ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Hh1.

Transcribed Image Text:Diamond & Turf Inc. is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 150 baseballs per hour to sewing 290 per

hour. The contribution margin per unit is $0.32 per baseball. Assume that any increased production of baseballs can be sold. The second machine is an automatic packing

machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $21 per hour. The sewing machine will cost $260,000,

have an 8-year life, and will operate for 1,800 hours per year. The packing machine will cost $85,000, have an 8-year life, and operate for 1,400 hours per year. Diamond & Turf

seeks a minimum rate of return of 15% on its investments.

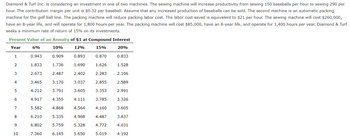

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.870

0.833

1.626

1.528

2.283

2.855

3.353

3.785

2

3

4

5

6

7

8

9

10

0.943

1.833

2.673

3.465

4.212

4.917

5.582

6.210

6.802

7.360

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5.335

5.759

6.145

0.893

1.690

2.402

3.037

3.605

4.111

4.564

4.968

5.328

5.650

4.160

4.487

4.772

5.019

2.106

2.589

2.991

3.326

3.605

3.837

4.031

4.192

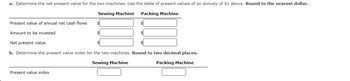

Transcribed Image Text:a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar.

Sewing Machine Packing Machine

Present value of annual net cash flows

Amount to be invested

$

$

Net present value

b. Determine the present value index for the two machines. Round to two decimal places.

Sewing Machine

Packing Machine

Present value index

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In the context of regulating new drugs, a type I error occurs when and a type II error occurs when A bad drug gets rejected and does not go on the market; a good drug gets approved for sale A good drug gets rejected and does not go on the market; a bad drug gets approved for sale A good drug gets approved for sale; a bad drug gets rejected and does not go on the market A bad drug gets approved for sale; a good drug gets rejected and does not go on the marketarrow_forward2. The CDC released the following data for the US population in its 2013 Vital Statistics report. Calculate the mortality rate for each age interval and add it to the table above. Then, below, describe the trends in adult and childhood mortality in the United States in 2013. Age interval Number dying in age interval Number surviving at beginning of age interval Mortality Rate (per 1000) 0-10 756 100,000 11-20 292 99,244 21-30 890 98,953 31-40 1,234 98,164 41-50 2,457 96,811 51-60 5,564 94,352 61-70 10,479 88,788arrow_forwardExplain what the Marshall-Lerner condition represents.arrow_forward

- Suppose the proportion P of people affected by a certain disease is described by ln (P/1-P) = 0.1t where t is the time in months. Find dP/dt, the rate at which P grows.arrow_forwardNumber of outpatient visit has.... and number of hospital beds has... over the last four decades in the US.arrow_forwardOnly typed solutionarrow_forward

- How did you get step 2? I am confused on how you went from dQ/dE= 6*1/2*E-1/2 to VMP=6*6*1/2*E-1/2arrow_forwardcourses/137060/quizzes/485278/take/questions/12956039 Dashboard Customer Portal - R... Dashboard | Labcor... Clinician SimonMed FLORIDA STA... Question 3 20 pts Which of the following makes best use of a signal phrase and parenthetical citation? O Hira Bhagtani writes, "The initial results of the new medication are positive" (637). O On page 637 it says, "The initial results of the new medication are positive" (Bhagtani). O The author states, "The initial results of the new medication are positive" (637). OHira Bhagtani states, "The initial results of the new medication are positive" (Bhagtani 637). • Previous Q Search Ca Next ▸ 25arrow_forwardWhere does the 404 come from?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education