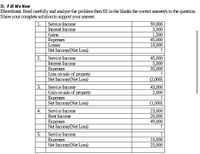

Transcribed Image Text:B. Fill Me Now

Directions: Read carefully and analyze the problem then fill in the blanks the correct answer/s to the question.

Show your complete solution to support your answer.

1.

Service Income

59,000

3,000

1,500

45,000

10,000

Interest Income

Gains

Expenses

Losses

Net Income/(Net Loss)

?

2.

Service Income

45,000

5,000

35,000

Interest Income

Expenses

Loss on sale of prDperty

Net Income/(Net Loss)

(2,000)

Service Income

Gain on sale of property

Expenses

Net Income/(Net Loss)

Service Income

3.

43,000

2,000

(1,500)

4.

23,000

20,000

49,000

Rent Income

Expenses

Net Income/(Net Loss)

Service Income

Expenses

Net Income/(Net Loss)

5.

10,000

25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- I need to complete the balance sheetarrow_forwardComplete the problem below using these accounts as needed: Cash Accumulated Depreciation Party Bus Loss on Sale of Party Bus Depreciation Expense Gain on Sale of Party Bus PLEASE NOTE: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). If no account name or DR/CR is needed, please use "None" and if no dollar amount is needed, please use "$0" - no quotation marks for either. You are to refer to the examples in the text for the proper order of the accounts. Party Hearty Co. owns a party bus that, all tricked out, costs $247,500, with accumulated depreciation of $123,450. Party Hearty Co. sells the party bus for cash. Record the journal entry for the sale of the party bus if Party Hearty Co. were to sell the party bus for the following amounts: Sold party bus for $118,635 cash: DR DR / CR? DR / CR? CR Sold party bus for $124,050 cash: DR DR…arrow_forwardatement this account. or Balance Account Name Account Type (*) Is this account part of Retained Earnings? Yes or No Normal Balance You increase with a Debit or Credit Write DEBIT or CREDIT. Financial Statement where you find this account. Write: Income Statement or Balance Sheet Prepaid Maintenance Prepaid Supplies Property Tax Property, plat & Equipment Rent Expense Retained Earnings Sales Sales Allowances Sales Discount Sales Revenue Sales Tax Payable Service Revenue Short Term Debt Telephone Expense Trademarks Travel Treasury Stock Utilities Wages Payable Work in Process Inventoryarrow_forward

- Dd.15.arrow_forwardHi! Could you verife what I did. Could you take into accout the comment that are written. Please. For the second comment on the picture a) it's between; cash, income summary, sue capital, madga capital and sur drawing.arrow_forwardActivity # 7 Application of the concepts of Assets, Liabilities, Owner’s Equity, Revenue, and ExpenseThe following table includes SFP and SCI elements. Put a check mark (√) in the column where each accounts belongs to.Account Asset Liability Owner’s Equity Revenue Expenses1. Interest Receivable2. Professional Fees3. Service Income4. Mr. A, Drawing 5. Doubtful Accounts6. Depreciation Expense7. Accrued Interest Income8. Unearned Interest Income9. Prepaid Interest10. Accumulated Depreciation11. Mortgage payable12. Unused Supplies13. Supplies Inventory14. Supplies on hand15. SSS Premium Expense16. Withholding Taxes Payable17. Repairs and Maintenance 18. Petty cash Fund19. Allowance for Bad Debts20. Cash in bank21. Accounts payable22. Prepaid Insurance23. Unexpired Insurance24. Salaries payable25. Utilities Expensarrow_forward

- MY NUMBERS ARE NOT COMING OUT CORRECTLY, CAN SOMEONE PLEASE HELP ME? List of Accounts Assistance Used Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Depreciation-Delivery Trucks Advertising Expense Buildings Cash Debt Investments Delivery Trucks Depreciation Expense Equipment Gasoline Expense Income Summary Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Long-term Debt Long-term Investments Maintenance and Repairs Expense Miscellaneous Expense Mortgage Payable No Entry Notes Payable Notes Receivable Owner's Capital Owner's Drawings Patent Needs Prepaid Advertising Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Service Revenue Short-Term Investments Stock Investments Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue…arrow_forward1.Expenses represent a reduction in ___. A.assets B.revenue C.liability D.equity 2.You are presented a financial statement and from it you can tell what the business owed looking at a financial statement. By studying the information on the statement, you can tell what the business owns and what it owes as of a certain date. You are looking at: A.Income Statement B.Assets C.Revenues D.Balance Sheetarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education