FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

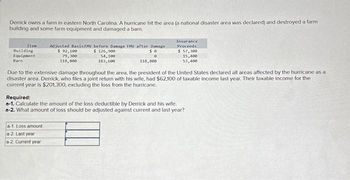

Transcribed Image Text:Derrick owns a farm in eastern North Carolina. A hurricane hit the area (a national disaster area was declared) and destroyed a farm

building and some farm equipment and damaged a barn.

Iten

Building

Equipment

Barn

Adjusted Basis FMV before Damage FMV after Damage

$ 92,100

79,300

118,800

$ 126,900

54,100

183,600

a-1 Loss amount

a-2 Last year.

a-2. Current year

50

0

118,800

Insurance.

Proceeds

$57,300

15,400

53,400

Due to the extensive damage throughout the area, the president of the United States declared all areas affected by the hurricane as a

disaster area. Derrick, who files a joint return with his wife, had $62,100 of taxable income last year. Their taxable income for the

current year is $201,300, excluding the loss from the hurricane.

Required:

a-1. Calculate the amount of the loss deductible by Derrick and his wife.

a-2. What amount of loss should be adjusted against current and last year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 32 Xavier bought his chicken farm property for $60,000. When he retired, he sold the property to his granddaughter, Julia, for $115,000. At the time of the transfer, the farm was valued at $600,000. Xavier had already used his lifetime capital gains exemption on the disposition of a previous farm property. What was Julia's adjusted cost base (ACB)? O a) $60,000 O b) $115,000 O c) $55,000 O d) $600,000 Previous Question Next Question View Summary CFP®, CERTIFIED FINANCIAL PLANNER® and are certification marks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPSB). FP Canada" is the marks licensing authority for the CFP marks in Canada, through agreement with FPSB.arrow_forwardAmelia’s business goes bankrupt this year. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions: Assets Purchased Date Cost Sold date Sold price Delivery car 5/1/23 30k 12/31/23 25k Furniture 3/20/20 40k 12/31/23 20k Equipment 4/1/20 110k 12/31/23 100k Land 1/1/22 150k 12/31/23 180k Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation. Show detailed calculation and explanation a) Calculate total accumulated depreciation of each asset until the sold date (12/31/23). b) Calculate the adjusted basis for each asset c) Calculate the gain/loss for each asset d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules Hint: Review textbook chapter on this. In the year of disposition, under half-year convention, only ½ of MACRS…arrow_forwardEva Stone's home in Chicago was recently gutted in a fire. Her living and dining rooms were destroyed completely, and the damaged personal property had a replacement price of $19,000. The average age of the damaged personal property was 8 years, and its useful life was estimated to be 18 years. What is the maximum amount the insurance company would pay Eva, assuming that it reimburses losses on an actual cash-value basis? Round the answer to the nearest cent.arrow_forward

- Which of the following items would not automatically be covered under an HO-3 form? the insured’s driveaway, if damaged by falling object The insured’s pedigreed collie valued at $6000 or $7000 A lawnmower in the insured’s garage personal property of the insured’s daughter who is away from collegearrow_forward-Betty is an unmarried attorney. During the year a hurricane completely destroys her home, which had a basis of $60,000. The value of her home before the tornado is $100,000 and the value afterwards is $35,000. Betty's home is located in a federally declared natural disaster area. Her AGI is $50,000. What is the amount that Betty can deduct after limitations? Group of answer choices $29,900. $54,900. $59,900. $65,000.arrow_forward28. John Jay paid interest expense of $12,000 on his personal residence original first mortgage this year and $5,000 on a $100,000 home equity credit line also secured by a mortgage on his home Half of the home equity credit line loan proceeds were used to put a new roof on the home and the other half was used to purchase a new car. Assuming the acquisition and home equity limits are not exceeded, how much of the total interest expense is deductible on John's Schedule A as qualified home mortgage interest? O$17,000 O$14,500. O$12,000 29 The Browns borrowed $30,000, secured by their home, to pay their son's college tuition. At the time of the loan, the fair market value of their home was $400,000, and it was unencumbered by other debt. The interest on the loan is treated for itemized deductions as ODeductible points. ONon-deductible home equity (mortgage) interest. ODeductible home equity (mortgage) interest.arrow_forward

- Jon uses his automobile 80% for his business that he operates as a sole proprietorship. He drove a total of 10,000 miles (8,000 business, 2,000 personal) and paid the following amounts for his vehicle: Parking at client's offices Auto Insurance Auto club Dues Oil Changes and Tune-ups Repairs $ 180 1,600 180 280 1,160 Depreciation allowable 2,050 Fines incurred while traveling for business 320 Gasoline 2,200 a. What is Jon's 2021 deduction for using his car if he uses the automatic (standard milleage) method? The IRS standard mileage rate for 2021 is.56 cents per mile. O $4,480 Ⓒ$7,970 O $4,660 $7,650 $6,310arrow_forwardushaarrow_forwardReynaldo and Sonya, a married couple, had flood damage in their home due to a dam break near their home in 2021, which was declared a Federally Designated Disaster Area. The flood damage ruined the furniture that was stored in their garage. The following items were completely destroyed and not salvageable: Damaged Items Antique poster bed Pool table Large flat-screen TV FMV Just Prior Original Item Cost (Basis) $ 6,100 14,025 4,425 Casualty loss deduction to Damage $ 8,200 8,375 1,250 Required: Their homeowner's insurance policy had a $11,485 deductible for the personal property, which was deducted from their insurance reimbursement of $15,725, resulting in a net payment of $4,240. Their AGI for 2021 was $45,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2021?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education