FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

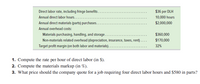

HH Auto Repair reports the following information for the coming year.

Transcribed Image Text:Direct labor rate, including fringe benefits.

$36 per DLH

Annual direct labor hours.....

10,000 hours

Annual direct materials (parts) purchases..

$2,000,000

Annual overhead costs:

Materials purchasing, handling, and storage..

$360,000

Non-materials related overhead (depreciation, insurance, taxes, rent)

$170,000

Target profit margin (on both labor and materials)..

32%

1. Compute the rate per hour of direct labor (in $).

2. Compute the materials markup (in %).

3. What price should the company quote for a job requiring four direct labor hours and $580 in parts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The business is expected to make principal payments totalling $90,000 towards the loan during the fiscal year to June 30 ,2021 journal entryarrow_forwardNash Marina has 300 available slips that rent for $700 per season. Payments must be made in full by the start of the boating season, April 1, 2021. The boating season ends October 31, and the marina has a December 31 year-end. Slips for future seasons may be reserved if paid for by December 31, 2021. Under a new policy, if payment for 2022 season slips is made by December 31, 2021, a 5% discount is allowed. If payment for 2023 season slips is made by December 31, 2021, renters get a 20% discount (this promotion hopefully will provide cash flow for major dock repairs).On December 31, 2020, all 300 slips for the 2021 season were rented at full price. On December 31, 2021, 234 slips were reserved and paid for the 2022 boating season, and 72 slips were reserved and paid for the 2023 boating season.(a) Prepare the appropriate journal entries for December 31, 2020, and December 31, 2021. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when…arrow_forwardSarasota Marina has 300 available slips that rent for $700 per season. Payments must be made in full by the start of the boating season, April 1, 2021. The boating season ends October 31, and the marina has a December 31 year-end. Slips for future seasons may be reserved if paid for by December 31, 2021. Under a new policy, if payment for 2022 season slips is made by December 31, 2021, a 4% discount is allowed. If payment for 2023 season slips is made by December 31, 2021, renters get a 17% discount (this promotion hopefully will provide cash flow for major dock repairs).On December 31, 2020, all 300 slips for the 2021 season were rented at full price. On December 31, 2021, 166 slips were reserved and paid for the 2022 boating season, and 50 slips were reserved and paid for the 2023 boating season.(a) Prepare the appropriate journal entries for December 31, 2020, and December 31, 2021arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education