Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

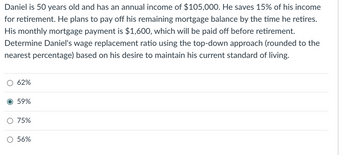

Transcribed Image Text:Daniel is 50 years old and has an annual income of $105,000. He saves 15% of his income

for retirement. He plans to pay off his remaining mortgage balance by the time he retires.

His monthly mortgage payment is $1,600, which will be paid off before retirement.

Determine Daniel's wage replacement ratio using the top-down approach (rounded to the

nearest percentage) based on his desire to maintain his current standard of living.

62%

O 59%

75%

56%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Manuel pays insurance premiums for his employees. What type of insurance premium is not deductible as compensation paid to the employee?arrow_forwardChoose the response that accurately completes the following sentence. Člaiming the Child and Dependent Care Credit is NOT allowed for taxpayers who: Are actively searching for employment. Lived with their spouse for the entire year, but will file a separate return. Are self-employed. Use the services of an independent caregiver, such as a nanny or babysitter.arrow_forwardWhich of the following is business income for NOL purposes? Interest earned on savings account. Unemployment compensation. Alimony received. IRA distribution.arrow_forward

- What are the pros and cons of rasining minimum wage? How would society differ?arrow_forwardExactly who can be a “qualifying relative” and who can’t…??? Say, for example, that you are unmarried but have a “friend” who lives with you full-time / all year. It’s just the two of you (and maybe a quadruped or two). The apartment (or house) is in your name only and you pay all of the rent (or mort-gage) and for absolutely everything else because your friend is a “writer” who does nothing by way of work other than on a supposed novel – which of course brings in absolutely zero income because it never seems to get finished, much less published… Since you’re the sole breadwinner and it’s your apartment (or house), can you file as “Head of household” instead of as “Single”? Explain in 2-3 sentences.arrow_forwardHow is self-employment income treated differently than income earned when you work for an employer?arrow_forward

- Calculate Brisky's Net Income.arrow_forwardUpon Jena’s retirement, the couple plans to relocate their home close to the beach. For this purpose, they intend to buy a house near the beach and a rental property (to fund their retirement). They do not have the funds to make these purchases. Please explain to the couple the downsizing retirement strategy most appropriate to their circumstance.arrow_forwardChild care expenses are generally deductible by the spouse with higher income in a two parents household. Question 5 options: True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education