Question

Do the reading and answer the questions! You got this!

Do all of them correctly.

Transcribed Image Text:Search.

ⒸLIVE

REVIEW

CALIFORNIA CONTENT

STANDARD 11.6.1

12:35 PM

Money and the Economy

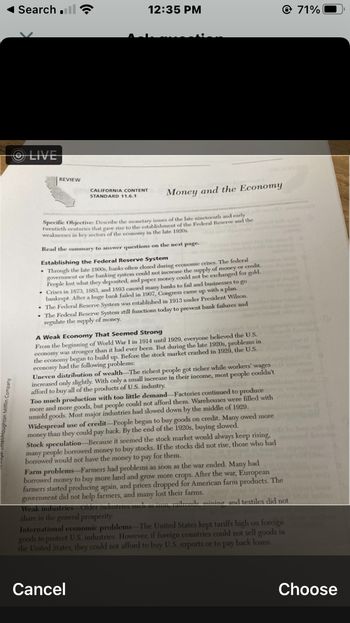

Specific Objective: Describe the monetary issues of the late nineteenth and early

twentieth centuries that gave rise to the establishment of the Federal Reserve and the ticke

weaknesses in key sectors of the economy in the late 1920s.

Read the summary to answer questions on the next page.

Establishing the Federal Reserve System

Through the late 1800s, banks often closed during economic crises. The federal

government or the banking system could not increase the supply of money or credit.

People lost what they deposited, and paper money could not be exchanged for gold.

. Crises in 1873, 1883, and 1893 caused many banks to fail and businesses to go

bankrupt. After a huge bank failed in 1907, Congress came up with a plan.

• The Federal Reserve System was established in 1913 under President Wilson.

• The Federal Reserve System still functions today to prevent bank failures and

regulate the supply of money.

A Weak Economy That Seemed Strong

From the beginning of World War I in 1914 until 1929, everyone believed the U.S.

economy was stronger than it had ever been. But during the late 1920s, problems in

the economy began to build up. Before the stock market crashed in 1929, the U.S.

economy had the following problems:

Uneven distribution of wealth The richest people got richer while workers' wages

increased only slightly. With only a small increase in their income, most people couldn't

afford to buy all of the products of U.S. industry.

Too much production with too little demand-Factories continued to produce

more and more goods, but people could not afford them. Warehouses were filled with

unsold goods. Most major industries had slowed down by the middle of 1929.

Widespread use of credit-People began to buy goods on credit. Many owed more

money than they could pay back. By the end of the 1920s, buying slowed.

Cancel

Stock speculation-Because it seemed the stock market would always keep rising,

many people borrowed money to buy stocks. If the stocks did not rise, those who had

borrowed would not have the money to pay for them.

@ 71%

M

Farm problems-Farmers had problems as soon as the war ended. Many had

borrowed money to buy more land and grow more crops. After the war, European

farmers started producing again, and prices dropped for American farm products. The

government did not help farmers, and many lost their farms.

Weak industries Older industries such

ilmade mining and textiles did not

share in the general prosperity.

International economic problems-The United States kept tariffs high on foreign

goods to protect U.S. industries. However, if foreign countries could not sell goods in

the United States, they could not afford to buy U.S. exports or to pay back loans.

Son

ellas

Choose

Transcribed Image Text:42

43

PRACTICE

CALIFORNIA CONTENT

STANDARD 11.6.1

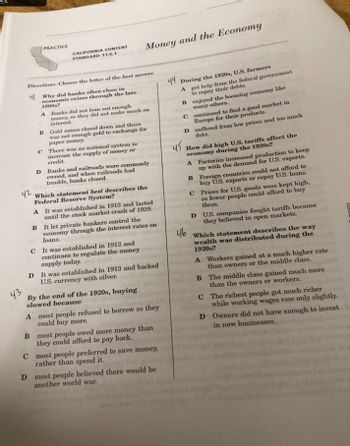

Directions: Choose the letter of the best answer.

4 Why did banks often close in

economic crises through the late

1800s?

A Banks did not loan out enough

money, so they did not make much on

interest.

Money and the Economy

B Gold mines closed down and there

was not enough gold to exchange for

paper money.

C There was no national system to

increase the supply of money or

credit.

D Banks and railroads were commonly

owned, and when railroads had

trouble, banks closed.

Which statement best describes the

Federal Reserve System?

A

It was established in 1913 and lasted

until the stock market crash of 1929.

B It let private bankers control the

economy through the interest rates on

loans.

C It was established in 1913 and

continues to regulate the money

supply today.

D It was established in 1913 and backed

U.S. currency with silver.

By the end of the 1920s, buying

slowed because

A most people refused to borrow so they

could buy more.

B most people owed more money than

they could afford to pay back.

C

most people preferred to save money,

rather than spend it.

D most people believed there would be

another world war.

44 During the 1920s, U.S. farmers

A

B

C continued to find a good market in

Europe for their products.

D

45

got help from the federal government

to repay their debts.

enjoyed the booming economy like

many others.

46

suffered from low prices and too much

debt.

How did high U.S. tariffs affect the

economy during the 1920s?

A Factories increased production to keep

up with the demand for U.S. exports.

B Foreign countries could not afford to

buy U.S. exports or repay U.S. loans.

Prices for U.S. goods were kept high,

so fewer people could afford to buy

them.

C

D

U.S. companies fought tariffs because

they believed in open markets.

Which statement describes the way

wealth was distributed during the

1920s?

A Workers gained at a much higher rate

than owners or the middle class.

B

The middle class gained much more

than the owners or workers.

C

The richest people got much richer

while working wages rose only slightly.

Owners did not have enough to invest

in new businesses.

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps