Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

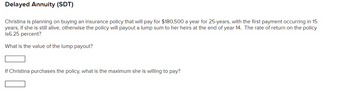

Transcribed Image Text:Delayed Annuity (SDT)

Christina is planning on buying an insurance policy that will pay for $180,500 a year for 25-years, with the first payment occurring in 15

years, if she is still alive, otherwise the policy will payout a lump sum to her heirs at the end of year 14. The rate of return on the policy

is6.25 percent?

What is the value of the lump payout?

If Christina purchases the policy, what is the maximum she is willing to pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Frank plans to set aside money for his young daughter's college tuition. He will deposit money in an ordinary annuity that earns 7.2% interest, compounded quarterly. Deposits will be made at the end of each quarter. How much money does he need to deposit into the annuity each quarter for the annuity to have a total value of $71,000 after 16 years?arrow_forward9. Implied interest rate and period Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Ryan inherited an annuity worth $3,280.16 from his uncle. The annuity will pay him five equal payments of $800 at the end of each year. The annuity fund is offering a return of Ryan's friend, Sebastian, wants to go to business school. While his father will share some of the expenses, Sebastian still needs to put in the rest on his own. But Sebastian has no money saved for it yet. According to his calculations, it will cost him $30,044 to complete the business program, including tuition, cost of living, and other expenses. He has decided to deposit $4,200 at the end of every year in a mutual fund, from which he expects to earn a fixed 7% rate of return. It will take approximately for Sebastian to save enough money to go to business school.arrow_forwardCheryl is setting up a payout annuity with her bank. She wants to receive a payout of $1200 per month for 20 years. A. How much will she have to deposit if she earns 8% interest compounde monthly? B. What's the total she will receive from her payout annuity?arrow_forward

- Erica purchases a retirement annuity that will pay her $1,500 at the end of every six months for the first twelve years and $500 at the end of every month for the next six years. The annuity earns interest at a rate of 3.8% compounded quarterly. a. What was the purchase price of the annuity? Round to the nearest cent b. How much interest did Erica receive from the annuity? Round to the nearest centarrow_forwardChristina is planning on buying an insurance policy that will pay for $157,250 a year for 25-years, with the first payment occurring in 15 years, if she is still alive, otherwise the policy will payout a lump sum to her heirs at the end of year 14. The rate of return on the policy is5.5 percent? What is the value of the lump payout? If Christina purchases the policy, what is the maximum she is willing to pay?arrow_forwardWithout using Excel and using the formula, Cheryl is setting up a payout annuity and wishes to receive $1200 per month for 20 years. A. How much does she have to deposit if her money earns 8% interest compounded monthly? B. Find the total amount Cheryl will receive from her payout annuity.arrow_forward

- To save for her newborn son's college education, Lea Wilson will invest P1,000 at the beginning of each year for the next 18 years. The interest rate is 12 percent. What is the future value? * 55,750. O 7,690 34,931. O 63,440. O 62,440.arrow_forwardAmy purchases an annuity that will give her payments of R at the end of each quarter for seven years. She will receive the first of these payments in 1.5 years. If Amy paid $50,000 for this annuity and will earn a nominal rate of interest of 6% compounded quarterly,(a) write the equation of value (using the appropriate actuarial notation) for this annuity at the time of purchase. Be sure to indicate the effective rate per payment period being used.(b) find the value of R.arrow_forwardSuppose that Kate is 45 years old and has no retirement savings. She wants to begin saving for retirement, with the first payment coming one year from now. She can save $20,000 per year and will invest that amount in the stock market, where it is expected to yield an average annual return of 5.00% return. Assume that this rate will be constant for the rest of her's life. In short, this scenario fits all the criteria of an ordinary annuity. Kate would like to calculate how much money she will have at age 60. Use the following table to indicate which values you should enter on your financial calculator. For example, if you are using the value of 1 for N, use the selection list above N in the table to select that value. Input Keystroke Output N Input Keystroke N Output I/Y Using a financial calculator yields a future value of this ordinary annuity to be approximately Kate would now like to calculate how much money she will have at age 65. Input Keystroke N Output Use the following table…arrow_forward

- Mary is going to receive a 31-year annuity of $8,600 per year. Nancy is going to receive a perpetuity of $8,600 per year. If the appropriate interest rate is 9 percent, how much more is Nancy’s cash flow worth?arrow_forwardSandra plans to retire and can receive a lump sum of $26,376 from her pension provider. She decides to invest of the lump sum for 8 years and use the rest for 3 travelling. Her bank account pays 4.99% compound interest per annum. How much interest will Sandra receive from this investment after 8 years? Round your answer to the nearest thousand dollars. %24arrow_forwardThe AGI of the Newtons, a married couple, is $199,000 this year. They would like to contribute to a Roth IRA. a. What is the maximum amount this couple can contribute to a Roth IRA? b. Now Supposed that the Newtons will report AGI of less than $196,000 and put $12,000 each year into their Roth IRA for 20 years, earning an annual return of 5%. What future value will accumulate in their Roth at the end of this period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education