FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

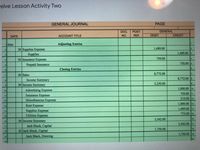

Directions: complete the Income Summary t-account. Use the closing entries

provided to determine the appropriate amounts for A, B, and C. C represents the total

amount in Income Summary after closing. Add your answers in t-account below.

Remember, the starting/ending balance of the Income Summary temporary account

is zero. A dash (-) represents zero. Complete the income summary T-account.

Transcribed Image Text:relve Lesson Activity Two

GENERAL JOURNAL

PAGE

GENERAL

DEBIT

DOC.

POST.

DATE

ACCOUNT TITLE

NO.

REF.

CREDIT

1 June

Adjusting Entries

1,489.00

30 Supplics Expense

Supplies

2

1,489.00

3

30 Insurance Expense

750.00

4

750.00 s

5

Prepaid Insurance

Closing Entries

30 Sales

8,772.00

Income Summary

8,772.00

30 Income Summary

5,230.00

1,000.00 10

Advertising Expense

Insurance Expense

Miscellaneous Expense

10

750.00 1

11

216.00 12

12

1,000.00 13

Rent Expense

Supplies Expense

Utilities Expense

13

1,489.00 14

775.00 15

14

15

30 Income Summary

3,542.00

16

16

3,542.00 17

Jack Black, Capital

30 Jack Black, Capital

Jack Black, Drawing

17

1,750.00

18

18

1,750.00 19

19

20

20

Transcribed Image Text:Income Summary

Debit

Credit

8,772.00

А:

В:

C:

In the area below explain how the Income Summary account is used in the closing

process.

nt tao

B:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- balance. Use the closing entry numbers as posting references to post each closing entry to the relevant accounts, then compute the ending balance of each account Label the ending balances with End. Bal. (For accounts with a 50 ending balance, select "End. Bal." and enter "0" on the normal balance side of the t-account.) Review the closing entries you prepared above. Adj. Bal. Closing entry 1 End. Bal. Adj. Bal Closing entry 1 End. Bal. Adj. Bal Closing entry 1 End. Bal. Closing entry 1 Closing entry 2 End. Bal. Closing entry 1 Closing entry 2 End. Bal. Cash 1,734,900 0 0 Supplies 250,000 0 0 360,000 0 0 Equipment 0 0 Accounts Payable 1,275,000 1,734,000 0 0 280.000 0 Closing entry 2 O Closing entry 3 End. Bal. 250,000 Wages Payable 0 Closing entry 2 0 Closing entry 3 End. Bal. 0 Closing entry 2 0 Closing entry 3 360,000 End. Bal. 1,275,000 Adj. Bal. 0 Closing entry 3 0 End. Bal. 280,000 Adj. Bal. 0 Closing entry 3 0 End. Bal. Adj. Bal. Closing entry 1 End. Bal. Adj. Bal. Closing entry…arrow_forwardWhich of these accounts is (are) credited during the closing process? Sales Revenue onlySales Returns and Allowances onlyInterest Revenue onlySales Revenue, Sales Returns and Allowances, and Interest Revenuearrow_forwardPlease help me with show all calculation thankuarrow_forward

- Identify the normal balance, financial statement, method of increasing the account, and whether the account is closed at the end of the period by selecting the letter that best describes those attributes. Answer choices may be used once, more than once, or not at all. Cash ·Debit, Balance Sheet, Debit, No Interest Payable 2. Credit, Balance Sheet, Credit, No v Trademark 3. Credit, Income Statement, Credit, Yes 4. Fees Earned Credit, Balance Sheet, Debit, Yes Inventory 5. Credit, Income Statement, Debit, No v Accumulated Depreciation 6. Debit, Balance Sheet, Credit, Yes Cost of Goods Sold 7. Debit, Income Statement, Credit, No v Gain on Sale of Investments 8. Credit, Income Statement, Credit, No Land 9. Debit, Income Statement, Debit, Yes v Dividends Payable Premium on Bonds Payable Loss on Write-Down of Inventory to LCNRV Retained Earnings v Goodwill V Depreciation Expensearrow_forwardIdentify the type of account (Asset, Liability, Equity, Revenue, Expense), normal balance (Debit, Credit), financial statement (Balance Sheet, Income Statement), and whether the account is closed at the end of the period (Yes, No) by selecting the letter that best describes those attributes. If an account is a contra or adjunct account, the answer will show the account type in parentheses. Answer items may be used once, more than once, or not at all. Retained Earnings 1. Equity, Credit, Balance Sheet, No 2. Freight-Out Liability, Credit, Balance Sheet, No V Loss on Impairment of Intangible Assets 3. Expense, Debit, Income Statement, Yes 4. Gain on Acquisition of Business (Equity), Debit, Balance Sheet, No 5. Amortization of Copyrights Asset, Debit, Income Statement, Yes Allowance for Doubtful Accounts 6. Expense or Loss, Credit, Income Statement, Yes Land 7. Revenue or Gain, Credit, Income Statement, Yes Federal Income Tax Withheld 8. (Revenue or Gain), Debit, Income Statement, Yes…arrow_forwardT-accounts and determine the final balance in each account balance. (Note: Posting to the Cash account is not required.) Prepaid Insurance choose a transaction date enter a debit amount choose a transaction date enter a credit amount choose the end date of the accounting period enter a debit balance choose the end date of the accounting period enter a credit balance Prepaid Rent choose a transaction date enter a debit amount choose a transaction date enter a credit amount choose the end date of the accounting period…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education