FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

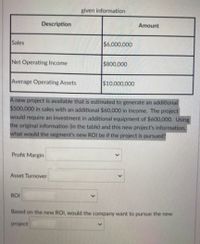

Transcribed Image Text:given information

Description

Amount

Sales

$6,000,000

Net Operating Income

$800,000

Average Operating Assets

$10.000,000

A new project is available that is estimated to generate an additional

$500,000 in sales with an additional $60,000 in income. The project

would require an investment in additional equipment of $600,000. Using

the original information (in the table) and this new project's information,

what would the segment's new ROI be if the project is pursued?

Profit Margin

Asset Turnover

ROI

Based on the new ROI, would the company want to pursue the new

project

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You Answered Some particulars for a project are as follows. Initial Capital Cost in year 0 ($Mn) Follow-up 'one-off' cost in year 1 ($Mn) Annual Operating Cost ($Mn/yr) Annual Benefits ($Mn/yr) Correct Answers Project Closure Cost, at end of project life ($Mn) Useful Life (years) Interest/Discount rate (percent) 1000 300 10% of capital cost 400 2,391 (with margin: 5) 200 20 7 What is the Life Cycle Cost of the project - expressed in present value term? (your answer must be rounded off to the nearest million dollars, i.e., no decimal places)arrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forwardsolve using equations and show work in the simplest way possible! No tables or excel please!!!arrow_forward

- How do you calculate net investment in working capital, net cash flows, present value of net cash flows, and NPV? WACC is 10.10%arrow_forwardProblem 2. Based on benefit to cost ratio, determine which project should be chosen. Please work out in excel spreadsheet.arrow_forwardCompute the NPV based on the following data Life of project 10.00 year Required Investment 500,000.00 Required Rate of Return 8% Required Working Capital to be released at the end of the project 35,000.00 Salvage value of equipment at end of year 10 12,000.00 Required overhaul in year 5 60,000.00 Annual increase in net income for this project 85,000.00 Year Cash flow 0 1 2 3 4 5 6 7 8 9 10 Net Present Value IRR Should we accept this project:?arrow_forward

- The senior management of Netherworld Ltd is evaluating four project proposals and will select one project to invest in. The following summary information is available: Project Code Initial Investment Required Net Present Value Project life (years) A 172,000 48,000 7 B 155,000 48,000 12 C 115,000 39,100 7 D 141,000 38,500 3 Required: Calculate the profitability index for each project. In order of preference, rank the four projects in terms of net present value and the profitability index. Which project do you think should be chosen?arrow_forwardTwo mutually exclusive investment altematives for implementing an office automation plan in an engineering design firm are being considered. If the firm's MARR is 10% per year, which alternative should be selected? Compare the altematives shown below on the basis of Incremental Analysis. Investment A Investment B Capital Investment, S 920,000 660,000 Annual Expenses, S/ yr. 167,000 133,000 Salvage value, S 410,000 330,000 Life, years 10 10 Determine IRR on incremental analysis, using 7% and 13% rates. Oa.86% Ob 11.1% 10.9% Od.95%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education