EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please given answer general accounting

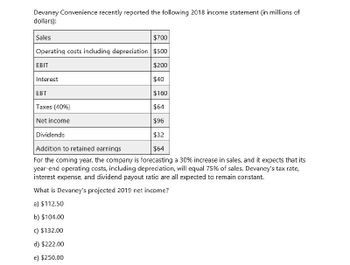

Transcribed Image Text:Devaney Convenience recently reported the following 2018 income statement (in millions of

dollars):

Sales

$700

Operating costs including depreciation $500

EBIT

Interest

EBT

Taxes (40%)

Net income

Dividends

$200

$40

$160

$64

$96

$32

$64

Addition to retained earnings

For the coming year, the company is forecasting a 30% increase in sales, and it expects that its

year-end operating costs, including depreciation, will equal 75% of sales. Devaney's tax rate,

interest expense, and dividend payout ratio are all expected to remain constant.

What is Devaney's projected 2019 net income?

a) $112.50

b) $104.00

c) $132.00

d) $222.00

e) $250.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is devaneys projected 2019 net income?arrow_forwardAustin Grocers recently reported the following 2019 income statement (in millions of dollars): Sales $700 Operating costs including depreciation 500 ЕBIT $200 Interest 40 ЕВT $160 Taxes (25%) 40 Net income $120 Dividends $40 Addition to retained earnings $80 For the coming year, the company is forecasting a 30% increase in sales, and it expects that its year-end operating costs, including depreciation, will equal 70% of sales. Austin's tax rate, interest expense, and dividend payout ratio are all expected to remain constant. a. What is Austin's projected 2020 net income? Enter your answer in millions. For example, an answer of $13,000,000 should be entered as 13. Round your answer to two decimal places. 2$ million b. What is the expected growth rate in Austin's dividends? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardGive me correct answerarrow_forward

- Austin Grocers recently reported the following 2019 income statement (in millions of dollars): Sales $700 Operating costs including depreciation 500 EBIT $200 Interest 40 EBT $160 Taxes (25%) 40 Net income $120 Dividends $40 Addition to retained earnings $80 For the coming year, the company is forecasting a 35% increase in sales, and it expects that its year-end operating costs, including depreciation, will equal 75% of sales. Austin's tax rate, interest expense, and dividend payout ratio are all expected to remain constant. What is Austin's projected 2020 net income? Enter your answer in millions. For example, an answer of $13,000,000 should be entered as 13. Round your answer to two decimal places.I got 98.13 and it says its wrong What is the expected growth rate in Austin's dividends? Do not round intermediate calculations. Round your answer to two decimal places. I am completely lost on this one An excel walk through it perfered :)arrow_forwardplease answer the following questionarrow_forwardpharoah marble company has total assets of 13350000 sales of 18690000 and net income of 4672500. management expects sales to grow by 25% next year. all assets and costs (including taxes) vary directly with sales, and management expects to maintain a payout ratio of 65%. Calculate Pharoah's EFN.arrow_forward

- What is devaneys projected 2019 net income? General accountingarrow_forwardBajaj Ltd. reported the following statistics and results for 2020: Net operating income Return on sales $ 54,000 Asset turnover 2.5 Residual income $ 10,880 Required: 1. What was the value of Bajaj's average operating assets in 2020? Average operating assets 2 If the required rate of return is 7% what Is the ROI? (Round your answer to 2 decimal places.) ROIarrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $90 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 90 Variable costs (70% of revenue) 1,260 Depreciation 160 Interest (6% of beginning-of-year debt) 18 Taxable income 272 Taxes (at 35%) 95 Net income $ 177 Dividends $ 89 Addition to retained…arrow_forward

- Provide correct solutionarrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $350,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $86 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,160 Fixed costs 86 Variable costs (70% of revenue) 1,512 Depreciation 280 Interest (6% of beginning-of-year debt) 18 Taxable income 264 Taxes (at 35%) 92 Net income $ 172 Dividends $ 86 Addition to retained…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 60 Variable costs (80% of revenue) 1,440 Depreciation 80 Interest (8% of beginning-of-year debt) 24 Taxable income 196 Taxes (at 40%) 78 Net income $ 118 Dividends $ 79 Addition to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT