Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please answer fast please arjent help please

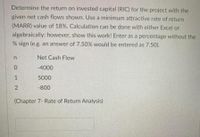

Transcribed Image Text:Determine the return on invested capital (RIC) for the project with the

given net cash flows shown. Use a minimum attractive rate of return

(MARR) value of 18%. Calculation can be done with either Excel or

algebraically; however, show this work! Enter as a percentage without the

% sign (e.g. an answer of 7.50% would be entered as 7.50).

Net Cash Flow

-4000

1

5000

-800

(Chapter 7- Rate of Return Analysis)

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need answer typing clear urjent no chatgpt used i will give upvotes full explanation plzarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardClasswork for Basua, X A Classwork for Basua, X VA VIA Character Streng X The Three Questions X Which line from Utop X X Edgenuity for Studen X Look What You've O X Homework Help and X + https://classroom.google.com/u/1/w/MzEyNjg5MTkxMzly/t/all 120% D ... TIOW TIhUCIT UO they pudget fo Each Category? Basua, M Pers&Bu Multiply the weekly income by each of the budgeted percents. $1,276.50 X 30% $1,276.50 X 18% = $229.77 Housing $382.95 Clothes $1,276.50 x 7% $1,276.50 × 6% = $76.59 $1,276.50 × 5% = $63.83 $1,276.50 x 4% = $51.06 M292-000001 $89.36 Food Entertainment Transportation $1,276.50 × 10% = $127.65 Insurance $1,276.50 × 10% = $127.65 $1,276.50 x 10% = $127.65 Gifts Miscellaneous | Savings Directions Find the amount budgeted for each category. Use the percents shown in the example for each weekly income shown. Weekly Income 1) $416.50 2) $1,246.59 3) $661.40 | 4) $1,413.56 Housing Food Transportation Gifts Savings Clothing Entertainment Insurance Misc Weekly Income 5) $1,156.89 6)…arrow_forward

- only answer d now pleasearrow_forward42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forwardWhat is greenmail?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education