FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Determine the amount of taxable income and separately stated items in each of the cases below. Assuming the corporation is a

Subchapter S corporation. Ignore any carryforward items.

Required:

a. Corporate financial statement: net income of $52,750 including tax expense of $15,300, charitable contributions of $3,000, and

depreciation expense of $37,450. Depreciation expense for tax purposes is $46,480.

b. Corporate financial statement: net income of $140,200 including tax expense of $68,450, charitable contributions of $28,000,

depreciation expense of $103,750, and meals expenses of $31,300. Depreciation expense for tax purposes is $145,900.

c. Corporate financial statement: net income of $227,350 including tax expense of $111,540, charitable contributions of $16,000,

municipal bond interest of $19,390, meals expenses of $41,900, capital gains of $6,150, and depreciation expense of $143,050.

Depreciation expense for tax purposes is $131,750, and the corporation has a $7,105 charitable contribution carryforward for the

current year.

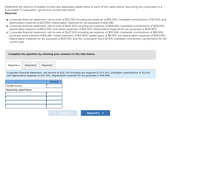

Complete the question by entering your answers in the tabs below.

Required a

Required b

Required c

Corporate financial statement: net income of $52,750 including tax expense of $15,300, charitable contributions of $3,000,

and depreciation expense of $37,450. Depreciation expense for tax purposes is $46,480.

Amount

Taxable income

Separately stated items

< Required a

Required b >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Prior to 2022, taxable income and accounting income were identical. 2. Accounting income was $1.7 million in 2022 and $1.46 million in 2023. 3. On January 1, 2022, equipment costing $1.97 million was purchased. It is being depreciated on a straight-line basis over eight years for financial reporting purposes, and is a Class 8-20% asset for tax purposes. Tax-exempt interest income of $70,000 was received in 2023. 4. 5. The tax rate is 30% for all periods. 6. Taxable income is expected in all future years. 7. Sunland had 100,000 common shares outstanding throughout 2023. (a) ง Calculate the amount of capital cost allowance and depreciation expense for 2022 and 2023, and the corresponding carrying amount and undepreciated capital cost of the depreciable assets at the end of 2022 and 2023. Capital Cost Allowance Undepreciated Capital Cost Depreciation Expense Net Book Valuearrow_forward18. Calculate the amount of corporate income tax due and the net income after taxes (in $) for the corporation. (Assume the corporate tax rate is 21%.) Name TaxableIncome TaxLiability Net Incomeafter Taxes Corporation 1 $256,100 $ $arrow_forwardCrimson Corporated was organized as a calendar - year corporation inJanuary, Year 1, incurring S51, 000 in qualified organizational expenses, andbegan business in March, Year 1. What is the maximum amount Crimsonmay deduct for organizational expenditures on its Year 1 corporate taxreturn? Multiple Choice S6, 350 S7, 133 S4, OOO S6, 611arrow_forward

- Nn.64. Subject :- Accountarrow_forwarda. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.arrow_forwardKline Company had checks outstanding totaling $6,400 on its May bank reconciliation. In June, Kline Company issued checks totaling $39,900. The July bank statement shows that $29,700 in checks cleared the bank in July. A check from one of Kline Company's customers in the amount of $300 was also returned marked "NSF." The amount of outstanding checks on Jones Company's July bank reconciliation should be Question 29 options: A) $16,600 B) $3,800 C) $19,600 D) $10,200arrow_forward

- I need to know how to solve the question.arrow_forwardThe following facts relate to Crane Corporation. Deferred tax liability, January 1, 2025, $30,600. Deferred tax asset, January 1, 2025, $10,200. Taxable income for 2025,$107,100. Cumulative temporary difference at December 31,2025 , giving rise to future taxable amounts, $234,600. Cumulative temporary difference at December 31,2025 , giving rise to future deductible amounts, $96,900. Tax rate for all years, 20%. No permanent differences exist. The company is expected to operate profitably in the future. (a) Compute the amount of pretax financial income for 2025. Pretax financial income $arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- Reyarrow_forwardBangura, Incorporated has regular taxable income of $932,500,000 and AFSI of $1,437,100,000. Required: Compute Bangura's regular tax liability, tentative minimum tax, AMT (if any) and total tax due. Regular tax liability Tentative minimum tax AMT Total tax duearrow_forwardADetermine the amount of taxable income and separately stated items in each of the cases below. Assuming the corporation is a Subchapter S corporation. Ignore any carryforward items. a. Corporate financial statement net income of $52,000 including tax expense of $15,000, charitable contributions of $3000, and depreciation expense of $37,000, Depreciation expense for tax purposes is $46,000. b. Corporate financial statement net income of $139,000 including tax expense of $68,000, charitable contributions of $28,000, depreciation expense of $103,000, and meals expenses of $31,000. Depreciation expense for tax purposes is $145,000. c. Corporate financial statement: net income of $226,000 including tax expense of $111,000, charitable contributions of $16,000, municipal bond interest of $19,000, meals expense of $41,000, capital gains of $6,000 and depreciation expense of $142,000. Depreciation expense for tax purposes is $131,000, and the corporation has $7000 charitable contribution…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education