Northeast Hospital’s Radiology Department is considering replacing an old inefficient X-ray machine with a state-of-the-art digital X-ray machine. The new machine would provide higher quality X-rays in less time and at a lower cost per X-ray. It would also require less power and would use a color laser printer to produce easily readable X-ray images. Instead of investing the funds in the new X-ray machine, the Laboratory Department is lobbying the hospital’s management to buy a new DNA analyzer.

Required:

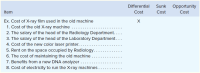

For each of the items below, indicate by placing an X in the appropriate column whether it should be considered a differential cost, a sunk cost, or an opportunity cost in the decision to replace the old X-ray machine with a new machine. If none of the categories apply for a particular item, leave

all columns blank.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Blossom Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost $183,000 $281,000 Annual cash inflows $70,000 $80,000 Annual cash outflows $28,000 $25,000 Cost to rebuild (end of year 4) $48,000 $0 Salvage value $0 $7,000 Estimated useful life 7 years 7 yearsarrow_forwardThe board of education for the Central Catskill School District is considering the acquisition of several minibuses for use in transporting students to school. Five of the school district's bus routes are underpopulated, with the result that the full-size buses on those routes are not fully utilized. After a careful study, the board has decided that it is not feasible to consolidate these routes into fewer routes served by full-size buses. The area in which the students live is too large for that approach, since some students' bus ride to school would exceed the state maximum of 60 minutes. The plan under consideration by the board is to replace five full-size buses with eight minibuses, each of which would cover a much shorter route than a full-size bus. The bus drivers in this rural school district are part-time employees whose compensation costs the school district $21,000 per year for each driver. In addition to the drivers' compensation, the annual costs of operating and…arrow_forwardThe hospital is considering the purchase of imaging equipment worth $25,000 to improve its visual capture results, and improve outcomes. The operating costs will be reduced by $7,000 per year. The computer has an estimated life expectancy of 5 years, and an estimated salvage value of $5,000. What is the profitability index if the discount rate is 8%. Ignore reimbursement considerations.arrow_forward

- Please see image for question.arrow_forward22. Glenn Medical Center has seen a growth in patient volume since its primary competitor decided to relocate to a different area of the city. To accommodate this growth, a consul- tant has advised Glenn Medical to invest in a positron-emission tomography (PET) scanner. The cost to implement the unit would be $4,000,000. The useful life of this equip- ment is typically about six years, and it will be depreciated over a six-year life to a $400,000 salvage value. Additional patient volume will yield $3,000,000 in new revenues the first year. These first-year total revenues will increase by $600,000 each year thereafter, but the unit is expensive to operate. Additional staff and variable costs, excluding depreciation expense, will come to $2,200,000 the first year, but these expenses are expected to rise by $400,000 each year thereafter. Over the life of the machine, net working capital will increase by $18,000 per year for six years. a. Assuming that Glenn Medical Center is a…arrow_forwardAn electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some alr pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $210.55 million, and the expected cash Inflows would be $70 million per year for 5 years. If the firm does Invest in mitigation, the annual inflows would be $75.20 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 19%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education