ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

unconstrained optimization application exercises

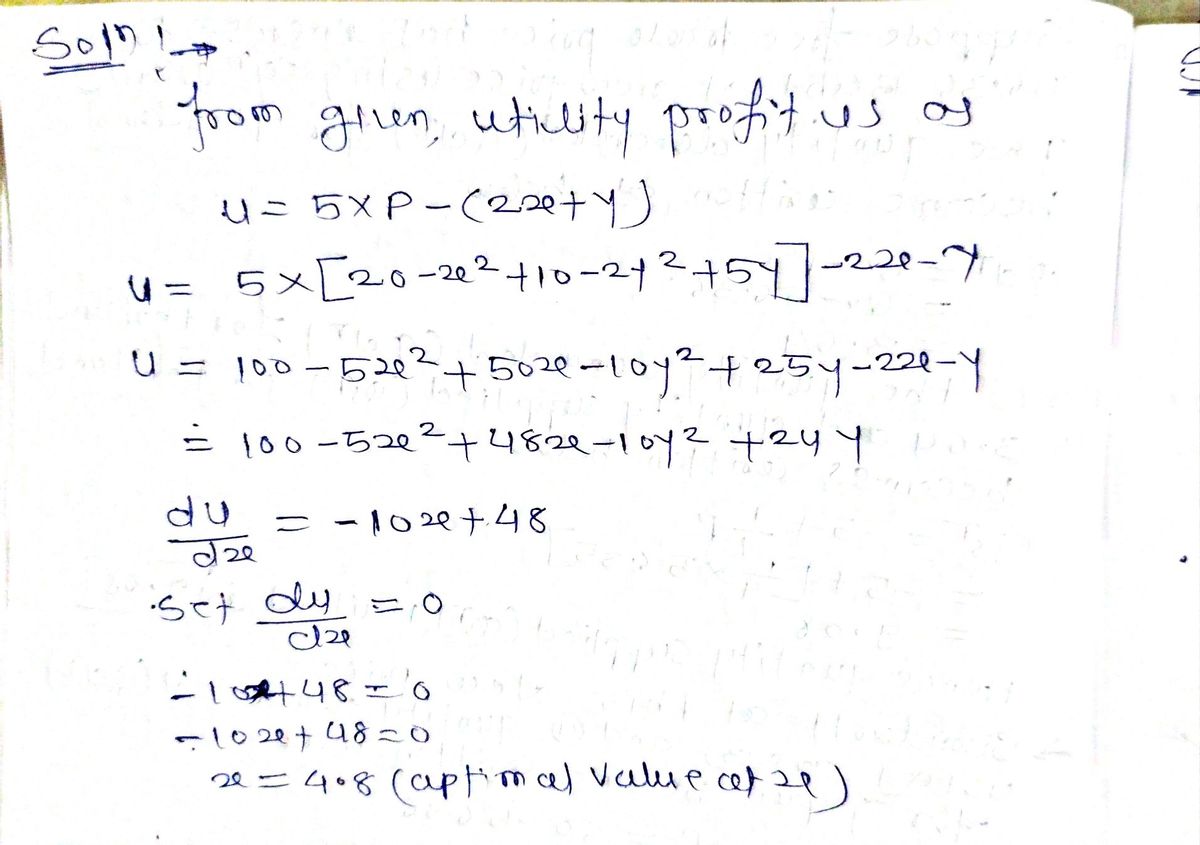

Determine the maximum utility if the production function is P = 20 – x2 + 10x – 2y2 + 5y, the prices of inputs x and y are 2 and 1, respectively, and the unit price of product P is 5.

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Please get correctarrow_forwardThe cost, C, to produce a product as a function of the quantity, q, is given by ?(?)=?3−2.5?2−8?+45�(�)=�3−2.5�2−8�+45 for 1≤?≤101≤�≤10, which of the following is the quantity that minimizes cost?arrow_forwardA consumer has the following utility function: U (x, y) = (x + a) (y + b) Prices of the two goods x and y respectively are px and py and the consumer has income m. We assume that all prices and income are strictly positive. Furthermore, throughout this question we assume that m is high enough so that both x and y are strictly positive in equilibrium. (a) Solve the consumer’s optimization problem and express the demand for the two goods in terms of prices and income. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- If Jackson's preferences over consumption bundles can be represented by the utility function U(X, Y) = 2X + Y, what will Jackson's optimal bundle, (X*,Y*), be when the price of X is px = 3, the price of Y is py = 1, and Jackson's income is I = 150? (a) (110,0) (b) (0, 150) (c) (0,80) (d) (50, 0) (e) (30,60)arrow_forwardA consumer has set of budget of $800 for the consumption of good X a d Y. The price of Good X is $10 and the price of good Y is $40.The consumer has a utility function given by U (X,Y) = X(0.80)Y(0.20).Find the optimal soloution using a methof that does not involves equations and illustrate the soloution?arrow_forwardA consumer has the following utility function U (X1, X2) = (x1 + 3) (x2+4) Prices of the two goods X₁ and x₂ respectively are p₁ and p2 and the consumer has income m. We assume that all prices and income are strictly positive. Furthermore, throughout this question we assume that m is high enough so that both goods are consumed in strictly positive amount in equilibrium. (a) Solve the consumer's optimization problem and express the demand for the two goods in terms of prices and income. (1) Compute the missing values of elasticities in the following table assuming M = 10, p₁ = 2, and p2 = 1. Show your work. Income elasticity Absolute value of own price elasticity Cross price elasticity X₁ T≤ X₂ (b) While x2 is produced locally, x₁ is transported from a different region. Assume P₂ = 1. Building a new railroad (that connects the regions) will reduce transportation cost which in turn will reduce the price of good 1 from p₁ = 2 to p₁ = 1. Railroad will be funded by taxes which will reduce…arrow_forward

- Q6 If the utility function of consumption of a pizzas and y sodas is ry, the cost of pizzas is $5 each, the cost of sodas is $2 each, and the total amount available for snacks is $20. Find the amounts of pizzas and sodas for which consumption will be a maximum.arrow_forwardA consumer facing a budget constraint will typically choose a combination of goods and services that: a) Provides the highest total utility b) Minimizes the total cost of consumption c) Equalizes marginal utility per dollar spent on each good d) Matches their preferences regardless of budget limitationsarrow_forwardEach week, an individual consumes x and y of two goods, and works for 1 hours. These three quantities are chosen to maximize the utility function U(x, y, l) = a ln(x) + ß ln(y) + (1 − a − ß) ln(L − 1), which is defined for 0 ≤ 1 0, and where a, ß > 0 and a + ß < 1. The individual faces the budget constraint px + qy = wl, where w is the wage per hour. • State the optimization problem • Solve completely for the utility-maximizing levels of x, y, and Iarrow_forward

- Using the homogeneity of indirect utility, which of the following cannot be an indirect utility function? (a) V: = (b) V: = (c) V: = [2 PzPy I Pz+Py p²+p² (d) V = 1 Pzarrow_forwardThe table below shows the production of all goods by the nation of Lemonaidia in 2013 and 2014 with their respective prices. 2013 Output 2013 Prices $1.00 per glass Lemonade 200 glasses Cookies 100 cookies $2.00 per cookie What was real GDP in 2013 using 2013 prices? 2014 Output 200 glasses 90 cookies 2014 Prices $1.00 per glass $2.50 per cookiearrow_forwardHow is YOUR ability to create & manager YOUR Wealth will impact you, your family, your community, and the world.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education