FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

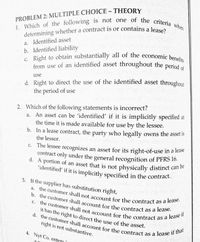

Transcribed Image Text:determining whether a contract is or contains a lease?

1. Which of the following is not one of the criteria when

c. Right to obtain substantially all of the economic benefits

from use of an identified asset throughout the period of

'identified' if it is implicitly specified in the contract.

C. the customer shall not account for the contract as a lease if

a. the customer shall not account for the contract as a lease.

b. the customer shall account for the contract as a lease.

d. the customer shall account for the contract as a lease if that

it has the right to direct the use of the asset.

PROBLEM 2: MULTIPLE CHOICE - THEORY

a. Identified asset

b. Identified liability

from use of an identified asset throughout the period of

d. Right to direct the use of the identified asset throughout

the period of use

use

2. Which of the following statements is incorrect?

a. An asset can be 'identified' if it is implicitly specified at

the time it is made available for use by the lessee.

b. In a lease contract, the party who legally owns the asset IS

the lessor.

c. The lessee recognizes an asset for its right-of-use in a lease

contract only under the general recognition of PFRS 16.

d. A portion of an asset that is not physically distinct can be

'identified' if it is implicitly specified in the contract.

3. If the supplier has substitution right,

right is not substantive.

4. Nyt Co. ente

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What are the primary benefits to a lessor of entering into a lease arrangement?arrow_forwardThe effect of an operating lease on the income distribution schedule: checked a. is non-existent b. affects only the lessee's income. c. affects only the lessor's income. d. affects the amount of income or distribution of income between the noncontrolling and controlling interests.arrow_forwardExplain the Remeasurement of the Lease Liability...arrow_forward

- Interest costs related to which of the following types of assets qualify for interest capitalization? An asset a company manufactures and sells on a routine basis. An asset ready for its intended use at the time of purchase. An asset a company constructs as a discrete project for sale or lease, or an asset a company constructs for its own All of the abovearrow_forwardIf an entity as lessee presents as investment property a property interest held under an operating lease then the entity 1has the option of measuring some items of investment property using the cost model. 2shall measure in the financial statement all of its investment property using the fair value models 3shall measure that leased property interest under the fair value model and the remaining investment property using the cost model. 4shall measure that leased property interest under the cost model and the remaining investment property either using the cost model or the fair value model.arrow_forwardIn calculating the amortization of a leased asset, the lessee should subtract a Select one: a. guaranteed residual value and amortize over the term of the lease. b. unguaranteed residual value and amortize over the term of the lease. c. guaranteed residual value and amortize over the life of the asset. d. unguaranteed residual value and amortize over the life of the asset. e. None of the above.arrow_forward

- Outline the accounting processes that must be followed by a lessee when using the operational lease method.arrow_forwarddetermine the initial recognition, initial measurement, and subsequent measurement offi nance leases;arrow_forward1. Statement I. When the bargain purchase option was not exercised, the lessee should record a loss equivalent to the excess of the cost of the leased asset over the option price.Statement II. If there is a reasonable certainty that the lessee will obtain ownership by the end of the lease term, the leased asset should be depreciated the shorter between the lease term and the asset’s remaining useful life.Statement III. Assuming the lessee depreciates the asset under the straight-line method, the pattern of the total expense that the lessee shall recognized with respect to the lease is the same every period. A. Only Statement I and II are incorrect. B. Only Statement II and III are incorrect. C. Only Statement I and III are incorrect. D. All statements are incorrect. E. All statements are correct. 2. Statement I. If the pattern of the repairs cannot be established and the obligation for warranty cannot be reasonably estimated, warranty costs are recorded as expense when…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education