Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

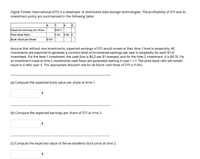

Transcribed Image Text:Digital Timber International (DTI) is a developer of distributed data storage technologies. The profitability of DTI and its

investment policy are summarized in the following table:

3

Expected earnings per share

Plow-Back Ratio

$26.3

0.83

0.56 0

Book Value per Share

$100

Assume that without new investments, expected earnings of DTI would remain at their time-1 level in perpetuity. All

investments are expected to generate a constant level of incremental earnings per year in perpetuity for each $1 of

investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for the time-2 investment, it is $0.15. For

an investment made at time t, incremental cash flows are generated starting in year t + 1. The plow-back ratio will remain

equal to 0 after year 3. The appropriate discount rate for all future cash flows of DTI is 11.4%.

(a) Compute the expected book value per share at time 1.

(b) Compute the expected earnings per share of DTI at time 2.

(c) Compute the expected value of the ex-dividend stock price at time 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Based on the above information, calculate the sustainable growth rate for Kayla's Heavy Equipment.arrow_forwardTo help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: Do = $1.45; Po = $22.50; and g = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? 11.68% 12,30% 12.56% 12.94% 13.36% O O o O o Oarrow_forwardAssume the following ratios are constant: Total asset turnover Profit margin Equity multiplier Payout ratio 2.5 6.5% 1.6 20% What is the sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate %arrow_forward

- HappyTunes Inc. forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 11.75%, the cost of equity is 19.25%, and the FCFs are expected to continue growing at a 5.25% rate after Year 5. Assuming that the ROIC is expected to remain constant in Year 5 and beyond, what is the Year O value of operations? Year: 1 2 3 4 5 Free cash flow: -$995 $15 $55 $80 $125 O-$310.32 million O $387.53 million O $139.31 million $445.46 million O-$176.72 milliarrow_forwardSolve the problemarrow_forwardClapTrap is a rapidly growing image messaging company. The company's growth strategy requires rapid reinvestment currently, with dividend payouts increasing as growth opportunities gradually disappear. You have the following financial information about ClapTrap: Earnings in the most recently concluded fiscal year were $$6.286.28. The company will retain all its earnings this year (from t=00 to t=11 ), reinvesting in new projects with a return on new investment of 44.044.0%. The next year (from t=11 to t=22 ), the company will retain 85.085.0% of its earnings. Return on new investment is expected to be 30.030.0%. In the following year (from t=22 to t=33 ), the company will retain 69.069.0% of its earnings with an expected return on new investment of 20.020.0%. The company will then enter a period of stable growth, retaining 49.049.0% of its earnings in perpetuity. a) What are the expected dividends per share for each period from t=11 to t=33 ? The expected dividends per share for…arrow_forward

- Need answerarrow_forwardAssume that the following ratios are constant. Total asset turnover 1.37, profit margin 6.9%, equity multiplier 1.7, payout ratio 57%. What is the sustainable growth rate?arrow_forwardLoreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forward

- Suppose Alcatel-Lucent has an equity cost of capital of 10%, market capitalization of $10.8 billion, and an enterprise value of $14.4 billion. Suppose Alcatel-Lucent’s debt cost of capital is 6.1% and its marginal tax rate is 35%. The cash flow for the project is as follows, same as was given in the previous question. Year 0 1 2 3 FCF -100 50 100 Calculate FCFE for each year but only answer: What is the Percentage change in FCFE in Year 2 from Year 1? Please give your answer in Percentage up to 2 places of Decimal without giving the % sign.arrow_forwardYou are given the following information on Kaleb's Heavy Equipment: Profit margin Capital intensity Debt-equity ratio Net income Dividends 18 $70,000 $ 15,200 Sustainable growth rate A Calculate the sustainable growth rate. (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education