FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

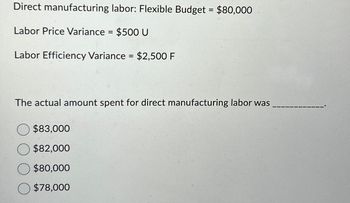

Transcribed Image Text:Direct manufacturing labor: Flexible Budget = $80,000

Labor Price Variance = $500 U

Labor Efficiency Variance = $2,500 F

The actual amount spent for direct manufacturing labor was

$83,000

$82,000

$80,000

$78,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Monty Company uses a flexible budget for manufacturing overhead based on direct labor hours. Budgeted variable manufacturing overhead costs per direct labor hour are as follows. Indirect labor $1.50 Indirect materials 1.10 Utilities 0.80 Budgeted fixed overhead costs per month are Supervision $3,920, Depreciation $1,176, and Property Taxes $784. The company believes it will normally operate in a range of 6,860-9,800 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2022 for the expected range of activity, using increments of 980 direct labor hours. (List variable costs before fixed costs.) MONTY COMPANY Monthly Manufacturing Overhead Flexible Budget For the Year 2022arrow_forward29arrow_forwardBudgeted production Actual production Materials: Standard price per lb Standard pounds per completed unit Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead rate Actual pounds purchased and used in production 11,800 Actual price paid for materials $23,000 Labor: Actual variable overhead costs Overhead is applied on standard labor hours. The direct material price variance is: 600F 600U 1,000 units 980 units 80F $2.00 12 $14 per hour 4.5 4,560 $62,928 $27,000 $3.50 per standard labor hour $15,500arrow_forward

- Information pertaining to the Excessive Bakery is shown below: Budgeted production 500,000 cakes Actual production 498,000 cakes Estimated FOH costs $200,000 Actual FOH costs $203,000 What is the fixed overhead spending variance for the period?arrow_forwardBudgeted variable factory overhead costs: $354,000 Budgeted production in units: 60,000 units Budgeted time: 2 direct labor hours per unit Allocation base: direct labor hours Actual production in units: 58,600 units Actual variable factory overhead costs incurred: $338,500 Actual direct labor hours used: 119,000 hours CALCULATE VARIABLE FACTORY OVERHEAD ALLOCATED: Allocated: $__________ CALCULATE VARIABLE FACTORY OVERHEAD SPENDING (PRICE) VARIANCE :…arrow_forwardGreen Garden Supply budgeted three hours of direct labour per unit at $20.00 per hour to produce 500 units of product. The 500 units were completed using 1,600 hours of direct labour at $20.50 per hour. What is the direct labour price variance at Green Garden Supply? A. $800 favourable B. $750 unfavourable OC. $800 unfavourable D. $750 favourablearrow_forward

- F Based on predicted production of 25,000 units, a company budgets $280,000 of fixed costs and $275,000 of variable costs. If the company actually produces 19,800 units, what are the flexible budget amounts of fixed and variable costs? -----Flexible Budget------ Variable Amount per Unit Total Fixed Cost 19,800 units $ 275,000 Variable cost Fixed costs 280,000 2 W S # 3 E D $ 4 $ D R F 4 U 8 J 9 Karrow_forwardJulum Limited manufactures a single product and operates a standard costing system. Budgeted Data (per unit) : Labour 5 hours @ £15.00 Per Hour Budgeted production for August was expected to reach 10000 Units Actual production 11000 Units The actual costs incurred were as follows : Actual Data : Labour 60000 hours @ £14.50 Per Hour a. What is Labour Rate Variance? Choose one from the following: A. £30,000.00 Favourable B. £75,000.00 Unfavourable C. £45,000.00 Favourable D. £45,000.00 Unfavourablearrow_forwardPlease help me with all answers thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education