FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

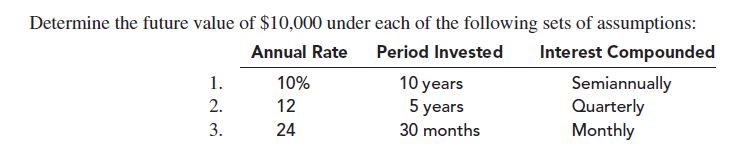

Transcribed Image Text:Determine the future value of $10,000 under each of the following sets of assumptions:

Interest Compounded

Annual Rate

Period Invested

Semiannually

Quarterly

Monthly

1.

10%

10 years

5 years

2.

12

3.

30 months

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Consider the following cases: Amount of Compounding Initial Stated Annual Frequency, m Deposit Case Deposit ($) Rate, r (%) (times/year) Period (years) A 2,500 6 2 5 B 50,000 12 6 3 C 1,000 5 1 10 D 20,000 16 4 6 a. Calculate the future value at the end of the specified deposit period.arrow_forwardUsing annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $6000 is deposited initially at 9% annual interest for 7 years, and (2) determine the effective annual rate (EAR).arrow_forwardCompute the future value of the following annuity investments:S 1. P6,000 quarterly investment at 8% interest compounded quarterly for 8 yearsarrow_forward

- Find the total number of compounding periods and the interest rate per period for the investment. Term ofInvestment Nominal(Annual) Rate (%) InterestCompounded CompoundingPeriods Rate perPeriod (%) 4 years 4.5 semiannuallyarrow_forwardFrom the interest statement of 18% per year, compounded monthly, determine the value for compounding period.arrow_forwardFind the total number of compounding periods and the interest rate per period for the investment. Term of Investment Rate per Period (%) Nominal Interest Compounding Perlods (Annual) Rate (%) Compounded 8 years quarterlyarrow_forward

- Calculate, to the nearest cent, the future value FV (in dollars) of an investment of $10,000 at the stated interest rate after the stated amount of time. 3% per year, compounded quarterly (4 times/year), after 7 yearsarrow_forwardfind the difference between the sums of an annuity due and an ordinary for the following data. peiodic payment = 12,000 pesos payment interval = 3 months term = 14 yrs interest rate = 14% compounded quarterlyarrow_forwardAssuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $6,500 under each of the following situations: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. The payments are received at the beginning of each of the five years and interest is compounded annually. 3. The payments are received at the end of each of the five years and interest is compounded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Deposit Date The payments are received at the end of each of the five years and interest is compour Note: Round your final answers to nearest whole dollar amount. First payment Second payment Third payment Fourth payment Fifth payment j= 3% 3% 3% 3% 3% Required 3 X Answer is complete but not entirely corre n= 4 ✓ $ 8 12 16 ✓…arrow_forward

- A. Calculate the effective annual rate (EAR) in each of the following scenarios: b. APR = 10%, monthly compounding c. 4% semi-annual interest rate, monthly compounding d. 1.5% monthly interest rate, daily compounding e. 3% quarterly interest rate, annual compoundingarrow_forwardif an investment pays interest at a rate of 8% compounded semi annually, then an investment of $1000 for 3 years would be found in a table using the future value of 1 table for a. 3 periods at 8% b. 8 periods at 3% c. 12 periods at 2 % d. 6 periods at 4%arrow_forwardFind the future value of the following ordinary annuity. Periodic Payment Payment Interval Term Interest Rate Conversion Period $1675 1 year 13 years 8% quarterlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education