Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:11

6352f7a500da4b46977a659c/pages/a54b822ae1345f43e0e4c9ff519851bf2733a4364?returnurl=https%3A%2F%2Fconsole.pearson.com

| McGraw Hill F FreshBooks

Content

microsoft M Gmail ► YouTube

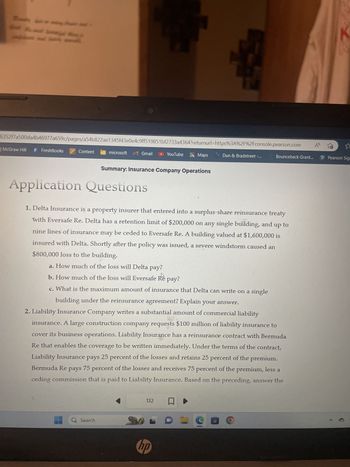

Application Questions

Summary: Insurance Company Operations

Q Search

Maps

up to

1. Delta Insurance is a property insurer that entered into a surplus-share reinsurance treaty

with Eversafe Re. Delta has a retention limit of $200,000 on any single building, and

nine lines of insurance may be ceded to Eversafe Re. A building valued at $1,600,000 is

insured with Delta. Shortly after the policy was issued, a severe windstorm caused an

$800,000 loss to the building.

132

a. How much of the loss will Delta pay?

b. How much of the loss will Eversafe Rè pay?

c. What is the maximum amount of insurance that Delta can write on a single

building under the reinsurance agreement? Explain your answer.

2. Liability Insurance Company writes a substantial amount of commercial liability

insurance. A large construction company requests $100 million of liability insurance to

cover its business operations. Liability Insurance has a reinsurance contract with Bermuda

Re that enables the coverage to be written immediately. Under the terms of the contract,

Liability Insurance pays 25 percent of the losses and retains 25 percent of the premium.

Bermuda Re

pays 75

75 percent of the losses and receives 75 percent of the premium, less a

ceding commission that is paid to Liability Insurance. Based on the preceding, answer the

hp

Dun & Bradstreet -...

=

Bounceback Grant...

2

P Pearson Sign

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- Accounting SBITAS are accounted for similarly to leases. A city signs a three- year licensing agreement with a soft-ware company for use of a payroll management system in its electrical utility fund. Annual charges are $10,000 per year. It is the policy of the city to use a discount rate of 6 percent to value right- to- use assets when an interest rate is not explicitly stated in a lease or comparable agreement. It also depreciates all capital and similar assets on a straight- line basis. The subscription period runs from January 1, 20X1 through December 31, 20X3, with payment due on January 1 of each of the three years. 1. Prepare a journal entries to record the start of the licensing agreement on January 1, 20X1 in its electrical utility fund (a proprietary fund) as well as the first payment of $10,000. 2. Prepare an entry to record an appropriate journal entry on December 31, 20X1. 3. Prepare an entry to record the second payment of $10,000 on January 1, 20X2.arrow_forwardOriole Co. purchases land and constructs a service station and car wash for a total of $472500. At January 2, 2021, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $510000 and immediately leased from the oil company by Oriole. Fair value of the land at time of the sale was $46500. The lease is a 10-year, noncancelable lease. Oriole uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Oriole at termination of the lease. A partial amortization schedule for this lease is as follows: Раyments Interest Amortization Balance Jan. 2, 2021 $510000.00 Dec. 31, 2021 $83000.15 $51000.00 $32000.15 477999.85 Dec. 31, 2022 83000.15 47799.99 35200.16 442799.69 Dec. 31, 2023 83000.15 44279.97 38720.18 404079.51 The total lease-related income recognized by the lessee during 2022 is which of the…arrow_forwardOn January 2, 2018, Hernandez, Inc. signed a ten-year noncancelable lease for a heavy duty drill press. The lease stipulated annual payments of P300,000 starting at the beginning of the first year, with title passing to Hernandez at the expiration of the lease. Hernandez treated this transaction as a finance lease. The drill press has an estimated useful life of 15 years, with no salvage value. Hernandez uses straight-line amortization for all of its plant assets. Aggregate lease payments were determined to have a present value of P1,800,000, based on implicit interest of10%. In its 2018 income statement, what amount of interest expense should Hernandez report from this lease transaction?arrow_forward

- Nonearrow_forwardOn January 1, 2023, Carla Vista Inc. sold a piece of equipment to Sunland Ltd. For $182,000, and immediately leased the equipment back. At the time, the equipment was carried on Carla Vista's books at a cost of $273,000, less accumulated depreciation of $109,000. The lease is a capital lease to Carla Vista, with a lease term of 5 years. The equipment under capital lease will be depreciated in Carla Vista's books over five years using double-declining balance depreciation. Calculate the amortization of the deferred gain on sale to be recorded at the end of 2023, if Carla Vista follows ASPE.arrow_forward1. On December 31,2020 the account for Shane Oil Company's individually insignificant unproved properties had a balance of $600,000. The impairment allowance account had a balance of $100,000. Required Give the entries for each of the following transactions occurring in 2020 and 2021 (all transactions concern individually Insignificant unproved leases) a.Assuming Shane has a policy of maintaining a 60% allowance, i.e. 60% of gross unproved properties, give the entry to record impairment on December 31, 2020 b.During 2021 Shane surrendered leases that cost $200,000. c.During 2021,leases that cost $40,000 were proved d.Give the entry to record impairment on December 31, 2021.arrow_forward

- A building valued at $300,000 in insured for $150,000 and there is an 80% co- insurance clause on the policy. The building sustained loss to one area and caused $60,000 worth of damage. The insured would receive a settlement of: $50,000 $60,000 $45,500 $37,500arrow_forwardOn January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of $100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is $2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswell’s incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of $7,000 annually,…arrow_forwardsaarrow_forward

- On January 1, 2016, Cook Textiles leased a building with two acres of land from Peck Development. The lease is for 10 years. No purchase option exists and the property will revert to Peck at the end of the lease. The building and land combined have a fair market value on January 1, 2016, of $1,450,000 and the building has an estimated life of 20 years with a residual value of $150,000. The lease calls for Cook to assume all costs of ownership and to make annual payments of $200,000 due at the beginning of each year. On January 1, 2016, the estimated value of the land was $400,000. Cook uses the straight-line method of depreciation and pays 10% interest on borrowed money. Peck’s implicit rate is unknown. Required: 1. Prepare journal entries for Cook Textiles for 2016. Assume the land could be leased without the building for $59,000 each year. 2. Assuming the land had a fair value on January 1, 2016, of $200,000 and could be leased alone for $30,000, prepare journal entries for Cook…arrow_forwardCrane Co. purchases land and constructs a service station and car wash for a total of $532500. At January 2, 2021, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $590000 and immediately leased from the oil company by Crane. Fair value of the land at time of the sale was $58500. The lease is a 10-year, noncancelable lease. Crane uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Crane at termination of the lease. A partial amortization schedule for this lease is as follows: Payments Interest Amortization Balance Jan. 2, 2021 $590000.00 Dec. 31, 2021 $96019.78 $59000.00 $37019.78 552980.22 Dec. 31, 2022 96019.78 55298.02 40721.76 512258.46 Dec. 31, 2023 96019.78 51225.85 44793.93 467464.53 What is the amount of the…arrow_forwardOn January 1, 2023, Wynn Manufacturing leased a floor of a building for use in its North American operations from Easymoney Bank. The 9-year, noncancellable lease requires annual lease payments of $12,000, beginning January 1, 2023, and at each January 1 thereafter through 2031.The lease agreement does not transfer ownership, nor does it contain a purchase option. The floor of the building has a fair value of $85,000 and an estimated remaining life of 10 years. Easymoney Bank's implicit rate of 10% is known to Wynn.At what amount is the lease liability recorded at lease commencement? Group of answer choices $85,735 $108,000 $76,019 $81,108arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education