FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

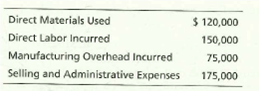

Dunaway Company reports the following costs for the year:

How much are Dunaway’s period Costs?

- $250,000

- $270 000

- $345,000

- $175,000

Transcribed Image Text:Direct Materials Used

Direct Labor Incurred

Manufacturing Overhead Incurred

Selling and Administrative Expenses

$ 120,000

150,000

75,000

175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following annual information is for Dexter Corporation: Product A Revenue per unit: $20.00 Variable cost per unit: $15.00 Total fixed costs: $100,000 How many units does the company have to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forwardThe selling price of a product is $75.00 per unit, the variable expense is $55.00 per unit, and the breakeven sales in dollars is $300,000, what are total fixed expenses? $80,000 $4,000 $300,000 $20arrow_forwardMinMin Corporation gathered the following information: Income tax rate 40% Contribution-margin ratio 30% If fixed costs are $600,000, what level of sales dollars is needed to produce an after-tax net income of $150,000? (Round to the nearest $, and enter a number only).arrow_forward

- ABC Corporation estimates handling cost at two-act levels:arrow_forwardThe cost data for Evencoat Paint for the year 2019 is as follows: Evencoat Paint data Month Gallons of Paint Produced Equipment Maintenance Expenses January 110,000 $70,700 February 68,000 66,800 March 71,000 67,000 April 77,000 68,100 May 95,000 69,200 June 101,000 70,300 July 125,000 70,400 August 95,000 68,900 September 95,000 69,500 October 89,000 68,600 November 128,000 72,800 December 122,000 71,450 Using the high-low method, express the company’s maintenance costs as an equation where x represents the gallons of paint produced. Y=$ + x What are the fixed costs? What are the variable costs per gallon of paint produced? Predict the maintenance costs if 90,000 gallons of paint are produced. Predict the maintenance costs if 81,000 gallons of paint are produced.arrow_forwardcalculate the break leven sales dellas it the Fixed expenses are $7000 + the contribution ratio is 40%arrow_forward

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs* $156,300 $192,700 $213,400 Insurance expense*: 970 970 970 Depreciation expense 1,820 1,820 1,820 Property tax expense*** 540 540 540 Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $970 a month; however, the insurance is paid four times yearly in the first month of the quarter, (i.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of April are a. $120,135 b. $117,225 c. $138,218 d. $156,300arrow_forward17arrow_forward2. An audio equipment manufacturer produced and sold 725 sound systems and made a net income of $50, 000 last year, with a total revenue of $1, 015, 000. The manufacturer's break-even volume is 600 units. a. Calculate the selling price of each sound system. b. Calculate the variable costs for each sound system. c. Calculate the fixed costs per year.arrow_forward

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $155,600 $192,800 $213,600 Manufacturing costs* Insurance expense** 880 Depreciation expense 2,180 Property tax expense*** 590 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $880 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. 880 2,180 590 880 2,180 590 The cash payments expected for Finch Company in the month of May are O a. $183,500 O b. $144,600 Oc. $38,900 O d. $222,400arrow_forward10 In July, TPM Co. incurred total costs of $60,000 and made 6000 units. In December it produced 4000 units and total costs were $40,000. What is the variable cost per unit? a. S12.00 b. $15.00 c. S10.00 d. $8.00arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: June $201,000 Manufacturing costs" Insurance expense** April May $157,200 $197,600 970 970 2,200 420 2,200 420 970 Depreciation expense Property tax expense*** "Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $970 a month; however, the insurance is paid four times yearly in the first month of the quarter, (.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of May are O&$187.500 b. $39,300 Oe5148,200 Od $226,800 2,200 420arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education