FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

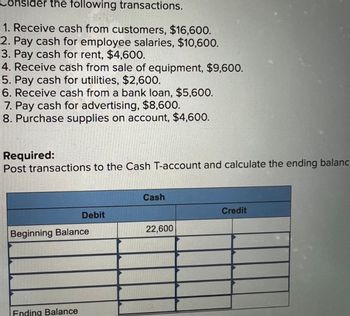

Transcribed Image Text:sider the following transactions.

1. Receive cash from customers, $16,600.

2. Pay cash for employee salaries, $10,600.

3. Pay cash for rent, $4,600.

4. Receive cash from sale of equipment, $9,600.

5. Pay cash for utilities, $2,600.

6. Receive cash from a bank loan, $5,600.

7. Pay cash for advertising, $8,600.

8. Purchase supplies on account, $4,600.

Required:

Post transactions to the Cash T-account and calculate the ending balanc

Debit

Beginning Balance

Ending Balance

Cash

22,600

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A. Started a petty cash fund in the amount of $250.B. Replenished petty cash fund using the following expenses: Auto Expense $17, Office Expense $15, Postage Expense $86, Miscellaneous Expense $74. Cash on hand is $35.C. Increased petty cash by $150. Record these transactions. If an amount box does not require an entry, leave it blank.arrow_forwardA $84 petty cash fund has cash of $17 and receipts of $72. The journal entry to replenish the account would include a Oa. credit to Cash Short and Over for $5 Ob. debit to Cash for $17 Oc. credit to Cash for $84 Od. credit to Petty Cash for $72arrow_forwardA. Started a petty cash fund in the amount of $250.B. Replenished petty cash fund using the following expenses: Auto Expense $72, Office Expense $82, Postage Expense $90, Miscellaneous Expense $6. Cash on hand is $10.C. Increased petty cash by $100. Record these transactions. If an amount box does not require an entry, leave it blank. A. Petty Cash Petty Cash Cash Cash B. Auto Expense Auto Expense Office Expense Office Expense Postage Expense Postage Expense Miscellaneous Expense Miscellaneous Expense Cash Over and Short Cash Over and Short Cash Cash C. Petty Cash Petty Cash Cash Casharrow_forward

- On April 3, Erin Gardner received her bank statement showing a balance of $2,086.93. Her checkbook showed a balance of $1,912.47. Outstanding checks were $234.15, $317.80, $78.10, $132.42, and $212.67. The account earned $20.43. Deposits in transit amount to $814.11, and there is a service charge of $7.00. Use the form below to calculate the reconciled balance. CHECKBOOK BALANCE Add: Interest Earned & Other Credits SUBTOTAL Deduct: Service Charges & Other Debits ADJUSTED CHECKBOOK BALANCE tA ta ta ta tA STATEMENT BALANCE Add: Deposits in Transit SUBTOTAL Deduct: Outstanding Checks LA tA ·SA $ LA ADJUSTED STATEMENT BALANCE $ LA Earrow_forwardI am not exactly sure what this question is asking me to do. The attached image is the information that is given to me. Below are the questions that I need to solve. The answer to question A is 3,650. That was given to me in the problem.Unknown Amounts Requireda. Total cash received $3,650b. Total cash collected from credit customersc. Notes payable repaid during the periodd. Good and services received from suppliers on accounte. Net income, assuming that no dividends were paidarrow_forwardRecord each transaction in a journal entry. Explanations are not required.arrow_forward

- A $54 petty cash fund has cash of $19 and receipts of $24. The journal entry to replenish the account would include a a.credit to Petty Cash for $24. b.debit to Cash Short and Over for $11. c.credit to Cash for $54. d.debit to Cash for $19.arrow_forward3. The April 30 bank statement of 10A Company showed a balance of $$24,635 and the following memoranda: Credits Collection of $1,250 note plus interest $50 Interest earned on checking account $65 Debits $75 NSF check: Banana Wang $635 Safety deposit box rent: 10A Company's cash account in the general ledger had a balance of $26,100 on April 30 and other information is as follows: (1) Cash receipts for April 30 recorded on the company's books were $6,695 but this amount does not appear on the bank statement. (2) The total amount of checks still outstanding at April 30 amounted to $6,575, including $2,000 certified checks. (3) Check No. 119 payable to 10B Company was recorded in the cash payments journal and cleared the bank for $248 but the payment should be $284. Instructions (a) (b) Prepare the bank reconciliation at April 30. Prepare any adjusting entries necessary as a result of the bank reconciliation. (Hint: Record Safety deposit box rent as Miscellaneous (Misc.) Expense)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education