FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

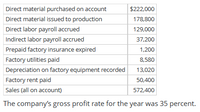

DeeZees makes evening dresses. The following information was gathered from the company records for the year, the first year of company operations. Work in Process Inventory at the end of the year was $6,300.

d. If net income was $50,000, what were total selling and administrative expenses for the year?

Transcribed Image Text:Direct material purchased on account

$222,000

Direct material issued to production

178,800

Direct labor payroll accrued

129,000

Indirect labor payroll accrued

37,200

Prepaid factory insurance expired

1,200

Factory utilities paid

8,580

Depreciation on factory equipment recorded

13,020

Factory rent paid

50,400

Sales (all on account)

572,400

The company's gross profit rate for the year was 35 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $177,180 Selling expenses 59,180 Administrative expenses 31,290 Sales 376,970 Finished goods inventory, January 1 42,600 Finished goods inventory, January 31 38,830 a. For the month ended January 31, determine Bandera Manufacturing’s cost of goods sold. Bandera Manufacturing Company Cost of Goods Sold January 31 $fill in the blank 485dbcfbb05e064_2 fill in the blank 485dbcfbb05e064_4 $fill in the blank 485dbcfbb05e064_6 fill in the blank 485dbcfbb05e064_8 $fill in the blank 485dbcfbb05e064_10 b. For the month ended January 31, determine Bandera Manufacturing’s gross profit. Bandera Manufacturing Company Gross Profit January 31 $fill in the blank bdadc6f76009002_2 fill in the blank bdadc6f76009002_4 $fill in the blank bdadc6f76009002_6 c. For the month ended…arrow_forwardAt the end of January, Mineral Labs had an inventory of 855 units, which cost $8 per unit to produce. During February the company produced 1,300 units at a cost of $12 per unit. a. If the firm sold 1,650 units in February, what was the cost of goods sold? (Assume LIFO inventory accounting.) Cost of goods sold b. If the firm sold 1,650 units in February, what was the cost of goods sold? (Assume FIFO inventory accounting.) Cost of goods soldarrow_forwardThe following were taken from the general ledger and other data of Du- sik Manufacturing on July 31: Finished goods, July 1- P85,000; Cost of goods manufactured in July P343,000; Finished goods, July 31 is P93,000. Compute the cost of goods sold *arrow_forward

- Lawson Manufacturing Company has the following account balances at year end: Office supplies Raw materials Work-in-process $ 4,000 25,000 61,000 Finished goods 109,000 Prepaid insurance 6,000 What amount should Lawson report as inventories in its balance sheet?arrow_forwardHill & Scott Company makes financial calculators. During the current year, Hill & Scott manufactured 106,700 financial calculators. Finished goods inventory had the following units on hand: January 1 1,386 units December 31 1,144 units How many financial calculators did Hill & Scott sell during the year? Group of answer choicesarrow_forwardThe worksheet of Bridget's Office Supplies contains the following revenue, cost, and expense accounts. Prepare a classified income statement for this firm for the year ended December 31, 20X1. The merchandise inventory amounted to $59,675 on January 1, 20X1, and $52,625 on December 31, 20X1. The expense accounts numbered 611 through 617 represent selling expenses, and those numbered 631 through 646 represent general and administrative expenses. Accounts 401 Sales $ 248,200 Credit 451 Sales Returns and Allowances 4,340 Debit 491 Miscellaneous Income 390 Credit 501 Purchases 103,500 Debit 502 Freight In 1,965 Debit 503 Purchases Returns and Allowances 3,590 Credit 504 Purchases Discounts 1,790 Credit 611 Salaries Expense—Sales 45,200 Debit 614 Store Supplies Expense 2,300 Debit 617 Depreciation Expense—Store Equipment 1,500 Debit 631 Rent Expense 13,400 Debit 634 Utilities Expense 2,990 Debit 637 Salaries Expense—Office 21,000 Debit 640 Payroll Taxes…arrow_forward

- Klum's Fashions sold merchandise for $45,000 cash during the month of July. Returns that month totaled $1,000. If the company's gross profit rate is 40%, Compute the following: a) Net sales revenue b) Cost of goods soldarrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education