FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ded

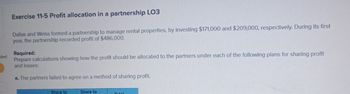

Exercise 11-5 Profit allocation in a partnership LO3

Dallas and Weiss formed a partnership to manage rental properties, by investing $171,000 and $209,000, respectively. During its first

year, the partnership recorded profit of $486,000.

Required:

Prepare calculations showing how the profit should be allocated to the partners under each of the following plans for sharing profit

and losses:

a. The partners failed to agree on a method of sharing profit.

Share to

Share to

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below] Ries, Bax, and Thomas invested $56,000, $72,000, and $80,000, respectively, in a partnership. During its first calendar year, the firm earned $430,200. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $430,200 net income under each of the following separate assumptions. Problem 12-3A (Algo) Part 3 3. The partners agreed to share income and loss by providing annual salary allowances of $40,000 to Ries, $35,000 to Bax, and $47,000 to Thomas, granting 10% interest on the partners' beginning capital investments; and sharing the remainder equally. Complete this question by entering your answers in the tabs below. Appropriation of profits General Journal Allocate $430,200 net indome by providing annual salary allowances of $40,000 to Ries, $35,000 to Bax, and $47,000 to…arrow_forwardCap 12 eBook Show Me How Recording Partner's Original Investment Vanessa Kaiser and Mariah Newman decide to form a partnership by combining the assets of their separate businesses. Kaiser contributes the following assets to the partnership: cash, $18,920; accounts receivable with a face amount of $198,660 and an allowance for doubtful accounts of $7,170; inventory with a cost of $99,540; and equipment with a cost of $139,330 and accumulated depreciation of $90,560. The partners agree that $8,740 of the accounts receivable are completely worthless and are not to be accepted by the partnership, that $14,900 is a reasonable allowance for the uncollectibility of the remaining accounts, that the inventory is to be recorded at the current market price of $93,570, and that the equipment is to be valued at $61,450. Journalize the partnership's entry to record Kaiser's investment. If an amount box does not require an entry, leave it blank.arrow_forwardChapter 2: Partnerships Exercise - 1 Computing initial partner investments Careem and Labeeb establish an equal partnership in both cquity and profits to operate a used- furniture business under the name of C&L Furniture. Careem contributes furniture inventory that cost $120,000 and has fair value of $160,000. Labceb contributes $60,000 cash and delivery cquipment that cost $80,000 and has a fair valuc of $60,000. Required: Assume that the initial noncash contributions of the partners are recorded at fair market value. A) Compute the ending balance of cach capital account under the bonus and goodwill approaches. B) Prepare the journal entries of the initial investments under both approaches.arrow_forward

- Problem 5A partnership held three assets: Cash $ 59,000Land $ 48,000Building $ 64,000and liabilities were $ 33,000 The partners decided to dissolve the business and anticipated that expenses required toliquidate their partnership would amount to $ 5,000Capital balances were as follows: King, capital $ 24,000Murphy, capital 30,000Madison, capital 48,000Pond, capital 36,000The partners shared profits and losses 10:20:30:40 respectively.The cash on hand was used to pay the liabilities. Any remaining cash in excess ofthe amount needed for anticipated liquidation expenses was immediatelydistributed to the partners.a. What is the total amount of cash that was immediately available to be distributed to the partners? b. The cash (in item a.) was distributed to each partner in a single payment.Show the total payment amount to each partner. (Show the amount of thesingle check that was written to each partner.) Support your answer with apredistribution plan (or schedule).arrow_forwardA-7arrow_forwardA-7arrow_forward

- Exercise 12-15 (Algo) Partner return on equity LO A1 Rugged Sports Enterprises LP is organized as a limited partnership consisting of two individual partners: Hockey LP and Football LP. Hockey LP $ 339,000 Football LP $ 1,389,900 734,925 (150,000) 35,850 $ 1,974,825 Beginning-year capital balance Annual net income Cash distribution Ending-year capital balance Compute partner return on equity for each LPand the total) for the year using the above data from Rugged Sports Enterprises LP. Complete this question by entering your answers in the tabs below. Return on Partner Return Equity on Equity $ 374,850 Rugged Sports Enterprises LP Compute partner return on equity for the year using the above data from Rugged Sports Enterprises LP. Return on Equity. Choose Numerator: ✓ Choose Denominator: 1 1arrow_forwardRequired information Problem 12-3A (Algo) Allocating partnership income LO P2 Skip to question [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $58,000, $74,000, and $82,000, respectively, in a partnership. During its first calendar year, the firm earned $361,500. Required: Prepare the entry to close the firm’s Income Summary account as of its December 31 year-end and to allocate the $361,500 net income under each of the following separate assumptions.arrow_forwardRequired information Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $58,000, $74,000, and $82,000, respectively, in a partnership. During its first calendar year, the firm earned $361,500. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $361,500 net income under each of the following separate assumptions. Problem 12-3A (Algo) Part 1 1. The partners did not agree on a plan, and therefore share income equally. View transaction list Journal entry worksheet 1 Record the entry to close the income summary account assuming the partners did not agree on a plan, and therefore share income equally. Note: Enter debits before credits. Date December 31 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education