FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

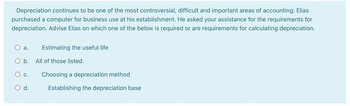

Transcribed Image Text:Depreciation continues to be one of the most controversial, difficult and important areas of accounting. Elias

purchased a computer for business use at his establishment. He asked your assistance for the requirements for

depreciation. Advise Elias on which one of the below is required or are requirements for calculating depreciation.

a. Estimating the useful life

All of those listed.

Choosing a depreciation method

Establishing the depreciation base

O b.

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After experiencing an equipment breakdown loss, Long Industries incurred various expenses. In Long's Equipment Breakdown Protection Coverage Form, expediting expenses include which one of the following? The cost for Long to rent another building in order to continue operations The costs of overnight shipping for Long to obtain a machine part The cost for Long to rent computer equipment Long's loss of net incomearrow_forwardCan you help solve this. Pleasearrow_forwardplease solve all steps. dont use excel . dont provide the answer in hand writing. thanks.arrow_forward

- Carol Keene, corporate comptroller for Dumaine Industries, is trying to decide how to present “Property, plant, and equipment” in the balance sheet. She realizes that the statement of cash flows will show that the company made a significant investment in purchasing new equipment this year, but overall she knows the company’s plant assets are rather old. She feels that she can disclose one figure titled “Property, plant, and equipment, net of depreciation,” and the result will be a low figure. However, it will not disclose the age of the assets. If she chooses to show the cost less accumulated depreciation, the age of the assets will be apparent. She proposes the following. Property, plant, and equipment, net of depreciation $10,000,000 rather than Property, plant, and equipment $50,000,000 Less: Accumulated depreciation 40,000,000 Net book value $10,000,000 Instructions Answer the following questions. a. What are the ethical issues involved? b. What should…arrow_forwardPlease see attached information. Is there a way to show the breakout of the straight line depreciation method in Excel? And any other assistance is much appreciated.arrow_forwardplease help me solve this problemarrow_forward

- Claudia is learning about depreciation and she is getting a little frustrated with the idea of accumulated depreciation. "Why can’t you just debit depreciation expense and credit equipment?" She complains. "It would be so much easier that way!" (1) What type of account is accumulated depreciation and why does it get used in the depreciation of fixed assets instead of doing it Claudia's way? (2) Does accumulated depreciation have a debit balance or a credit balance? Part II Benny, an inexperienced accountant at Ace Plus, is about to post the monthly depreciation entries for the company's fixed assets. The depreciation amounts have already been calculated on a spreadsheet by the owner, who is not very knowledgeable in accounting. Benny's instructions are to post the following depreciation amounts for the month: Building - $1,100 Land - 500 Equipment - 800 What will Benny's journal entries look like if they are done correctly? Can each item "share" an accumulated depreciation account…arrow_forwardEthics and depreciation Issues you are auditing the financial records of a company and are reviewing the depreciation computations.Included in the assets are two buildning and numerous machine in each building.One of the building is used to, amnufacture components of toys and the other for assembly and packing,using the manufactured componenets as well as others purchased from suppliers.You see that the company uses straight-line depreciation over 40 years for the buildings and 20 years for the machinaery.You decide to ask the CFO about these calculatons,and he replies,"we use 40 years for the buildings because it is close to the 39 we use for tax.And our best guess is that we will replace the machines twice while we use the building.And the method is easy to use and most comapnies use it,don't they?Or have things changed that much since I was in college?" you feel as if you have annoyed the CFO with ypur questions,so you decide to leave.As you back to your office,you recall from…arrow_forwardAssume that you are the accountant for Computer Consultants. Prior to this year, Computer Consultants operated out of a leased office. However, the company purchased its own office building this year. The building is in an area where real estate values have been increasing an average of 6 percent per year. The owner of Computer Consultants has asked why you recorded depreciation on the building if real estate values are appreciating. Write a response to the owner explaining why depreciation must be recorded on the company’s accounting records.arrow_forward

- You are an accountant at a large research university. The controller is considering switching its accounting policy so that it is in line with other universities. The current policy requires all assets be depreciated on a straight-line basis with no salvage value and a full year of depreciation taken in the year of acquisition regardless of the acquisition date. The proposed policy would require all asset depreciated on a straight-line basis with no salvage value and depreciation taken based on the nearest full month from the acquisition date. The data provided shows all assets that are in use even though some assets have already been fully depreciated. The controller has provided a dashboard visualization that shows the differences between the two depreciation policies for the period ending December 31, 2018 and asks you to answer the questions below. Click here to view the data in Tableau, and here to view it in Power BI. (The Tableau and Power BI files contain the same data; you can…arrow_forwardJones Co. recently sold a piece of equipment. Which of the following journal entries would be most appropriate for recording the sale? O Debit to cash O Credit to Loss on Sale O Credit to Accumulated Depreciation O Debit to Equipmentarrow_forwardanswer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education