FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Solve both questions

Do not give answer in image formate

Transcribed Image Text:Diego Company manufactures one product that is sold for $73 per unit in two geographic regions-the East and West

regions. The following information pertains to the company's first year of operations in which it produced 44,000 units and

sold 39,000 units.

Variable coats per uniti

Manufacturing:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative.

Fixed costs per years

Fixed manufacturing overhead

Fixed selling and administrative expense

Foundational 7-7 (Algo)

$ 23

$16

$2

$4

The company sold 29,000 units in the East region and 10,000 units in the West region. It determined that $180,000 of its

fixed selling and administrative expense is traceable to the West region, $130,000 is traceable to the East region, and the

remaining $90,000 is a common fixed expense. The company will continue to incur the total amount of its fixed

manufacturing overhead costs as long as it continues to produce any amount of its only product.

$748,000

$400,000

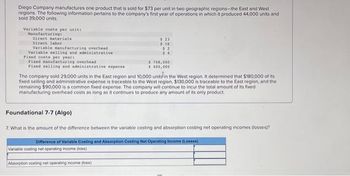

7. What is the amount of the difference between the variable costing and absorption costing net operating incomes (losses)?

Variable costing net operating income (loss)

Absorption costing net operating income (loss)

Difference of Variable Costing and Absorption Casting Net Operating Income (Losses)

![[The following information applies to the questions displayed below]

Diego Company manufactures one product that is sold for $73 per unit in two geographic regions-the East and West

regions. The following information pertains to the company's first year of operations in which it produced 44,000 units and

sold 39,000 units.

Variable costs per uniti

Manufacturing:

Direct naterials

Direct labor

Variable manufacturing overbead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expense

$ 23

$16

$2

3.4

$ 748,000

$ 400,000

The company sold 29,000 units in the East region and 10,000 units in the West region. It determined that $180,000 of its

fixed selling and administrative expense is traceable to the West region, $130,000 is traceable to the East region, and the

remaining $90,000 is a common fixed expense. The company will continue to incur the total amount of its fixed

manufacturing overhead costs as long as it continues to produce any amount of its only product.

Foundational 7-10 (Algo)

10. What would have been the company's variable costing net operating income (loss) if it had produced and sold 39,000 units? You do

not need to perform any calculations to answer this question.](https://content.bartleby.com/qna-images/question/fbe34582-b62c-4284-8862-b01b773ee480/ac22911b-284a-4549-9e25-815c13ea598e/5pyxb5_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below]

Diego Company manufactures one product that is sold for $73 per unit in two geographic regions-the East and West

regions. The following information pertains to the company's first year of operations in which it produced 44,000 units and

sold 39,000 units.

Variable costs per uniti

Manufacturing:

Direct naterials

Direct labor

Variable manufacturing overbead

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

Fixed selling and administrative expense

$ 23

$16

$2

3.4

$ 748,000

$ 400,000

The company sold 29,000 units in the East region and 10,000 units in the West region. It determined that $180,000 of its

fixed selling and administrative expense is traceable to the West region, $130,000 is traceable to the East region, and the

remaining $90,000 is a common fixed expense. The company will continue to incur the total amount of its fixed

manufacturing overhead costs as long as it continues to produce any amount of its only product.

Foundational 7-10 (Algo)

10. What would have been the company's variable costing net operating income (loss) if it had produced and sold 39,000 units? You do

not need to perform any calculations to answer this question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education