FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

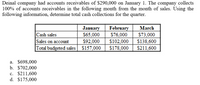

Transcribed Image Text:Deinal company had accounts receivables of $290,000 on January 1. The company collects

100% of accounts receivables in the following month from the month of sales. Using the

following information, determine total cash collections for the quarter.

January

February

S76,000

$102,000

$178,000

March

S65,000

$92,000

Cash sales

$73,000

$138,600

Sales on account

Total budgeted sales $157,000

$211,600

a. $698,000

b. $702,000

c. $211,600

d. $175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5 At Lyman Company, past experience reveals that 10% of sales are for cash and the remaining 90% are on credit. Lyman Company expects to collect 30% of its credit sales in the month of sale, 50% in the month following sale, and 18% in the second month following sale. Which ONE of the following is part of the cash collections expected to be made in January? O Cash sales from the preceding December O Cash collections of credit sales from the preceding December O Cash collections of credit sales from the preceding September O Cash sales from the preceding Novemberarrow_forwardA company is preparing its cash buget for the month of May. Below is A/R information: Actual credit sale for March $130,000 Actual credit sale for April $160,000 Estimated credit sales for May $210,000 Estimated collections in the month of sale 25% Estimated collections in the first month after the month of sale 60% Estimated collections in the second month after the month of sale 10% Estimated provision of bad debts (made in month of sale) 5% ** Firm writes off all UNCOLLECTIBLE account receievables at the end of second month after the month of sale. Required: For the month of May, calculate the following: 1. Estimated cash receipts from account recievable collections. 2. The gross amount of A/R at the end of the month (after appropriate write off of uncollectiable amounts). 3. The net amount of A/R at the end of the month 4. Recalculate the requirement 1 & 2 under the assumption that estimated collections in the month of sale equal 60% and in the first…arrow_forwardSchedule of Cash Collections of Accounts Receivable Bark & Purr Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $160,000 June 230,000 July 350,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 37% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. May June July May sales on account: Collected in May $fill in the blank 1 Collected in June $fill in the blank 2 Collected in July $fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July fill in the blank 6 Total cash collected $fill in the blank 7 $fill in the blank 8 $fill in the…arrow_forward

- Woodpecker Co. has $298,000 in accounts receivable on January 1. Budgeted sales for January are $965,000. Woodpecker Co. expects to sell 20% of its merchandise for cash. Of the remaining 80% of sales on account, 75% are expected to be collected in the month of sale and the remainder the following month. The January cash collections from sales are a $1,368,000 Ob. $856,000 O $1,070,000 Od $642,000arrow_forwardWoodpecker Co. has $300,000 in accounts receivable on January 1. Budgeted sales for January are $964,000. Woodpecker Co. expects to sell 20% of its merchandise for cash. Of the remaining 80% of sales on account, 75% are expected to be collected in the month of sale and the remainder the following month. The January cash collections from sales are a.$642,720 b.$1,071,200 c.$1,371,200 d.$856,960arrow_forwardRefer to the picture pleasearrow_forward

- Schedule of cash collections of accounts receivable OfficeMart Inc. has "cash and carry" customers and credit customers. OfficeMart estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 30% pay their accounts in the month of sale, while the remaining 70% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: October $58,000 November 65,000 December 72,000 The Accounts Receivable balance on September 30 was $35,000. Prepare a schedule of cash collections from sales for October, November, and December. Enter all amounts as positive numbers. OfficeMart Inc. Schedule of Cash Collections from Sales For the Three Months Ending December 31 Line Item Description Receipts from cash sales: Cash sales September sales on account: Collected in October October sales on account: Collected in October Collected in November November sales on account: Collected…arrow_forward4 Jasper Company has 70% of its sales on credit and 30% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $525,000 for April, $535,000 for May, and $560,000 for June. Total sales for March are $500,000. Prepare a schedule of cash receipts from sales for April, May, and June, ts Book erences Sales Cash receipts from: Total cash receipts JASPER COMPANY Schedule of Cash Receipts from Sales April 525,000 May 535,000 June 560,000arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education