Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

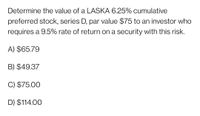

Transcribed Image Text:Determine the value of a LASKA 6.25% cumulative

preferred stock, series D, par value $75 to an investor who

requires a 9.5% rate of return on a security with this risk.

A) $65.79

B) $49.37

C) $75.00

D) $114.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investor X invested in three stocks equally. Return on his portfolio is 18%. Return of Stock A is 14% Return of Stock B is 15%. What is the return on Stock C? a) 8.33% b) -11.00% c) 25.00% d) 6.00%arrow_forwardWhat are the portfolio weights for a portfolio that has 195 shares of Stock A that sell for $96 per share and 170 shares of Stock B that sell for $130 per share? Note: Do not round intermediate calculations and round your answers to 4 decimal places, e.g., .1616. Stock A Stock Barrow_forward9. Conceptualquestions on portfolio and stand-alone risk Manuel holds a $5,000 portfolio that consists of four stocks. His investment in each stock, as well as each stock's beta, is listed in the following table: Stock Investment Beta Standard Deviation Perpetualcold Refrigeration Co. (PRC) $1,750 0.90 18.00% $1,000 1.30 11.00% Kulatsu Motors Co(KMC) Water and Power Co. (WPC) Makissi Corp. (MC) $750 1.10 18.00% $1,500 0.60 19.50% Suppose all stocks in Manuel's portfolio were equally weighted. The stock that would contribute the least systematic risk to the portfolio Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the is least amount of unsystematic risk is If the risk-free rate is 4.00% and the market risk premium is 6.50%, then Manuel's portfolio will exhibit a beta of and a required return ofarrow_forward

- Report the beta of each stock and demonstrate a clear understanding of the concept of market efficiency.arrow_forwardYou own a stock portfolio invested in 40 percent in stock A and 60 percent in Stock B. The betas for these two stocks are 0.5 and 1.0 respectively. What i S the portiolio beta? 1.5 0.75 1.0 0.8arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forward

- Pls show Every step and conceptarrow_forwardPlease show working Please answer ALL OF QUESTIONS 1 AND 2A and 2B 1. Stock R has a beta of 1.2, Stock S has a beta of 0.35, the required return on an average stock is 9%, and the risk-free rate of return is 5%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. 2. Harrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. a. What is the yield to maturity at a current market price of: $759? Round your answer to two decimal places. ________% $1,083? Round your answer to two decimal places. _________% b. Would you pay $759 for each bond if you thought that a "fair" market interest rate for such bonds was 13%-that is, if rd = 13%? You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond. You would buy the bond as long as the yield…arrow_forwardWhat is the expected return of the following portfolio? Stock Price Per Share Number of Shares Security Expected Return A $ 16 1509.01 B $ 13 175 10.53arrow_forward

- Assume a two-stock portfolio with $50,000 invested in Stock A and $30,000 invested in Stock B. The expected return of Stock A is 12% and the expected return of Stock B is -2%. What's the expected portfolio return? Group of answer choices 7.50% 6.75% 10.0% 6.0%arrow_forwardYou are given the following information regarding four stocks in a portfolio: Company # of Shares Price ($) 2020 Price ($) 2021 ELITE 40,000 3.11 2.99 FTNA 5,000 30.37 34.10 GWEST 55,000 2.05 1.80 TTECH 20,000 5.55 4.60 Assuming 2020 is the base year with an index value of 500: i. Compute a price-weighted index of these four stocks for 2021. ii. Compute a value-weighted index of these four stocks for 2021. What is the percentage change in the value of the index from 2020 to 2021? iii. Compute the un-weighted index of these four stocks for 2019. What is the percentage change in the value of the index from 2020 to 2021arrow_forwardPortfolio risk and return Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.00% Water and Power Co. (WPC) $1,125 1.10 16.00% Makissi Corp. (MC) $2,250 0.50 28.50% Suppose all stocks in Emma’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Kulatsu Motors Co. Makissi Corp. Andalusian Limited Water and Power Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Water and Power Co. Makissi Corp. Andalusian Limited…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education